Data released yesterday showed U.S. economic growth revised slightly lower in Q417 to 2.5% on an annualized basis, down from the previous estimate of 2.6% and from 3.2% in Q3. However, estimates for 2018 are getting stronger on the back of recently announced fiscal stimulus measures, with Moody’s earlier this week revising up its 2018 forecast to 2.7% in common with the IMF. Meanwhile in the Eurozone inflationary pressures were stagnant in February. While advance data for February showed that core consumer price inflation remained unchanged at 1.0% y/y, headline inflation slowed from 1.3%y/y to 1.2%y/y. These price trends suggest the ECB will not be in a hurry to draw its asset purchase program to an end, although it may drop the easing bias from its forward guidance at its meeting next week.

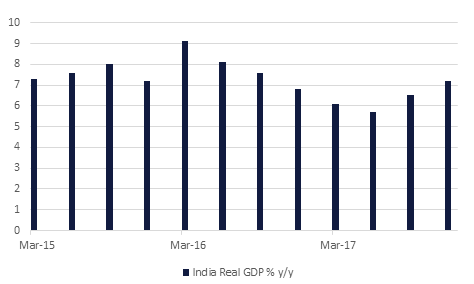

India’s GDP for Q3 FY 2018 came in at 7.2% y/y, higher than consensus estimates of 6.9%. The full year FY 2018 GDP estimate was revised higher to 6.6% y/y from 6.5%. The GVA, which removes the impact of indirect taxes and subsidies, came in line with estimates at 6.7%. The pick-up in growth was relatively broad based apart from private consumption which weakened. Encouragingly, fixed capital formation grew 12%. The GDP data confirms our view that India is in the middle of a cyclical recovery which should gather further pace in the next few quarters. High frequency data such as the manufacturing PMI, which came in at 52.1 for February 2018, lends further support to our view.

The Iraq government has reached a tentative deal with the semi-autonomous Kurdistan Regional Government to resume exports of crude oil through its territory, according to Iraqi Prime Minister Haider al-Abadi. Scepticism around the news remains given that the KRG has not yet affirmed this, and there are significant and difficult issues to resolve around the export of crude through the region, and the operation of disputed oil fields around Kirkuk. Nevertheless, it seems that there has been some progress in patching up relations between the two parties in the wake of Kurdistan’s failed independence bid in September.

There was no follow-through action in US Treasuries following comments from Fed Chairman as month-end flows dominated. Yields on the 2y USTs, 5y USTs and 10y USTs closed at 2.25% (-1 bps), 2.64% (-2 bps) and 2.86% (-3 bps) respectively.

Regional bonds felt the after-effects of move in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 2 bps to 4.16% and credit spreads widened by 3 bps to 155 bps.

Fitch assigned Taqa a senior unsecured rating of A.

Saudi Telecom clarified that the company has no financial exposure nor obligations to Aircel after amending shareholder agreements. Aircel has filed for bankruptcy in India.

AUD underperforms in the Asia session after softer than expected economic data. The AiG Performance of Manufacturing Index fell to 57.5 in February, down from 58.7 the previous month. In addition, House prices fell 0.3% in February following a 0.5% decline in January and private capital expenditure missed expectations for a 1.0% increase in Q4 2017, contracting 0.2% instead.

Currently AUDUSD is trading 0.38% lower at 0.77326, the 50% one year Fibonacci retracement, having hit lows of 0.7717 earlier in the session. This decline has added to the losses of the previous two days and has taken the price further below the 100 day and 200 day moving averages (0.7785 and 0.7774 respectively) which were breached on Wednesday. As these levels provided strong support earlier in February, their sustained break is significant. Another close below this level is likely to result in a retest of 0.7630, not far from the 38.2% one year Fibonacci retracement of 0.7637 and close to our Q1 2018 forecast of 0.76.

Developed markets closed lower as markets continued to remain wary following comments from the Fed Chairman Powell. The S&P 500 index and the Euro Stoxx 600 index dropped -1.1% and -0.7% respectively.

The Qatar Exchange (-3.1%) led regional markets lower. The change in headline number was on account of two stocks going ex-dividend. IQCD dropped -4.3%. Elsewhere, the outflow on account of MSCI changes dragged the DFM index (-1.3%) lower.

Oil prices were down sharply overnight as EIA data was uniformly bearish. Crude inventories rose by 3m bbl along with gains in inventory stocks and lower refinery utilization. Crude production also rose to above 10.28m b/d. In response WTI lost more than 2% to close below USD 62/b while Brent futures gave up around 1.3% and are now trading below USD 65/b.

OPEC’s production in February fell by 70k b/d last month, thanks to overcutting by the UAE which was more than 150% compliant with its target last month. Saudi Arabia has actually increased production that last two months running, adding 50k b/d in total since the start of the year, in line with our expectations of higher production there this year.