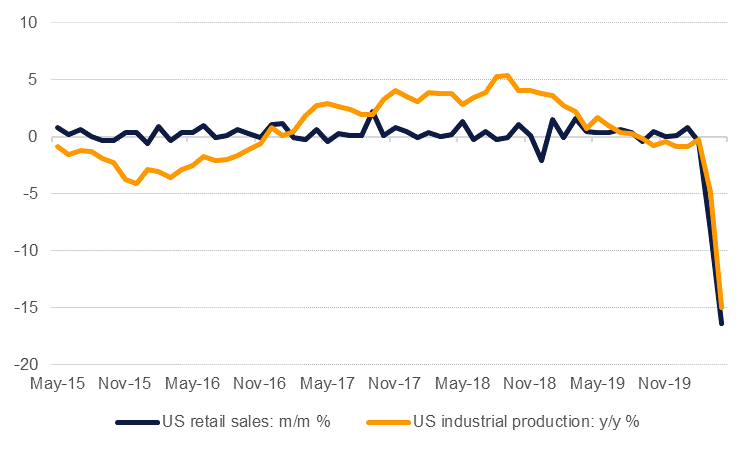

Economic data out of the US continue to highlight the ravages of coronavirus-related lockdowns. Retail sales for April fell by 16.4%, outpacing the prior month’s already precipitous drop of 8.3%. Consumption in all categories declined bar online sales as consumers bought online as lockdowns impeded normal economic activity. Industrial production declined in April by 11.2% m/m, its worst print in the more than 100-years of data collection. Factory output along with mining and utilities production all sank as workers stayed home and demand dried up. Data is likely to start improving over the coming weeks as lockdowns have been lifted in many states, even at risk of a resurgence of coronavirus cases. Interestingly, consumer confidence actually improved for May according to a survey from the University of Michigan. A general uptrend in US equity markets may be leading consumers to think the worst is over. However, any further stimulus measures from the government remain frustrated by partisan fighting. A USD 3trn Democrat-sponsored support plan passed the House at the end of last week but has already been widely rejected by Republicans, who control the Senate, and President Trump.

The US doesn’t have a monopoly on the dismal data, however, as Germany’s economy recorded a 2.2% decline q/q for the first three months of the year. It was the worst GDP performance for the Eurozone’s biggest economy since the Global Financial Crisis. Germany has been a relative ‘outperformer’ amongst major European economies, showing the least bad growth as the government took a more muted approach to lockdowns and has begun to ease restrictions.

China continues to show signs of a recovery from lockdowns as industrial production actually rose in April by 3.9% y/y compared with a decline of 1.1% y/y in March. Fixed asset investment continued to decline—by 10.3% for the first four months of the year—albeit at a less rapid pace than data showed in March. Retail sales also improved—declining by 7.5% for April compared with almost a 16% drop in March.

The Central Bank of Egypt kept its benchmark overnight deposit rate on hold at 9.25% at its MPC meeting at the close of last week, in line with our expectations. The bank acted proactively in March with an unscheduled 300bps rate cut as the coronavirus crisis started to take hold, but has judged it appropriate to hold steady at the last two scheduled meetings. While inflation did tick up to 5.9% in April, from 5.1% the previous month, and will likely head higher still owing to pandemic-related disruptions, it will likely remain within the central bank’s target range of 9% ±3, and we expect rates to remain on hold for the next several meetings.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed higher following heightened tensions between the US and China and a somber assessment of the US economy by the Fed Chairman Jerome Powell. The Fed Chair also reiterated his views on negative rates as an option not considered by the Federal Reserve at the moment. The curve flattened with yields on the 2y UST and 10y UST ending the week at 0.14% (-1 bp w-o-w) and 0.64% (-4 bps w-o-w) respectively.

Regional bonds continued their positive run even as the pace slowed. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -9 bps w-o-w to 3.71% and credit spreads tightened 6 bps 2-o-2 to 311 bps.

Last week saw the dollar experience some choppy movement, particularly during its first half, but eventually consolidated above the crucial 100.00 mark on its DXY measure to end at 100.361. The DXY index, a measure for the dollar against a narrow basket of other major currencies, met resistance at 100.556 the highest point recorded in May so far, but still cemented its bullish form. The strengthening dollar caused the JPY to record losses of over -0.70% to finish the week at 107.06.

The Euro briefly made gains against the dollar to reach 1.0896 on Wednesday but met resistance at this level following Fed Chairman Jerome Powell's statement on the U.S. economy. The currency ended the week bearish at 1.0820, a loss of -0.17%. Meanwhile Sterling has been under heavy bearish pressure for the entire week, dropping over 2.40% to reach its lowest point since late March at 1.2104 after both the EU and the UK reported a deadlock in Brexit talks.

Both the AUD and NZD were under similarly negative pressure following risk aversion on the back of growing tensions between the US and China. The currencies declined by over -1.80% and -3.30% respectively.

Regional equities started the week on a mixed note. The DFM index and the Tadawul outperformed their regional peers with gains of +0.9% and +1.6% respectively. The continued strength in oil prices drove petrochemical stocks higher with Saudi Aramco gaining +1.8%. Banking sector stocks also rose on the back of positive corporate earnings from National Commercial Bank (+2.8%) and Riyad Bank (+2.9%).

Oil prices extended their recovery for a third week running as sentiment toward demand improves as more countries ease their lockdown conditions and allow for economic life to return to something approximating pre-coronavirus conditions. Brent futures gained nearly 5% over the course of the week to settle at USD 32.50/b while WTI closed the five days at USD 29.43/b, up nearly 19%. For the month of May alone the improvement in oil futures has been dramatic: Brent has gained nearly 30% while WTI is up by around 56%. June WTI futures expire this week but the relative improvement in sentiment toward crude and easing concerns over whether storage was reaching tank tops should prevent a repeat of last month’s hysteria when expiring futures moved into negative prices for the first time ever.

Click here to Download Full article