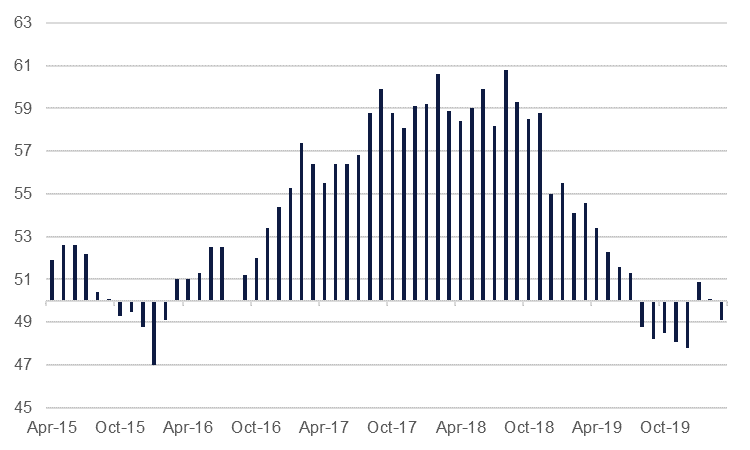

The ISM manufacturing survey for the US was released yesterday, falling from 50.1 to 49.1. While this is in contractionary sub-50 territory, it exceeded expectations of 44.5. However, the headline figure actually masks indications that there is a far more severe downturn on the way. Many of the ill effects of pandemic-related shutdowns in the US had not yet manifested themselves at the time of the survey, enabling the headline figure to come in better than expected, but new orders and employment still slowed at the fastest pace since the global financial crisis. With both of these slowing at such a rapid clip, it seems likely the headline figure of 49.1 somewhat understates the actual state of affairs in US factories, and that a far worse reading looms for April. This stands in contrast to the China PMI figures released this week which indicated that China is past the worst, with activity picking up.

The ISM survey supports what we have seen in terms of new jobless claims, with last week’s 3.3mn new claimants more than four times the previous record. Non-farm payroll numbers for March are released tomorrow, with consensus forecasts predicting a net fall of 100,000, compared to 273,000 new jobs reported in February.

The US environment of falling orders and mounting job losses chimes with what has been seen in the UK and Eurozone, where final PMI numbers were released yesterday. Both indices fell modestly from the flash readings, with the UK dropping from 48.0 to 47.8 and the Eurozone from 44.8 to 44.5. Italy’s 40.3 was a 131-month low. All of these headline survey figures would have been higher had they not been boosted by supplier delays, which usually indicate robust demand but are currently a sign of disruption. In the UK, jobs were cut at the fastest level since 2009. European economies have been extending and deepening their lockdowns in recent days, indicating that there will be no improvement in the survey released next month.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as risk-off mood returned. USTs received another boost following an announcement by the Federal Reserve that it was temporarily easing the supplementary leverage ratio for one year, excluding USTs and deposits at Federal Reserve banks from the calculation of the leverage ratio. The USD swap spreads jumped on the announcement. Overall, yields on the 2y UST and 10y USTs ended the day at 0.20% (-4bps) and 0.58% (-8bps) respectively.

Regional bonds came under renewed pressure at the start of the new quarter. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose to 4.76% while credit spreads widened further to 415 bps.

The credit rating adjustment continues in the GCC. Moody’s placed on review for downgrade the Aa3 and A1 long-term deposit rating of National Bank of Kuwait and Kuwait Finance House. The rating agency said that primary driver behind the move is the potential weakening of the Kuwaiti government’s capacity to provide support in case of need. S&P revised the outlook on Batelco ratings to stable from positive.

The dollar was mixed on Wednesday, regaining losses it suffered towards the end of Tuesday with narrow ranges despite an overall risk-off tone as COVID-19 cases and deaths continued to mount. Wall Street was sharply lower overnight, while Treasury yields fell. Incoming data was better than expected, with ADP jobs losses less than forecast, and the manufacturing ISM falling less than expected. The risk-off theme also supported the Yen against other major currencies, while there is an increasingly soft bias in the Euro - its underperformance, giving further strength to the dollar.

Developed market equities started the new quarter on a negative note as worries of a prolonged halt in economic activity gathered pace. The continued drop in oil prices and announcements of dividend cancellations also weighed on investor sentiment. The S&P 500 index and the Euro Stoxx 600 index dropped -2.9% and -4.4% respectively.

The Tadawul (+1.0%) was a notable exception in what was a negative day of trading for regional markets. The DFM index and the KWSEPM index lost -2.9% and -1.8% respectively. Emaar-related names remained under pressure following their decision to not pay dividends for 2019. The Tadawul was led higher by strength in market heavyweights with Saudi Aramco gaining +1.5% and Saudi Telecom adding +2.9%. The government of Saudi Arabia also decided to list all government assets planned for privatization on the Tadawul after their IPOs.

Oil prices are higher in early trading today, supported by news that US president Donald Trump has been pressuring both Russia and Saudi Arabia for some form of oil production restraint. Brent futures are up almost 6% at USD 26.18/b while WTI is up 4.6% at USD 21.24/b. Russian officials condeded that producing at current prices was no longer profitable but have yet to endorse a production cut strategy. Meanwhile, Saudi Arabia increased production apparently immediately after the breakdown of OPEC+ in March with total production in the month of 10m b/d, up almost 300k b/d m/m.

US crude inventories rose 13m bbl last week as shutdowns across the country crimp demand. Product supplied, a proxy for demand, fell by 1.5m b/d including a 2.2m b/d drop in apparent gasoline consumption. Production, so far, has held stable at 13m b/d while exports fell by around 700k b/d to 3.2m b/d.