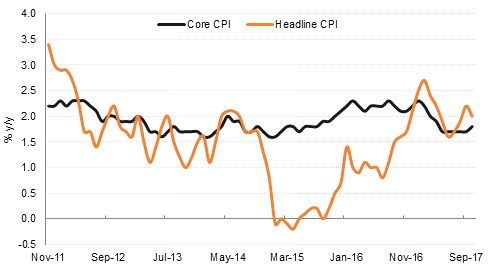

US economic data was mixed overnight, with retail sales coming in slightly higher than forecast at 0.2% m/m in October, while the Empire Manufacturing Index slipped by more than expected to just 19.4 in November. Headline inflation was in line with consensus at 0.1% m/m (2.0% y/y) but the annual rate of core inflation increased to 1.8% y/y from 1.7% in September, slightly ahead of expectations. There are more manufacturing indicators due out later today, as well as the NAHB housing market index and housing starts (tomorrow).

Employment data in the UK yesterday was disappointing, with a decline of -14k jobs in Q3 against expectations of a 52k rise, while average weekly wage growth slowed slightly to 2.2% in September. However, the overall unemployment rate was unchanged at 4.3%. Meanwhile, the government has won the first two days of voting in the committee stage of the EU withdrawal bill, despite several conservative MPs indicating they would vote against certain parts of the legislation, in particular the inclusion of the date at which the UK leaves the EU. However this issue, along with other more controversial clauses, will likely only be debated and voted on towards the end of the committee stage. Key data released in Europe today include UK retail sales , which are expected to be flat m/m once autos and fuel are excluded, and Eurozone inflation which is forecast to ease to 0.1% m/m (1.4% y/y) in October.

Australian jobs data released this morning was mixed. While only 3.7k new jobs were added in October, against a forecast for 18.8k there was in an increase of 24.300 full time jobs. As a result, the unemployment rate eased to 5.4% from 5.5% previously and the participation rate declined slightly.

The IMF has concluded its annual Article IV consultation with Kuwait and has commended the progress made so far on fiscal reform against a backdrop of “lower for longer” oil prices. However the Fund notes that further progress on fiscal consolidation is needed, including lowering the wage bill, cutting subsidies and transfers and diversifying budget revenue in order to achieve intergenerational equity within 10 years.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

UST curve flattened despite an increase in US core inflation in September (see above). Yields on the 2y USTs rose by 1bp to 1.69%, while 5y USTs dropped by 1bp to 2.05% and 10y USTs dropped 3bps to 2.34%.

Regionally, bonds continued to trade in a tight range with YTW on the Bloomberg Barcalys GCC Credit and High Yield index remaining flat at 3.73%. Having said that, credit spreads did tighten by 3 bps to 167 bps.

The CEO of Dana Gas said that he is not concerned that ongoing litigation will affect future borrowing. Elsewhere, Omani corporates continued to see the impact of the rating downgrade of the sovereign with the S&P downgrading Oman United Insurance to BBB- from BBB.

JPY outperformed yesterday amid a lack of risk appetite and the negative performance of equity markets. Over the course of the day USDJPY fell 0.51% to close at 112.88, having reached lows of 112.48 before finding support at near the 50 day moving average (112.49). As we go to print, USDJPY trades at 112.99. We expect support to again be found at the 50 day moving average, however a break of this level may catalyze further declines towards the 100 and 200 day MA (111.74 and 111.77 respectively).

This morning’s outperformer is AUD which has firmed against the other G10 currencies following mixed economic data. While a report from the Melbourne Institute showed that consumer expectations declined to 3.7% in November from 4.3% the previous month, data from the Australian Bureau of Statistics showed that 24,300 full time jobs had been added in October, helping take the employment rate down to 5.4% from 5.5% the previous month. Currently AUDUSD is trading 0.13% higher at 0.75985.

Yesterday global equities succumbed to negative performances. In the United States, the Dow Jones declined by 0.59% while the S&P fell 0.55% and the NASDAQ posted a 0.47% loss. On the other side of the Atlantic, performances were similarly bad with the Euro Stoxx losing 0.30% and the DAX closing 0.44% lower. Regional equites were also casualties of risk appetite with the ADX and DFM declining 0.7% and 0.6% respectively while the Saudi Tadawul fell by 1.0%.

This morning Asian markets have opened with mixed results. While the Nikkei is currently trading 0.83% higher while the Shanghai Composite is currently down 0.1%.

Oil prices continued to linger on Wednesday as the EIA reported a surprise build in US crude stocks of 1.8m bbl along with another increase in US production. Meanwhile Rosneft warned that the exit from the production cut agreement would be a ‘serious challenge’ as it could unleash significant volumes of oil onto the market in a disorderly function.