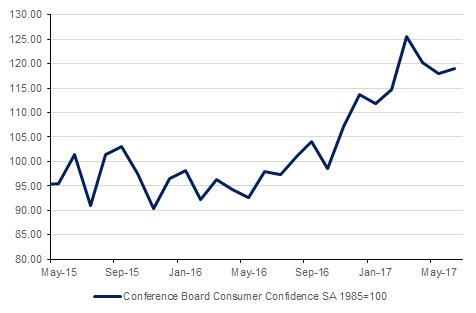

According the Conference Board, US Consumer Confidence rose to 118.9 in June from 117.9 the previous month, better than market expectations for a decline to 116. Despite this positive surprise, the markets were given some concern by comments by Fed Chair Yellen that stock valuations are “rich” right now.

The Euro was given a boost after ECB President Mario Draghi commented that “while there are still factors that are weighing on the path of inflation, at present they are mainly temporary factors that typically the central bank can look through.” EURUSD hit its highest levels in 10 month in response while EURJPY hit 15 month highs after the market interpreted this remark as preparation for future removal of monetary stimulus.

These comments reinforce positive market sentiment carried over from the end of last week when the Eurozone Composite PMI figure of 55.7 for June suggested that the economy was performing solid in Q2 and was supportive of healthy GDP growth.

Regionally, markets will resume trading after the long Eid weekend, with the focus likely to remain on oil prices and regional geopolitical issues. The stand-off with Qatar continues with Saudi officials indicating that there is no room for negotiation over its 13 demands, while US Secretary of State Tilllerson urged the various parties to begin talking.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

|

| Time | Cons |

| Time | Cons |

| US Wholesale Inventories m/m | 16:30 | 0.2% | US Pending Home Sales m/m | 18:00 | 1.0% |

Source: Bloomberg.

Fed speakers continue to caution about the pace of rate rises in the US with Minneapolis President Neel Kashkari saying it was unnecessary to 'cool down' the economy as inflation pressures are absent. The flattening of the UST curve continues with the 2-10yr spread narrowing to 0.833 this morning. Yields on 10yr USTs are holding just above 2.2%. Gilts jumped following on ECB president Mario Draghi's comments that the bank may be tweaking policy as the regional economy needs less stimulus now that growth looks to be on a more sustainable path.

Regional markets have been quiet thanks to the Eid holidays. The JPM UAE CEMBI index is holding at elevated levels although it has lost a few points over the past few days. As markets reopen with oil prices in a negative mood there may be more downward pressure on regional securities.

EURUSD has risen to a ten month high following comments from ECB President Mario Draghi (see Macro). This morning EURUSD trades 0.1% higher at 1.1350, a level last seen on 23rd August 2016, and remains in the daily uptrend that has been in effect since 11th April 2017. A break of the 1.14 level would pave the way for a retest of 1.16, the highs of May 2016.

Elsewhere, CAD outperforms this morning, gaining on all the other majors. As we go to print, USDCAD is trading 0.4% lower at 1.3147, having broken below the 38.2% one year Fibonacci retracement to reach levels not seen since February 2017. A close below this level indicates that further softness is on the horizon.

Yesterday saw developed markets perform poorly across the board. In the United States the Dow Jones declined by 0.46% while the S&P500 declined by 0.81%. On the other side of the Atlantic, European equities performed equally poorly with the Euro Stoxx 50 recording a loss 0.66% while the DAX closed 0.78% lower. Regional equity markets were closed for the Eid national holidays.

This morning, Asian equity markets have opened with mixed performances. While the Nikkei is currently down 0.30%, the Shanghai Composite is 0.05% higher.

Despite rising over the previous two sessions, oil prices initially retreated this morning after the American Petroleum Institute reported that US stockpiles had increased by 851,000 barrels over the previous week. As we go to print, NYMEX WTI Crude futures trade at USD44.16/bbl while ICE Brent Crude futures trade at USD46.69/bbl. With investors will be eyeing this evening’s Government report which is expected to show an inventory drawdown of 2.25m barrels, a deviation from this expectation could cause further price declines.