The U.S. and China are due to sign a ‘phase-one’ trade deal later today in the White House, although there are still few details about what exactly to expect from it, and whether there is a roll-back of tariffs enough to satisfy markets.The text of the agreement will apparently be made public once the deal has been signed. Yesterday there was some optimism about the deal as the White House dropped its "currency manipulator" label on China, seen as a sign of goodwill ahead of today’s deal. However, overnight there were some reports that existing tariffs on Chinese goods coming into the U.S. are likely to be kept in place, with only the imposition of new tariffs looking less likely. Only after 10 months of today’s deal will the U.S. review its progress and potentially consider additional cuts on tariffs that already exist, contingent on China having kept to its side of the bargain in terms of buying more U.S. agricultural products, more manufactured goods, energy supplies, and services.This means that the average US tariff on Chinese imports will stay at around 19% for the best part of this year, compared to just 3% at the start of 2018. Further, while the dispute with China and NAFTA looks set to be more quiescent, Europe remains in the Trump administration’s crosshairs, which could see trade tensions remain a central theme of 2020, only affecting different geographies.

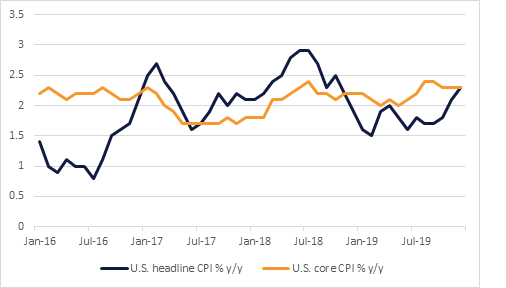

Meanwhile in the U.S. yesterday December headline CPI rose 0.2% m/m, with the core rate rising 0.1% m/m, both slightly below expectations, following respective gains of 0.3% and 0.2% in November. On a y/y basis, the headline consumer price index accelerated to 2.3% y/y versus 2.1% y/y, while the core was steady at 2.3% y/y. The report shows that underlying price pressures remain subdued and gives the Fed ample room to stand pat on rates in 2020, even if economic growth begins to recover.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries closed higher as investors turned cautious ahead of details from the Phase 1 trade agreement. Yields on the 2y UST and 5y UST closed at 1.57% (-1 bp) and 1.81% (-3 bps) respectively.

Regional bonds closed marginally higher. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed at 3.17% (-1 bp) and credit spreads remained flat at 143 bps.

First Abu Dhabi Bank raised USD 500mn in a 5y sukuk which was priced at mid swaps plus 90 bps.

The dollar was unmoved by the U.S. CPI report, that came in a little below expectations. EURUSD remained soft while USDJPY was also little changed as the markets awaited the signing of the US-China tradxe deal. Meanwhile GBP posted fresh lows against the euro while remaining heavy against the dollar in the wake of recent UK data misses and dovish BoE commmentary.

Developed market equities closed mixed as investor’s exercised caution ahead of the formal signing of Phase 1 trade deal between the US and China. The S&P 500 index dropped -0.2% while the Euro Stoxx 600 index added +0.3%.

Regional equities continued their positive run as investor’s add position ahead of the Q4 2019 earnings season. The DFM index and the Tadawul added +1.0% and +0.4% respectively. Gains continued to be led by market heavyweights.

Oil markets snapped a recent losing streak with gains in both Brent and WTI futures. Brent added 0.45% to settled at USD 64.49/b while WTI rose 0.26% to close at USD 58.23/b. Both contracts have given much of their gains back, however, following API data which showed a rise in US crude stocks.

The EIA revised up its forecast for US oil production this year to 13.3m b/d, implying growth of over 1m b/d. its initial projections for 2021 assume oil output of 13.7m b/d, or growth of 410k b/d.

Projections from the US-China phase one trade deal would assume a significant increase in Chinese purchases of energy products. However, at a time of slowing industrial growth in China’s economy there are doubts how much could actually be absorbed.

The modest contango that developed at the front of the WTI curve has persisted, even if at minimal levels.