The White House has proposed stimulus measures worth over USD 1.2tn to support households and businesses in the coming weeks. The plan includes cash disbursements in the next two weeks of at least USD 1000 for each adult, although this may be subject to some form of means testing. Treasury secretary Mnuchin proposed more cash disbursements four weeks after the initial round, if needed. These direct payments to households could amount to USD 750bn. Research by Fed economists indicate that cash payments to households at the start of a recession can reduce the severity or length of an economic downturn. Mnuchin said that without such support, unemployment could surge to 20%. Other measures proposed include USD 300bn in small business loans and USD 200bn in stabilisation funds.

The Federal Reserve also took further measures to support credit markets, restarting the commercial paper funding facility last seen in 2008 to help companies fund themselves directly from the Fed, and also setting up a primary dealer credit facility of offer funding of up to 90-days at 0.25%.

Retail sales data for the US showed a decline of -0.5% m/m in February against a consensus forecast of 0.2% rise, indicating a slowdown in consumption even before the spread of the coronavirus led to the closure of schools, restaurants and other leisure services in March. Some of the decline in retail sales may have been due to lower fuel prices at the pump. Industrial production rose 0.6% m/m in February, although factory output was barely changed at 0.1% m/m.

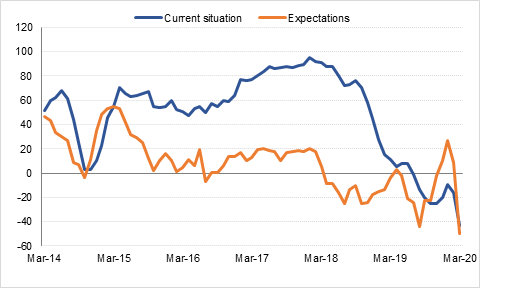

The German ZEW survey for March saw both the current situation and the expectations index fall by much more than forecast. Confidence fell the most on record this month and is at levels last seen during the European debt crisis in 2011. Sentiment was negative across all industries except information technology.

The TCMB became the latest central bank to implement cuts in an irregular meeting, as it slashed the one-week repo rate by 100bps cuts yesterday. This takes the benchmark Turkish interest rate to 9.75%, and real interest rates to -2.5%. The move will exert greater pressure on the lira, which is now trading at TRY 6.4125/USD, compared to TRY 5.9511/USD at the start of the year, but was seen as necessary in order to support the economy as the coronavirus takes hold in the country and the wider region.

Source: Bloomberg

Source: Bloomberg

Treasuries closed sharply lower as risk assets rallied following reports for a large stimulus package from the US government. Gains were led by the long-end of the curve with the 10y UST yields closing back above 1%. Yields on the 2y UST closed at 0.49% (+13 bps).

Regional bonds continue to see investors paring position. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +15 bps to 4.20% and credit spreads remained flat at 328 bps.

GBPUSD continued its decline yesterday despite Boris Johnson escalating the UK’s response to the coronavirus outbreak. Their laissez-faire approach has been unsettling to investors, given that the rest of Europe are taking more extreme measures. After opening at 1.2271, it steadily declined to the area of 1.2004, its lowest price since September. However, overnight GBP has recovered a little after the UK PM announced a big rescue package for UK businesses. Despite all the measures taken by Europe to try and control the outbreak, that did not stop EURUSD from also experiencing a steady decline. The poor results from the ZEW Survey to -49.5 only compounded the losses to below 1.10, before recovering slightly this morning. USDJPY saw some modest gains, to the 107.10 level. The surprising firmness of US Libor and Treasury yields continues to underpin the USD despite the sharp cut in Fed interest rates at the start of the week.

Developed market equities closed higher in what was another volatile session of trading. Investor took comfort in another booster shot from the Fed and reports of a large stimulus package from the US government. The S&P 500 index and the Euro Stoxx 600 index added +6.0% and +2.3% respectively.

Regional markets closed mixed as some buying interest came back. The Tadawul added +2.5% while the DFM index lost -5.0%. Banking sector stocks continued to remain under pressure.

Oil prices continued to push lower as emergency measures from governments and central banks only compounds a sense of panic in financial and commodity markets. Brent settled at USD 28.73/b, down more than 4% while WTI lost more than 6% to close at USD 26.95/b. Saudi Arabia has said that it will boost exports to more than 10m b/d in April-May, diverting oil from domestic consumption, and will swamp markets ever further than expected. There are few lines of resistance in the way of oil testing lower amid the demand chaos and oversupply and markets may need to prepare for substantially lower levels ahead.