Trade tensions between the US and EU are escalating in response to mutual accusations of state aid for their respective airline industries. The European Commission is reportedly preparing a list of USD 23bn of goods from the US that it will hit with tariffs in response to statements from US president Donald Trump’s plan to impose tariffs on USD 11bn worth of goods coming from EU members. Both sides are taking their arguments through the WTO at a time when there is enormous scrutiny on disruptions to trade acting as a barrier to growth in 2019-20. At the IMF meetings held over the weekend in Washington DC, finance ministers and central bankers highlighted tariffs as a major drag on global GDP.

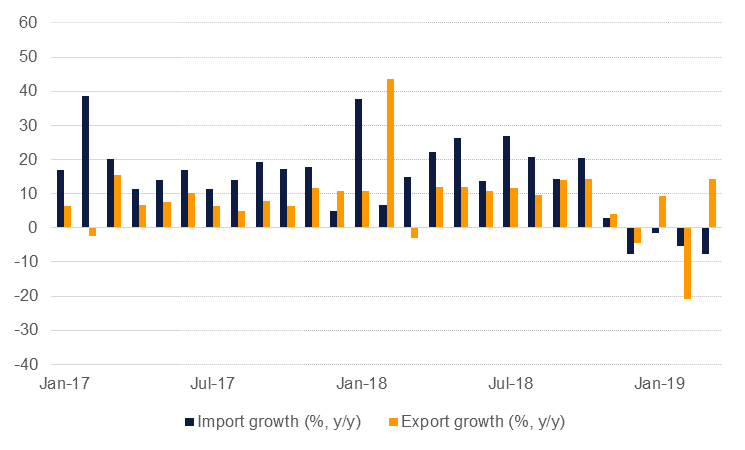

China’s exports recovered in March, rising more than 14% y/y after a nearly 21% drop in February. The gain likely reflects a catch-up period after Lunar New Year holidays in February and exports may struggle to carry that momentum forward. More telling on the health of the Chinese economy, imports declined for a fourth consecutive month. The US treasury secretary, Steve Mnunchin, said at the end of last week that both the US and China had agreed on enforcement mechanisms to ensure any deal signed by the countries is implemented and maintained.

After several weeks of pending deadlines and back and forth summits with EU leaders, the Brexit saga had a relatively quiet few days as the market beds down a delay until the end of October. Theresa May will continue to push for her deal to be accepted by parliament, likely with some concessions offered to the Labour party, so that the UK can leave at an earlier stage. One sticking point may be whether Labour insists on a second confirmatory referendum on the terms of the deal. The UK’s chancellor Philip Hammond said he expected that a proposal for a second referendum to be put to parliament although he maintains the government’s position is still to oppose it. Sterling has continued to be relatively stable since the start of April, hanging on to range between 130 and 131 but we would attribute this more to the uncertain outlook for Brexit and the markets not wanting to be caught out sharply on one side or the other, more than any particular underlying strength to the currency.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Treasuries ended the week lower amid reduced volatility as economic data in the US came in better than expected. Yields on the 2y, 5y and 10y USTs closed at 2.39% (+6 bps w-o-w), 2.38% (+5 bps w-o-w) and 2.56% (+7 bps w-o-w) respectively. Despite IMF’s recent growth downgrades and ECB’s dovish outlook, yield on 10yr Gilts and Bunds also increased to 1.21% (+6bps, w-o-w) and 0.05% (+7bps, w/w) respectively. Adequate risk appetite also saw CDS levels on US IG and Euro Main decline by two to three bps to 57bps each.The yield spread between 10y Gilts and 10y Bunds stayed close to its widest level since October amid a dovish outlook by the European Central Bank and a six-month extension to the Brexit date.

GCC bonds benefited from stability in oil prices with credit spreads on Bloomberg Barclays GCC Credit and High Yield index tightening 5 bps w-o-w to 158 bps though average yield rose a bp to 4.04% in response to rising benchmark yields.

Aramco bonds underperformed in the secondary market. ARAMCO 49s are currently trading at USD 97.535, ARAMCO 29s at USD 98.12 and ARAMCO 24s at USD 98.69 respectively.

EURUSD rose for the first time in four weeks, climbing 0.74% to close at 1.1299, not far from the 1.13 handle we predicted. Despite breaking above the 50-day moving average (1.1304) on Friday, the cross was unable to hold onto these gains and a daily close above this level was not realized. Over the next week, the price is likely to encounter resistance at the 200-week moving average (1.1341), a level which has halted gains over the last five weeks.

A 0.26% climb took USDJPY to 112.02 in a third week of gains. The price remains above its 200-day moving average (111.51) which was broken last week and is likely to continue to provide support. In addition, analysis of the weekly candle chart shows that the 100-week moving average (110.80) has provided support for a second week. In addition, there was a test of the 200-week moving average (112.04) although the price was unable to break above this level.

The ADX index outperformed its regional peers on the back on sharp gains in banking sector stocks. First Abu Dhabi Bank rallied more than 4% after the company implemented the increase in foreign ownership limit to 40% from 25%. Elsewhere, Emaar Malls and Emaar Development stocks came under pressure at the start of the week.

Oil markets continued to push higher, lengthening their year-to-date gains. WTI futures rallied 1.3% last week to close at USD 63.89/b while Brent futures closed at USD 71.55/b, up 1.7% on the week. WTI has risen more than 40% ytd while Brent has gained 30% so far this year. Oil’s gains come despite downgrades to global growth forecasts from the IMF and the potential of escalating trade tensions between the US and EU.

The escalation in political instability in Libya is a short-term supply risk as the LNA controls access to several key production facilities in the country. On top of the uncertainty over whether the US will extend waivers to its Iran sanctions in May, the Libya risk will be fueling discussion within OPEC+ on whether the current production cuts will be extended from June into H2 2019. Russian officials in recent days have been very outspoken in questioning whether output cuts can be ended even if it risked sending prices lower. Our view has long been that production from OPEC+ would increase in the second half of the year to compensate for the ‘over’-tightening of the market that has resulted from producers cutting output more than required and involuntary outages in producers like Iran, Venezuela and Libya.