Fed Chair Jerome Powell announced an historic policy shift towards average inflation targeting at his address to the virtual Jackson Hole symposium on Thursday. The change of tack outlined in Powell’s address, which was accompanied by relevant documents, means that inflation of ‘moderately’ higher than 2% will now be tolerated for extended periods when following periods when price growth has undershot the target – what Powell termed ‘a flexible form of average inflation targeting.’ His speech acknowledged the flattening of the Philips curve in recent years – the inverse relation between unemployment and inflation – and ‘shifts in estimates of the natural rate of unemployment’, implying that the Fed will not necessarily immediately act to dampen pressures as the unemployment rate falls, unless there is an accompanying and durable shift in inflation.

Inflation in the US has consistently fallen short of the Fed’s 2% target despite the central bank using massive stimulus since the Global Financial Crisis and keeping rates close to historically low levels. Even during the 2015-19 hiking cycle, the upper bound of the Fed’s target rate peaked at just 2.5%, compared with more than 5% during the pre-financial crisis round of hikes. Yet the Fed’s preferred measure of inflation only reached its target of 2% for a few months and barely exceeded it. Given the structural factors weighing against inflation in the US—demographics shifting to an older population for example—along with the deflationary impact of the Covid-19 pandemic—a spike in unemployment and excess capacity as many industries operate at slower paces—we see little immediate chance that the Fed will be able to achieve its 2% target through keeping rates on hold alone.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

That leaves the door open to more unconventional policy choices. Minutes from recent FOMC meetings have suggested there is little support for the Fed to make use of yield curve control and target a specific yield on the 2yr UST for instance, as central bankers in Australia and Japan have done. Moreover there appears to be little appetite for the US to go down the route of negative interest rates which have so far failed to spark sustained high output in economies where they have been deployed (the EU and Japan most notably). Stronger forward guidance—albeit without linking moves in rates to a specific unemployment rate level—seems all but assured to be a tool the Fed will lean on more extensively in coming meetings. Additionally the Fed may choose to accelerate its asset purchases or broaden them to even more sectors.

With rates now anchored at 0.25% for the foreseeable future and with several options still available to the Fed that would put downward pressure on yields we now expect UST yields at a lower trajectory than previously. Yields will likely move higher into the end of 2020 and into 2021 in line with the recovery in the US economy and may be prone to spikes in response to newsflow surrounding the potential for a Covid-19 vaccine. However, we would expect any burst in borrowing costs to elicit a response from the Fed—for instance in the language used in FOMC minutes—that would seek to quash yields.

.png)

Source: Bloomberg, Emirates NBD Research. Note: range during quarter. Data as of August 31 2020.

Treasury markets will also be motivated more by actions on the fiscal policy front rather than monetary policy over the rest of 2020. Markets will be closely watching for political compromise between Democrats and Republicans to allow a new stimulus plan to emerge but political divisions in the US appear to be widening, rather than narrowing and we are not holding out hope that a substantial fiscal package will be reached. While US data has been encouraging recently with recent PMI numbers and housing market conditions appearing promising, the economy is by no means ready to stand on its own two feet and further unemployment and consumption-oriented relief would be welcome.

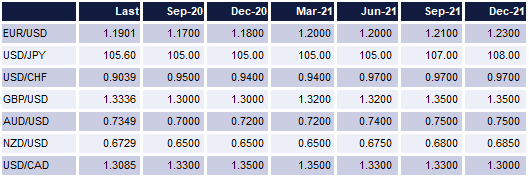

The Fed’s strategy shift and the yield lowering tools available to them reaffirms our view of broad dollar weakness against most major currency pairs out to the end of 2020 and into next year. The pace of dollar weakness over the summer months has meant many of our end of year targets have already been reached and surpassed and we are marking our forecasts to market accordingly. The underlying fundamental factors behind our medium-term currency views that we laid out in our July Monthly Insights remain intact but we have updated our views in response to what we expect will be a sustained period of USD softness, at least well into 2021.

The one potential outlier among the majors to this trend is GBP, as sterling faces considerable political risk over the coming months as negotiators from the UK and EU have yet to reach a deal on a new trading relationship post-Brexit. A modest deal related to goods may be achievable and help to limit the economic fallout of a no-deal Brexit, helping sterling hold its gains against the dollar and tentatively push higher into 2021. However, anxiety over the shape of a future UK-EU trading relationship means there are still considerable downside risks to sterling in the months ahead.

Source: Bloomberg, Emirates NBD Research. Data as of August 31 2020.