The UK labour market continued to show signs of strength with the unemployment rate remaining at 3.8% as 180k jobs were added in the three months to December. Wage growth was up 3.2% y/y when stripping out bonuses, well over the pace of inflation in the UK while productivity also nudged higher. The data affirms the Bank of England’s decision to keep rates on hold at its January meeting and shows the economy still operating well even as Brexit uncertainty clouds the outlook for investment. Both sterling and gilt yields moved higher in response to the data before unwinding their gains by the end of the day.

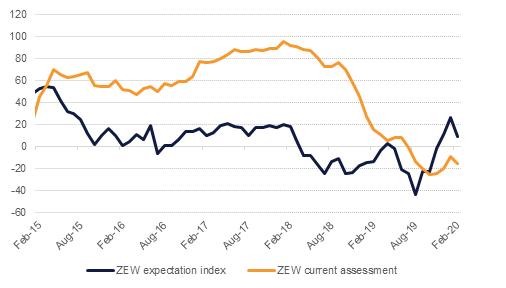

Germany’s ZEW index of investor confidence collapsed for February with the assessment of current economic conditions falling to -15.7 from -9.5 in January while the expectation index slumped to 8.7 compared with 26.7 a month ago. Germany’s economy is drifting with no clear sign of momentum and may be at risk of serious downturn should it become a target for the US administration’s hawkish trade agenda. Political uncertainty following the resignation of Chancellor Angela Merkel’s preferred successor also won’t help shore up sentiment in the Eurozone’s most important economy.

Singapore’s government announced an extensive fiscal support programme to help fight the impact of the Covid-19 outbreak on the country’s economy, allocating SGD 800m specifically for health care spending. A total of SGD 4bn will be spent to help local firms endure the health crisis and on consumers to compensate for cost of living changes.

Trade figures from Japan showed a tentative improvement in January with exports declining by 2.6% y/y, better than the more than 6% decline recorded in January. That relative outperformance—while still being negative—affirms some of the views from the WTO that trade had started to look like it was improving at the end of 2019 only for those gains to be unwound by the impact of the Covid-19 outbreak. Imports in January declined by 3.6% leaving Japan with a trade deficit of JPY 1.3trn, far short of market expectations of almost JPY 1.7trn.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as risk assets gave up some of their gains. The curve bull flattened with yields on the 2y UST and 10y UST closing at 1.41% (-1 bp) and 1.56% (-2 bps) respectively.

Regional bonds continued their positive run. However gains were very marginal compared to moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained at 2.94% and credit spreads widened 2 bps to 142 bps.

The primary market appears to be gathering pace in Saudi Arabia with corporates marketing USD denominated bonds. Riyad Bank, Dar Al Arkan and Islamic Development Bank are in market to raise money.

This morning JPY is trading softer as Asian equity markets open on a more positive note following a slowdown in the number of new virus cases in China. As we go to print, USDJPY is trading 0.15% higher, at 110.04. Should the price see a daily close above the 110 level, we could see further gains towards 110.50 in the short term, not far from the 76.4% one-year Fibonacci retracement of 110.53.

Developed market equities gave me of their gains following warnings from some US companies regarding supply issues from China. The S&P 500 index and the Euro Stoxx 600 index dropped -0.3% and -0.4% respectively.

The Qatar Exchange (+0.7%) was a notable exception in what was a weak day of trading for regional equities. The weakness was rather broad based as investors remained cautious.

Oil markets received a boost following the US imposing sanctions on Rosneft, Russia’s largest oil producer for its ties to Venezuela’s state oil company. Production in Venezuela has already been seriously curtailed by the economic crisis hitting the country but may dwindle even further as there will be now fewer lifters of crude from the country. Brent futures settled at USD 57.75/b, up 0.14% while WTI was unchanged.

The EIA’s drilling productivity report expects crude production from shale basins to rise to 9.17m b/d in March, a gain of 980k b/d y/y. While it is a slowdown from the more than 1.2m b/d increase on average in 2019, supply additions from shale basisn are coming on an elevated pace.