As had been widely anticipated since the Conservative Party leadership contest was whittled down to the final two, Foreign Secretary Liz Truss beat her opponent Rishi Sunak by securing 57% of the vote to 43% and is set to be asked to form a government by the Queen later today. Sunak had been Chancellor of the Exchequer before his resignation in early July helped set in motion the mass ministerial resignations which led to the downfall of previous prime minister, Boris Johnson, and he had enjoyed the strongest support from fellow MPs during the initial stages of the contest. However, Liz Truss, with a focus on tax cuts and a stated aversion to ‘handouts’, won the favour of the larger share of the 170,000 or so members of the Tory party that voted for the final two.

With Boris Johnson having been reluctant to leave office before the contest was decided, but also deciding not to initiate any policy changes as a lame duck leader, new PM Truss now has an unenviable inbox to deal with upon her taking office as the UK looks in the face of rampant inflation, a resultant cost-of-living crisis, and stalling economic growth. In the days preceding the contest results she pledged to hit the ground running and promised a plan to deal with these multiple challenges as well as a long-term vision that would unlock the UK’s potential.

.jpg) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

True to her word, shortly after the results were announced Truss signaled plans to intervene in the energy markets through freezing energy prices below the current household average of GBP 1,971, scrapping the current pricing regime and using a new unit price set by the government. The plan is expected to cost more than GBP 100bn but would avert the further rises in energy prices currently anticipated and would keep inflation from hitting some of the more eye watering forecasts of recent months. CPI inflation hit 10.1% y/y in August and was expected to head much higher still as the energy price cap rose, placing increasing pressure on households, especially those on lower incomes, and on businesses.

While Truss has changed tack on the energy freeze, a more doctrinaire adherence to some of the other positions adopted during the leadership contest could exacerbate some of the inflationary challenges, and it remains to be seen to what degree her stance mollifies upon taking office; Truss’ acceptance speech remained bullish on tax cuts and on governing ‘as a Conservative’. This pledge to cut taxes on a universal basis for households and to slash expected corporation tax levels could also further stimulate price pressures, driving up core inflation at a more rapid pace in addition to the ongoing impact from already higher gas costs, while failing to directly support those most at need of support – lower income households will see little benefit from lower income tax levels.

Source: ONS, Emirates NBD Research

Source: ONS, Emirates NBD Research

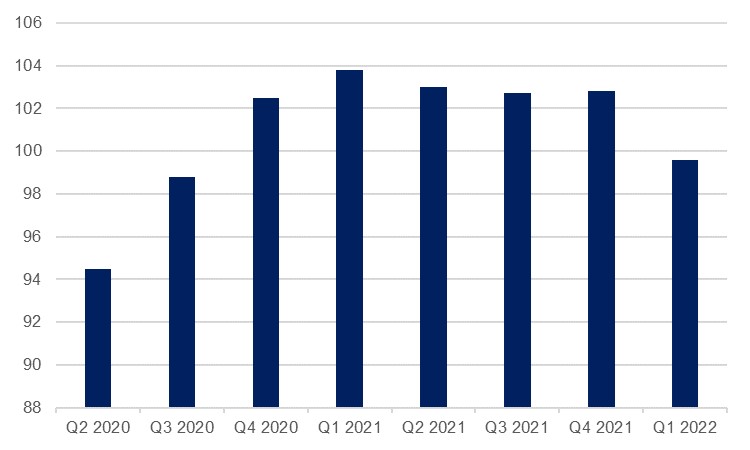

The expenditure required for the energy plan, alongside rises in inflation-linked benefits programmes and these mooted tax cuts will place mounting pressure on the government’s fiscal position, and while Truss has said that economic growth is her priority, the debt/GDP ratio will likely deteriorate at a time when interest rates are steadily climbing. Having dipped back to 99.6% of GDP in Q1 2022, debt is widely expected to rise above output once again in the coming quarters as debt rises and GDP contracts. UK GDP contracted -0.1% q/q in the second quarter and is projected to shrink by a further -0.3% in Q3. Indeed, the UK saw a negative reading on its composite PMI reading for August on the final reading in data released yesterday. The index came in at 49.6, down from the initial reading of 50.9 and marking the first sub-50.0 result for the survey since February 2021, when the country was under a Covid-19 lockdown. Demand for consumer services such as restaurants is falling as high inflation bites, while financial services are facing a slowdown as interest rates rise.

The freeze on energy prices should offer some support to household spending in the coming months, but on the aggregate level UK households have already seen their real incomes fall at a record -3% y/y in Q2. While this is still likely to worsen in the coming quarters, it will not fall as sharply as it would have otherwise. Nevertheless, this fall in real wages has already prompted an uptick in industrial action this summer, with more disruptions to transport, education and postal services planned which will further hamper economic activity and drag on growth.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

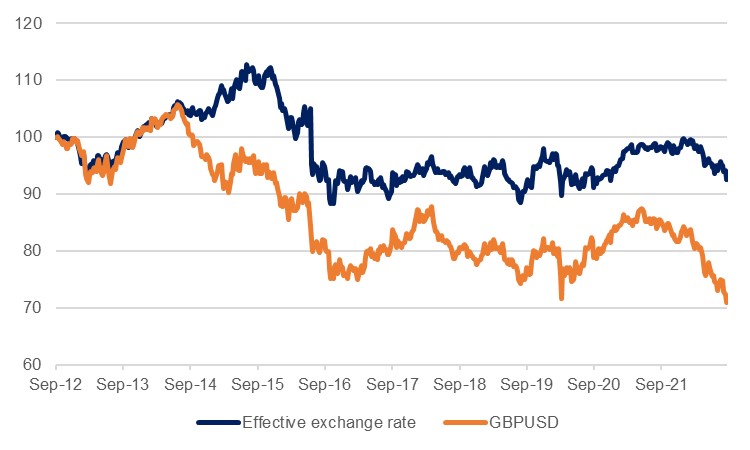

The worsening growth outlook and fiscal position is being reflected in the fixed income market – 10yr gilt yields have risen 113bps since the start of August – and in the currency market, as sterling has been steadily weakening against the dollar, falling to multi-decade lows in recent sessions. Much of this is as much a dollar strength story as it is inherent GBP weakness – EUR, JPY and other majors have also weakened against USD, and the pound’s effective exchange rate, while weakening, is arguably within the post-Brexit range still – but the upside for the currency is certainly limited at present with public debt levels rising, inflation set to remain high, and a deteriorating growth outlook as the energy crisis bites on both households and businesses. Sterling enjoyed a 0.5% bounce against the greenback yesterday but remains low compared to long-run averages.

Source: Bloomberg, Emirates NBD Research. Rebased 10 years

Source: Bloomberg, Emirates NBD Research. Rebased 10 years

The Bank of England’s stance will be key in the coming months and quarters, and the market is currently pricing a further 150bps of hikes through Q1 2023 to 4%, much higher than analysts currently expect given the worsening economic outlook. The bank might well act more firmly as it looks to balance the changing fiscal outlook and its potential impact on inflation, but with UK rates likely to remain lower than those of the US, we expect that sterling will remain under pressure.