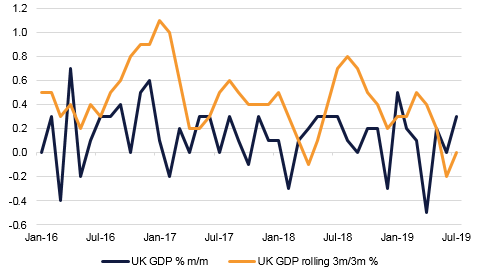

UK July GDP data came in a little above expectations, with growth rising 0.3% m/m, above the median forecast for 0.1%, and with industrial output also unexpectedly expanding by 0.1% m/m. Service-sector growth lifted the overall GDP figure rising by 0.3%. In the three months to July, GDP was flat while production fell -0.5%, reflecting slowing global growth. The data casts doubt on the extent to which Brexit was negatively affecting activity during the last few months, and also suggests that the UK may avoid a recession in Q3 following a contraction in Q2. It may be reasonable to think that recent political developments may have been a much heavier burden on confidence and activity, but other factors in August are likely to be positive including car production.

There was also a second vote in the UK Parliament yesterday on PM Johnson’s wish to hold a snap general election, which failed again, and parliament was finally suspended for 5 weeks until 14th October. Johnson said he will work in the coming weeks to secure a Brexit deal with Brussels but he still refused to rule out a ‘no-deal’ Brexit despite a bill passed last week instructing him to request a delay if a deal cannot be reached by the 17-18 October EU Council summit.

The Dubai PMI fell to 51.7 in August, down from 55.2 in July and the lowest reading since early 2016. The main driver was slowing output and new order growth. The employment index returned to contraction territory last month, falling to 49.5 from 50.1 in July. Selling prices declined for the 16th month in a row, although the extent of price discounting in August was fractional. The lack of pricing power on the part of businesses in Dubai is also reflected in the official CPI data, with Dubai CPI down -0.4% m/m and -3.0% y/y in July. The main driver of deflation is the continued decline in housing costs, which make up 40% of the index. However, clothing & footwear, transport and miscellaneous goods and services also saw prices fall relative to a year ago.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries ended the week lower as risk sentiment revived following confirmation of trade talks between the US and China in October. In fact, weak non-farm payrolls data and comments from Fed Chair Jerome Powell which reinforced expectations of a rate cut at next week’s meeting had limited impact. Yields on the 2y UST, 5y UST and 10y UST closed at 1.54% (+4 bps w-o-w), 1.43% (+5 bps w-o-w) and 1.56% (+7 bps w-o-w) respectively.

In Europe, there was intra-week volatility in UK bond yields as the Brexit process unfolded. However, on a w-o-w basis, yields on 10y Gilts rose marginally to 0.50% as risks of a no-deal Brexit receded.

Regional bonds closed flat for the week as investors track moves in benchmark yields and hold position ahead of key central bank meetings over the next two weeks. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained flat at 3.07% while credit spreads tightened 5 bps w-o-w to 153 bps.

This morning, NZD is trading firmer against the other major currencies following firmer economic data. Total credit card spending in August increased by 1.3%, an improvement from a 0.2% contraction the previous month, and a sign of increased consumer spending. As we go to print, NZDUSD is trading 0.15% higher at 0.64337 and and is on target for a sixth day of gains. This level co-incides with the 23.6% one-year Fibonacci retrcamement, a level which the cross needs to close above in order to hold onto these gains.

Regional equities closed mainly lower. The DFM index dropped -0.7% as investors locked in gains from the previous week. Emirates NBD (-2.9%), Emaar Properties (-0.2%) and Emaar Malls (-1.9%) were notable losers. Shuaa Capital lost -1.5% after the company informed that they will sell their brokerage and market making businesses to a unit of International Holdings Co in an all cash deal.

Oil prices rallied further yesterday in the wake of the appointment of new Saudi Arabia energy minister Prince Abdulaziz bin Salman. Prince Abdulaziz said there would be no radical change in energy policy ahead of OPEC+ meetings towards the end of the week, implying that the strong relationship developed with non-OPEC countries like Russia by his predecessor would continue. Brent futures closed up 1.7% at USD 62.59/b, while WTI saw even greater advances, climbing 2.4% to USD 58.1/b. Both benchmarks have seen further gains in early morning trading today.