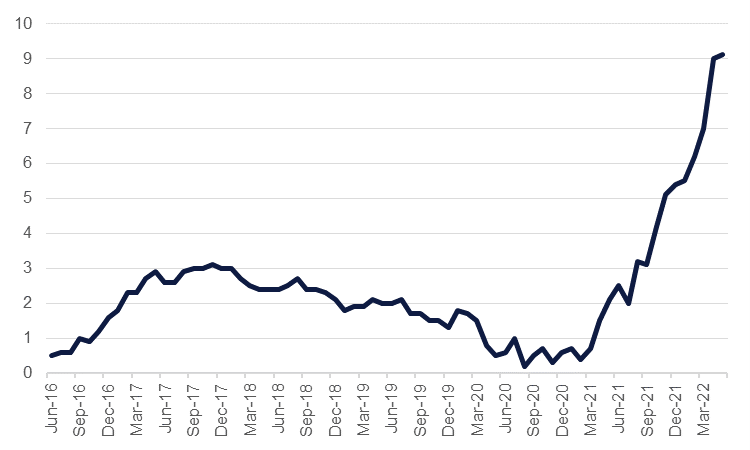

Inflation in the UK rose by 9.1% y/y in May, roughly in line with market expectations and up from 9% recorded a month earlier. Core CPI, stripping out food and energy prices, rose by 5.9% y/y. The move was primarily driven by a sharp increase in the price of food and beverages with several other sectors seeing incremental rises as well. Housing, utilities and transport costs continue to act as the main drivers of inflation. On a monthly basis, CPI slowed to 0.7% m/m compared with 2.5% previously, indicating some slowdown in consumer price growth.

The inflation outlook for the UK is unlikely to materially improve in the coming months as energy costs remain high and food prices are still being affected by supply disruptions from Russia’s invasion of Ukraine. At the same time, GBPUSD has moved steadily lower since the start of June, down by almost 3% as of the May CPI print to 1.2233. Labour action also raises the risk of wage costs moving higher as well, potentially by as much as headline CPI levels.

Source: Bloomberg Emirates NBD Research

Source: Bloomberg Emirates NBD Research

The Bank of England raised rates by 25bps at its MPC meeting at the start of June but commentary from officials has since turned more hawkish, seemingly focusing on the inflation challenge at the expense of growth. Indeed, three members of the MPC voted for a 50bps hike at the June meeting already. Chief economist of the BoE, Huw Pill, has noted since that the bank would need to take “more aggressive action” if high inflation becomes “embedded” while Catherine Mann, another MPC members said that a “robust policy move” would help to “reduce the risk” of inflation staying higher for longer amid external drivers of higher prices and a weaker currency.

With inflation unlikely to moderate in the coming data prints—and the BoE itself targeting a peak of as much as 11% this year—we now expect more considerable hikes to the Bank Rate at upcoming meetings. We expect the BoE to hike by 50bps at their August and September meetings with another 25bps pencilled in for November. That will bring the Bank Rate to 2.5% by the end of 2022 with risks likely to the upside. For 2023 we currently expect another two 25bps to bring the Bank Rate up to 3%.

While the higher policy rates should notionally serve to help support GBPUSD, we expect the BoE will keep chasing inflation while the economy weakens. Moreover, the Federal Reserve in the US now appears to be much more committed to using aggressive hikes to stave off inflation and based on our forecasts will maintain an interest rate differential of 150bps relative to the BoE by the end of 2022. We maintain our view for GBPUSD to be subject to considerable downside risks with levels around 1.20-1.22 serving as a top for Q3-Q4.