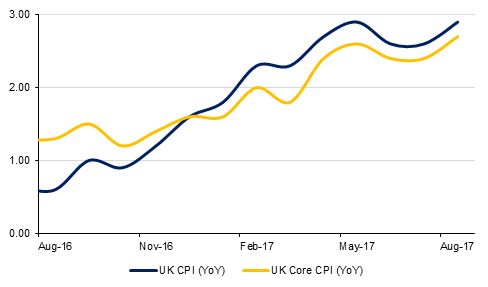

Inflation in the UK in August was stronger than the market anticipated. CPI rose 2.9% y/y up from 2.6% a month earlier and core CPI rose 2.7% (from 2.4% previously). Gains in clothing and fuel prices pushed the overall index higher to the joint highest level since 2012. The inflation data will raise scrutiny over the Bank of England’s meeting later this week over the trajectory for rates. With inflation gathering pace the market will likely start to price in some move higher in benchmark rates even if policymakers at the Bank have been outspoken against doing so.

India’s consumer price index (CPI) jumped to 3.36% in August 2017, higher than consensus estimates of 3.2% and 2.36% in July 2017. The increase was primarily driven by jump in food prices. The food price component in the index rose 1.52% in August compared to -0.36% in July. Inflation is likely to see upward pressure in the short term, a possibility highlighted by the Reserve Bank of India (RBI) at its last meeting, as changes in indirect tax system (GST), impact of an increase in government employee salaries and increase in oil prices feed into the system. However, despite the increase inflation remains below the RBI’s medium term target of 4.0%. The industrial production data, released separately, showed an increase of 1.2% y/y in July 2017.

Labour figures out of the US showed continued strength in the jobs market with job openings hitting a record high of 6.2m according to the JOLTS report. Companies are reportedly having a hard time finding skilled labour, a dynamic which should support wages and inflation pressures going forward. The quits rate, highlighting workers voluntarily leaving their jobs in search of new opportunities, also increased to 3.2m as confidence that wages will increase is spreading across the economy. The labour figures helped to push rates higher and put the odds of a rate hike in December at nearly 1 in 3.

Source: Emirates NBD Research

Source: Emirates NBD Research

The long end of US Treasuries closed lower for a second consecutive trading session helped in part by losses in European Government bonds. Yields on 10y GILTs rose 9 bps to 1.13% as inflation in the UK came in much stronger than expected. Yields on the 10y USTs rose 3 bps to 2.16% and 30y USTs by 3 bps to 2.77%.

Local bond market continued to follow the moves in benchmark yields. The yield on the Bloomberg Barclays GCC Credit and High Yield index rose 2 bps to 3.37% and credit spread tightened by 2 bps to 160bps.

Much of the focus remains on the Bahrain sovereign which is expected to price either later today or early tomorrow. It is expected to issue bonds and sukuk in three tranches of 7y, 12y and 30y. The current BAHRAIN26s is yielding 6.19% and the 5y CDS is trading at around 232 level.

The dollar is trading marginally softer in this morning Asia session this morning, with Dollar Index currently trading 0.08% lower at 91.81 and remaining in the daily downtrend that has been seen since that start of 2017. From a technical perspective the dollar remains vulnerable and unless supported by a firm inflation report on Thursday, the path of least resistance is for further declines towards the one year low of 91.01. A break of this level will expose the index to the risk of falling towards 88.24, the 38.2% five year Fibonacci retracement.

Developed market equities closed higher amid lack of new development on geopolitical front. In fact, risk appetite received a boost from reports of a fresh push by Donald Trump to get tax reforms passed. The S&P gained +0.3% to close at record highs while the Euro Stoxx 600 index added +0.5%. Apple closed -0.4% lower as investors were underwhelmed by company’s new product launches.

Most regional equity indices closed lower with the Qatar Exchange dropping -0.7%. Foreign investors continue to pare their positions in Qatari stocks.

In terms of stocks, Banque Saudi Fransi dropped 4.2% after Credit Agricole said that it has agreed to sell 16.2% stake in the bank to Kingom Holdings at a discount to the current market price. Under the terms of the deal, Credit Agricole may further sell its stake in the company. In contrast to Banque Saudi Fransi stock, Kingdom Holding shares jumped +5.1%.

Oil prices rose modestly yesterday, reacting to varying narratives for the market. Private sector data from the API showed an increase in US crude stocks of 6.2m bbl as the impact of Hurricane Harvey weighs on demand while the EIA cut is projections for oil output this year and next as it measures the recovery effect in US oil and gas. OPEC, in its monthly oil report, revised up its demand expectations and the ‘call’ on its own crude output by 410k b/d in 2018, which could give some countries a pass with respect to not sticking to their agreed production cut levels.

The backwardation in Brent futures has widened further and 1-2 month spread is around USD 0.26/b while the similar spread in WTI remains in a contango of close to USD 0.50/b. The Brent-WTI spread widened to as much as USD 6/b yesterday as the markets expects further tightening in international markets than in the US.