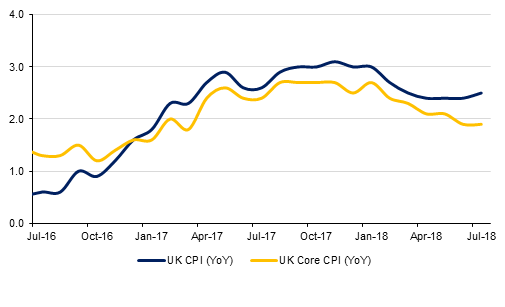

Consumer Price Inflation in the UK in July ticked marginally up to 2.5% y/y from 2.4% in June mainly as a result of increase in energy costs and computer games prices. Core inflation excluding food and energy held steady at 1.9% y/y. The recent depreciation of sterling is likely to prevent inflation from falling much. In addition house price index in the UK showed continued weakness, falling 0.7% m/m in July, its biggest declining streak since 2009.

Boosted by the recent tax cuts, both headline and underlying retail sales in the US grew 0.5% m/m in July. The gain in headline sales was helped by a 0.2% m/m rise in auto sales and 0.8% gain in non-store sales. In addition sentiment on US housing remains solid with the NAHB housing index remaining well above 50, coming in at 67 now vs a similar level in August last year. With retail sales still robust and inflationary pressures building, the Fed is expected to continue to increase interest rates by 25bp each quarter, even though volatility has increased materially in the emerging markets recently.

Japan’s trade balance turned negative in July with deficit coming in at $2.1 billion. Imports surged 14.6% y/y in July due to higher oil bill while exports rose 3.9% y/y. Though exports increased for the 20th straight month, the growth fell below expectations with the drop in shipments to the U.S. offering the biggest surprise.

The unemployment rate in Australia fell to 5.3% in July from 5.4% in the previous month, boosting hopes for inflation to pick up pace and lend support for RBA to hike rates for the first time since 2010, sometime in the next 12 months.

UAE bank deposits rose 0.6% m/m and 6.5% y/y in July, according to preliminary data released by the central bank. Loan growth remained flat m/m but was up 1.8% y/y.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher amid broad-based sell off in risk assets. Yields on the 2y UST, 5y UST and 10y UST closed at 2.60% (-3 bps), 2.73% (-4 bps) and 2.86% (-4 bps) respectively.

Regional bonds closed higher but continued to trade in a tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -2bps to 4.47% and credit spreads widened +3 bps to 178 bps.

This morning, EURUSD is trading 0.33% firmer and has risen to 1.1385, climbing back above the 50-day moving average in the process. Should the price realize a daily close above this level, we could see further relief for the common currency. The chances of this happening will be greater if the price can close above the 100-day moving average of 1.1387.

This afternoon, investors will be looking towards the UK where retail sales data is expected to show robust growth. With the GBPUSD climbing back above the 1.27 handle this morning, after being pressured heavily by Brexit uncertainties, any downside surprises in the data could catalyze more significant losses.

Developed market equities closed lower as weak corporate earnings and drop in commodity prices weighed on investor sentiment. The S&P 500 index and the Euro Stoxx 50 index declined -0.8% and -1.6% respectively.

Most regional equity markets closed lower. The DFM index and the Tadawul dropped -0.8% and -0.4% respectively. The DFM index was led lower by weakness in real estate stocks with Emaar Properties and Damac dropping -1.6% and -1.4% respectively.

Commodities were caught in a tailspin yesterday with red across all markets. Lead prices fell more than 7% as a sharp drop in copper futures dragged industrial metals lower. Copper prices fell below USD 6,000/tonne for the first time since July last year as soft data out of China earlier this week and few signs of a strike affecting output at a mine in Chile weighed on prices. Oil markets were caught up in the maelstrom and WTI prices fell more than 3% and Brent closed down by 2.3% to a USD 70/b handle.

The EIA report showed enormous demand for US crude with refineries running flat out but production and inventories also moving higher. Even with refining utilization running well above its five-year average the amount of crude being offered is overwhelming and prices are acting as the release valve.