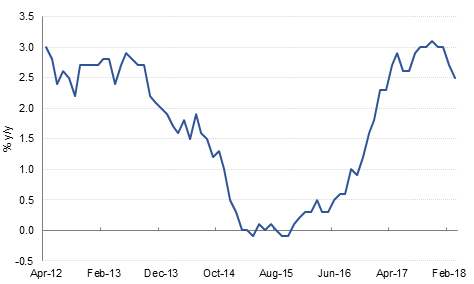

UK inflation came in softer than expected yesterday at 2.5% y/y compared with a forecast for 2.7% and also lower than February’s reading. This put some pressure on GBP, coming as it did after lower than forecast wage inflation released the day before. The market is still pricing in a more than 80% probability of a BOE MPC rate hike at next month’s meeting, but this is lower than the probability at the start of the week. With this in mind, the UK retail sales data released today will be of great interest.

In the Eurozone, March CPI came in at 1.3% y/y, just under the forecast for 1.4% but slightly higher than the February reading of 1.1%. Construction output declined -0.5% m/m in February, following a (revised) -0.8% m/m drop in January.

The US Federal Reserve Beige Book contained few surprises. Economic activity expanded at a “modest to moderate” rate and the outlook was described as positive despite increased concerns about newly imposed and proposed tariffs. Employment growth was also described as “modest to moderate” but in general, wage growth was only “modest”, despite several industries reporting difficulty in finding qualified candidates.

The Bank of Canada kept rates on hold at 1.25% as expected overnight, and there was no significant change in the Bank’s outlook for the economy or monetary policy, with the Bank appearing in no hurry to accelerate the pace of rate hikes. The market is expecting the next move by the BOC only in July.

Finally, Turkey’s President Erdogan has called a snap election for 24 June; it had been scheduled for November 2019. The move surprised markets as Erdogan had brushed off speculation about early elections as recently as 6 April.

The UST closed lower in what was a relatively volatile session of trading following mid-session reports that the Trump administration told Russia that no more sanctions were coming. Yields on the 2y UST, 5y UST and 10y UST closed at 2.42% (+3 bps), 2.73% (+5 bps) and 2.87% (+5bps).

Regional bonds continued to drift lower with the YTW on the Bloomberg Barclays GCC Credit and High Yield index gaining 1 bp to 4.38%. The credit spreads however declined 4 bps to 171bps as oil prices continued their strong rally.

GBPUSD fell for a second day on Wednesday following softer than expected inflation data out of the UK (see macro). Over the course of the day GBPUSD fell almost 0.6% to close at 1.4203 as long positions took profit and speculation on a second potential hike from the Bank of England fell and the market implied probability of a rate hike at the May meeting fell from to 83.5% compared 96.2% at the start of the week. As we go to print, the price is almost unchanged at 1.4196 during the Asia session.

This morning’s outperformer is AUD which has gained against all the other major currencies after positive employment data. Reports from Australian Bureau of Statistics showed that the unemployment rate in February was revised down from 5.6% to 5.5% and confirmed this rate for March 2018. AUDUSD is currently trading 0.2% higher at 0.7779, and is about to test the re-test the 100 day moving average of 0.7799. Having closed back above the 50 day MA on Wednesday, for the first time in over a month, additional daily closes above this level (0.7780) are likely to see it turn into a mild support zone.

Developed market equities closed marginally higher amid continued strong earnings season. The S&P 500 index added +0.1% while the Euro Stoxx 600 index gained +0.3%.

Regional equities closed mixed with the DFM index losing -1.4% and the Qatar Exchange adding +1.1%. The Tadawul continued its positive streak with gains of +0.6%.

Emaar Properties dropped -3.6% as investors pared position ahead of the scheduled annual general meeting later this month. The likelihood of a positive surprise on dividend payout remains minimal. Dubai Islamic Bank closed -1.8% lower after the bank announced details of its rights issue. The bank said it aims to raise AED 5.12bn from rights issue by selling 1.647bn shares at AED 3.11 per share. This equates to a 45% discount to previous day’s closing price. Dubai Islamic Bank also announced Q1 2018 net profit of AED 1.17bn, beating consensus estimates of AED 1.14bn by 2.6%.

Oil markets rose sharply yesterday on a bullish US inventory report and market reports that Saudi Arabia was targeting oil prices in a USD 80/b-100/b range. Brent prices closed up 2.65% at USD 73.48/b while WTI added almost 3% to close at nearly USD 68.50/b. Retuers reported that Saudi ‘sources’ were pushing for prices as much as USD 100/b, which would imply a lengthier and probably deeper supply cut. While we doubt there would be any official confirmation from Saudi Arabia that this price target was actual policy the market will nevertheless take it as a strong signal of further tightening ahead.

In the US, inventories fell over 1m bbl last week and there were drops across the rest of the barrel. Crude production rose again although the market largely appeared to discount it the increase.

The biggest gain in commodities on the day though was nickel, up nearly 7.5% as anxiety creeps in that Russian nickel producers could be the next firms targeted by US sanctions. The direct targeting of Rusal has contributed to a sharp rally in aluminium prices (up 5.5% yesterday) and considering Russia’s large production of nickel, similar sanctions could tighten the market considerably.

Click here to download the full publication