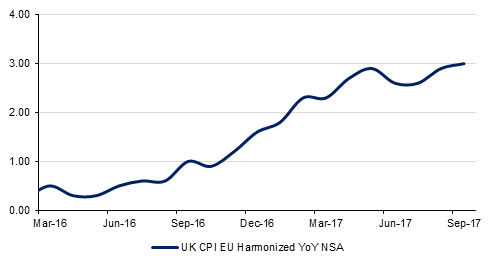

Inflation in the UK accelerated further in September, rising to 3% y/y in line with market expectations while core inflation was stable at 2.7%. Prices have largely been pushed upward as a result of the decline in sterling but these effects will start to wane in Q4 as sterling has steadily appreciated most of 2017. Nevertheless, the above target inflation rate is increasing pressure on the Bank of England to hike rates before the end of the year, which the market is pricing at a nearly 80% likelihood following the data. Dave Ramsden, the new deputy governor of the Bank of England, indicated he was not prepared to raise rates yet as wages had not yet seen the impact of higher prices.

Price pressures in the Eurozone held steady in September with CPI rising at 1.5%, unchanged m/m. Core inflation, however, slowed to 1.1% from 1.2%, mirroring trends seen both in the UK and the US where structural factors are likely at work preventing prices from getting close to targeted levels. The inflation miss is unlikely to be enough to derail ECB plans to begin a process of policy normalisation with a drawdown in asset purchases expected to be announced later this month.

Germany’s ZEW index for economic sentiment expanded marginally for October but missed expectations. An elevated euro in recent months has cut into Eurozone exports and will likely hit Germany exporters substantially. The ZEW assessment of current conditions was more stable but still failed to hit market expectations for an increase. Talks to form a coalition in Germany are still ongoing after parliamentary elections in September.

US industrial production expanded by 0.3% in September, helping to recover some of the declines in August when output was affected by hurricanes in the Gulf of Mexico. Mining output, which includes oil and gas production, rose 0.4% m/m as oil production recovered quickly from the hurricanes while overall manufacturing rose just 0.1%. While industry is showing signs of relatively soft growth the constructive consumer data that has come out of the US in recent weeks should help assuage any concerns about economic moment in Q4.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Lacking any material catalyst for change, US treasuries were range-bound yesterday albeit with continued flattening of the curve. Yields on 2yr and 5yr UST rose a bp each to 1.55% and 1.96% respectively however those on 10yr remained unchanged at 2.30% and 30yr were down by 2bps to 2.80%. In UK, dovish comments from the new deputy governor of BoE caused yields on 10yr Gilts to fall 6bps to 1.27%. Credit spreads on corporate bonds were largely stable in the developed world with CDS levels on US IG and Euro Main down by less than a bp each to 54bps and 55bps respectively.

GCC bonds were mostly unchanged with mild yield widening bias. CDS levels on GGCC sovereigns were up by a bp or two each and option adjusted spread and yield on Barclays GCC index each was also up by a bp to 133bps and 3.41% respectively.

Primary market saw Al Ahli Bank joining the queue, mandating banks for a benchmark sized dollar denominated bond sale after reporting 3Q 2017 result which was in line with expectations.

Despite inflation rising to 3%, in line with market expectations, GBP softened on Tuesday after deputy governor Dave Ramsden commented that he did not support raising interest rates. GBPUSD fell 0.46% to close at 1.3190, the level it currently trades at as we go to print. The next level of support is likely to be the 50 day moving average (1.3154), a level which has held since September 5, 2017. A daily close below this level is likely to result in further declines towards 1.3050, close to the 100 day moving average (1.3042).

Global equities were mixed yesterday. S&P 500 and Dow Jones closed in green at +0.18% and +0.07% while bourses in Europe were slightly under pressure as FTSE 100 and DAX closed down by -0.14% and -0.07% respectively. Asia is recovering some lost ground this morning with Nikkei and Hang Seng gaining 0.05% in early morning trades.

Despite stable oil prices, equities in the GCC remained under pressure. Qatar led the sell-off closing down by -0.85%, followed by Abu Dhabi at -0.77% and Dubai at -0.39%. Losses in the UAE bourses were lead mostly by the banking sector and Dana Gas which came under pressure due to its exposure to the Kurdistan region where military conflict continues. In contrast, Tadawul was steady at +0.08%.

With uncertainty over political stability in Iraq, doubts about Saudi Aramco’s awaited IPO and the potential for sanctions to be re-imposed on Iran, the oil market can be forgiven for struggling to find direction. Futures prices oscillated between gains and losses yesterday, settling the day up slightly. Brent futures closed just shy of USD 57.90/b and WTI closed at USD 51.88/b. EIA data is expected later today with the market expecting a draw of over 4m bbl. However, a critical number to watch will be the level of US crude exports. As oil fundamentals in the US improve, the country may simply moving some of its excess crude onto international markets.

Curve structures are again pointing to a tightening market with 1-2 month Brent in a backwardation of almost USD 0.4/b, its widest level since the start of October. The contango in WTI is also narrowing, closing yesterday at just USD 0.23/b. Risk of supply disruptions in Iraq are affecting international grades more acutely and helped to push the WTI-Brent spread back to USD 6/b.

Click here to Download Full article