Headline annual CPI inflation in the UK slipped to 3.0% in December from 3.1% in November, much in line with expectations. The outturn was 0.3% above the 2.7% projected in the BOE’s November Inflation report. Core inflation also fell in December, to 2.5% from 2.7% in November. That’s slightly below the consensus estimate of 2.6%. The drop in CPI probably marks the beginning of a sustained downward trend over the course of 2018 as currency holds ground. It also gives Bank of England more breathing space though next move is likely to only be up. In the Eurozone, inflation in Germany came in line with expectation. December final CPI came in at +1.7% y/y, exactly on estimate and in line with the previous month’s reading of 1.7%.

In the US, lawmakers failed to achieve concensus on future government spending ahead of the current agreement that expires at the end of this week. However, House Republicans have released a plan that will extend the deadline for a shutdown until February 16 from the current January 19 dropoff. In addition to the funding extension, the plan tacks on a series of healthcare, tax, and military funding changes. Whether or not the bill will pass is questionable. Democrats have demanded that any funding bill include a codification of the Deferred Action for Childhood Arrivals (DACA) immigration program. Outside of the House fight, the plan will also need some support from Senate Democrats in order to avoid a filibuster in that body.

Core machinery orders in Japan increased by 4.1% YoY, contrasting the expectation of a fall by -1.4% and almost double the 2.3% recorded in the previous month. Orders from the non-manufacturing sector rose 9.8% from the previous month, while orders from the manufacturing sector declined 0.2%. A recovery in goods exports has driven corporate profits and business investment, and the latest core machine orders suggest that non-manufacturing firms are also becoming more confident about the business outlook. In another data release, Japan’s Producer Price index rose 3.1% in December vs concensus estimate of 3.2% and actuals of 3.5% in the previous month.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

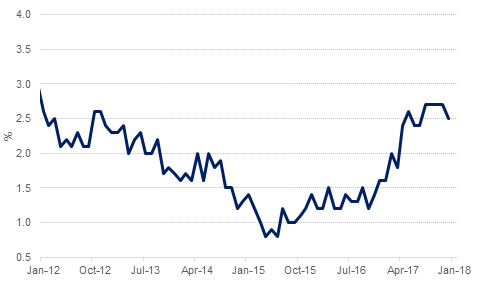

UST yield curve recorded bear flattening yesterday with yields on 2yr treasuries rising two bps to 2.03% and that on 10yr rising a bp to 2.55% as probability of rate hike in March increased to 88%. Weaker inflation print in UK dragged Gilt yields down by 2bps to 1.30% and that on 10yr Bunds followed suit, also closing 2bps lower at 0.56%.Credit spreads were mixed wiith CDS level on US IG rising 1 bp to 48bps and those on Euro Main down by 0.5bp to 43bps.

Regionally GCC bonds ere supported by improved sentiment on oil prices. Credit spreads on Barclays GCC index tightened two bps to128bps and average yield was down a bp to 3.69%.

Earning announcements continued to beat analyst’s estimates with two of the largest bank in the region reporting solid revenue and income growth. Emirates NBD reported 15% increase in FY2017 net income to AED8.35 billion and Qatar’ QNB showed 6% increase in net income to 13.1 billion riyals.

NZD underperformed yesterday losing ground on the other G-10 currencies as markets overlooked the results of the dairy auction. Despite Whole Milk Power average price rising to $3010 a ton, NZDUSD fell 0.44% over the course of the day to close at 0.72685, not far from the 61.8% one year Fibonacci retracement of 0.7261. The losses continue into Wednesday morning, with NZDUSD currently trading 0.16% lower today at 0.72575, following a report from ANZ Bank revealing a 2.2% decline in commodity prices in December. Further declines look likely for the NZDUSD which has risen almost 5.15% since 1 December 2017, with the next support level coming in at 0.72. A break of this level will expose the cross to further declines towards the 50% one year Fibonacci retracement of 0.7169.

Global equities were mixed with all indices in US closing lower on the back of fears about government shutdown and some weakness in corporate results particularly from likes of GE. S&P 500 was down -0.35%, contrasting the +0.28% gain in Euro Stoxx 50.

Marginal softness in commodity prices is leading Asian equities lower this morning. Both Hang Seng and Nikkei are trailiong down at -0.48% and -0.43% respectively in early morning trades.

Positive result announcements in the region are boosting the GCC equity bourses. DFM rose 0.84% followed by +0.29% gain in Abu Dhabi. Qatar exchange erased previous day’s losses and closed up by 2.58%. Elsewhere Tadawul gained 0.69% though Bharain and Muscat stocks were slightly in red.

Oil prices eased overnight with benchmark Brent futures declining 1.6% to move back below USD 70/b while WTI closed at USD 63.73/b, down 0.9%. There have been few fundamentals to push the market around this week and weekly data from the EIA will be delayed owing to a public holiday in the US at the start of the week. The EIA did publish their drilling productivity report overnight and expect oil production from shale assets to reach 6.55m b/d in February, up more than 110k b/d month on month.