A very bleak picture of the UK economy was delivered yesterday with news that GDP, trade and production data all disappointed relative to expectations. Q4 GDP rose by just 0.2% q/q with December alone falling by -0.4% m/m. Of note business investment fell by -1.4% q/q, which marks four successive quarters of declines. The visible trade balance came at a deficit of GBP 12.1bn, also worse than expected. Industrial production, meanwhile, unexpectedly contracted by -0.5% m/m while manufacturing output came in at -0.7% m/m.

Overall, the data contributes to a picture of significantly slowing momentum in the UK economy, slowing global and European growth, along with a significant portion of Brexit-related uncertainty, are all taking effect, with all the signs being that the weakness will continue into the first half of 2019 at least.

Better news from the US this morning, however, where a tentative deal has been reached between the Republicans and Democrats on border security (according to Bloomberg) aimed at keeping the government open after the temporary funding agreement expires on Friday. The deal would allocate USD1.375bn for border fencing in Texas, notably falling short of the USD5.7bn sought by President Trump for a full border wall. The question now is whether President Trump will approve the deal or whether he will stick out for more money and risk closing down the government again. Markets have reacted favourably to the deal, but there has been no reaction from the White House as yet.

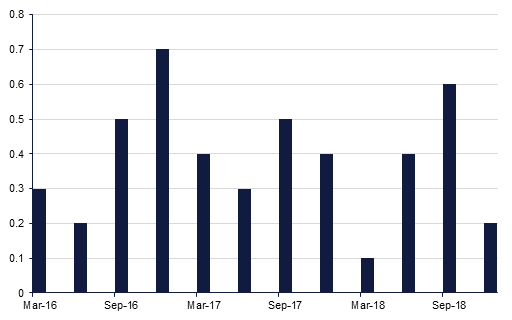

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

The news about an “agreement in principle’ being reached to avert a second government shutdown in the US helped UST yields to rise yesterday. Yields on 2yr, 5yr and 10yr USTs closed at 2.49% (+2bps), 2.47% (+3bps) and 2.65% (+2bps) respectively. Credit spreads were range-bound with CDS levels on US IG and Euro Main closing at 68bps (-1bp) and 73bps (+1bp) respectively.

GCC bonds had a stable day with yield on Barclays Bbg GCC bond index remaining unchanged at 4.37%. The UST benchmark yield widening was counter-balanced by 3bps tightening in option adjusted credit spread to 184bps.

GBP dropped against most of the other major currencies on Monday due to weaker than expected economic data (see macro). Over the course of the day, GBPUSD fell 0.69% to close at 1.2855 in a move that took the price back below the 100-day moving average (1.2884). Monday’s close below this level is technically significant and there is a risk that the price falls from its current level of 1.2866 to test the 50-day moving average of 1.2814. Should it break and close below this level, a retest of 1.27 is likely.

AUD is this morning’s outperformer following economic data which has showed improving business confidence in January. As we go to print, AUDUSD is trading 0.21% higher at 0.70766 after having fallen for the last three trading sessions. In order to hold onto these gains, the cross needs to break back above the 50 and 100-day moving averages (0.7145 and 0.7165) that were breached last week.

On the other end of the spectrum, JPY has softened among boosted risk appetite after it was reported that U.S. lawmakers reached an “agreement in principle” on funding for border security, avoiding a second U.S. government shutdown. This morning’s 0.21% gain takes USDJPY to 110.62, building on the yesterday’s gains which resulted in a break above the 50-day moving average (110.31). The next level of resistance for the price may exert itself near the 110.70 level, not far from the 61.8% one-year Fibonacci retracement.

Developed market equities closed higher on the back of better than expected corporate earnings. The S&P 500 index and the Euro Stoxx 600 index added +0.1% and +0.9% respectively.

Most regional equities closed lower. The DFM index dropped -1.3% while the Tadawul declined -0.4%. Emaar Malls added +2.0% ahead of its corporate earnings later today. Elsewhere, market heavyweights in Qatar continued to drag the broader index lower.

Oil markets closed lower amid reports that US crude stockpiles are projected to rise for a fourth consecutive week. Brent futures dropped -1.0% while WTI futures declined -0.6%. Concerns that the US and China will not reach a resolution at their latest talks also weighed on investor sentiment.