UK GDP growth slowed sharply in August, coming in at 2.1% m/m against a median forecast of 4.6% m/m. This was despite the “eat out to help out” scheme which did support growth in the hospitality sector. Industrial production and construction output were also softer than expected in August, up 0.3% m/m and 3.0% m/m respectively. The August data is particularly disappointing as restrictions on activity have been progressively tightened in September as coronavirus cases have surged, which will further weigh on GDP. On Friday, Chancellor Sunak expanded the Job Support Scheme to cover workers in companies forced to close because of tighter restrictions. The weak data and additional localised restrictions on activity expected this week also raises the prospect of additional QE by the BoE before year-end.

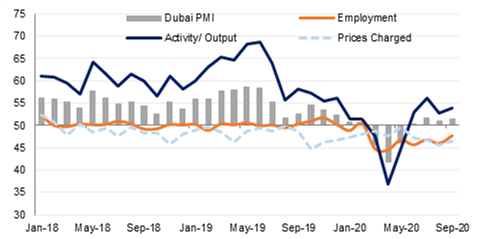

The Dubai PMI rose to 51.5 in September from 50.9 in August, as output and new work increased at the fastest rate so far this year. Panellists noted increased client demand although this was likely due in part to further discounts on selling prices. Employment at private sector firms declined for the seventh month in a row in September, although at the slowest rate since February, as firms sought to reduce costs. The survey data suggests that Dubai’s economy returned to modest growth in the third quarter, after contracting in H1 2020.

The Reserve Bank of India’s MPC opted to keep its benchmark interest rate on hold at 4.0% on Friday, when it held its delayed policy-setting meeting. Persistently high inflation has hampered the central bank’s efforts to support economic activity through lower rates. That being said, while it did not make any change to the benchmark rate, the bank did do almost everything else in its power to boost liquidity, including providing INR 1tn of ‘on-tap’ TLTRO of up-to three-year tenors and increasing banks’ allowed exposure to retail credit, amongst other measures. The expected easing in inflation and the still-highly accommodative language used by the MPC means that we hold to our expectation of a December rate cut for now, but the risk that this is pushed into Q1 2021 is growing.

Egypt’s inflation rate remained low in September, coming in at 3.7% y/y. While this is up from the 3.4% recorded the previous month, it remains lower than the central bank’s target range of 9% ±3. Inflation is likely to pick up from here, but remain below the target range through the end of the year. There remain two more MPC meetings in 2020; given our expectation that inflation will pick up and that that risk-off tone will likely build as the US election and the end of the year approaches, we expect that the CBE will remain on hold through the remainder of 2020 now. However, should inflation remain around these levels in October, we see scope for another cut of 50bps cut at the November MPC.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Treasuries were weaker across the curve as markets shifted to pricing in more fiscal stimulus in the US, even if it would only be forthcoming after the November presidential election. A ‘Blue Wave’, in which Joe Biden wins the presidency and Democrats take control of Congress may unleash considerable government spending, even at the cost of higher taxes. Yields moved higher in response—despite gridlock in place in the current Congress—with the 2yr UST yield adding 2bps to 0.1529% over the week and the 10yr closing at 0.7737%, up 7bps on the week.

The UST curve has also been steepening in anticipation of more government spending. The 2s10s spread settled at the end of the week at 62bps while the 5s30s at 123bps is at its highest level of the whole year. The steepening appears to be linked to expectations that higher government spending will produce higher inflation and allow the Fed to return to policy normalization. We are hesitant to endorse that view given that many of the inflation challenges in the US remain structural and higher spending—which would only hit the economy by mid-2021—may not be as inflationary as hoped.

Emerging market bonds (USD-denominated) rallied 1% last week as markets shifted back to risk-on, at least temporarily ahead of the US presidential election. Spreads over USTs compressed to 328bps, close to pre-pandemic levels. Among emerging market central banks, Indonesia, South Korea and Sri Lanka all set policy this week.

The USD continued its losing streak last week. The DXY index, a measure of the dollar against a basket of major currencies, fell by 0.84% and settled at 93.057, a new multi-week low for the currency. This marks a second consecutive week of losses as renewed risk sentiment takes hold following signals from the White House that they were leaning towards a large-scale stimulus bill, reneging on their previous withdrawal message. It was this type of mixed signaling that caused the USDJPY to retreat from highs of 106.11 and close at 105.62, still a 0.31% increase from the week prior's closing price, but noticeably less than other major pairs.

The EUR has been on the rise amid improved market sentiment, increasing by 0.94% to settle at 1.1826, marking a break above the 50-day moving average of 1.1801. This comes in spite of an ever growing number of Covid-19 cases in the region, with new lockdown restrictions being imposed regularly. The GBP was particularly volatile last week, with Brexit and the US fiscal stimulus saga dominating the headlines, but the currency did spike on Friday evening, advancing by 0.78% and closing at 1.3036. The AUD was amongst the biggest movers, rallying by 1.10% to settle at 0.7240 whilst the NZD increased by 0.38% to close at 0.6666.

It was a strong week for equities around the globe last week as the major indices all closed higher. The Shanghai Composite returned from its Golden Week holiday on Friday, with its stocks surging to close the index 1.7% higher, bolstered by a better-than-expected Caixin services PMI reading. Meanwhile, the Nikkei and the Hang Seng closed up 2.6% and 2.8% w/w respectively. In the US, hopes for stimulus of some degree, whether in the near term or in the increasingly likely eventuality of a Biden victory, saw gains across the board as the Dow Jones (3.3%), the S&P 500 (3.8%) and the NASDAQ (4.6%) all climbed higher. Even in Europe, which is facing rapidly rising Covid-19 cases and renewed lockdowns, equities had a strong week. The UK’s FTSE 100 gained 1.9%, France’s CAC 2.5%, and Germany’s DAX 2.9%.

The largest bank in Saudi Arabia in terms of assets, National Commercial Bank, has according to a statement on Sunday agreed to buy Samba Financial Group for USD 15bn. This will make the entity the third-largest lender in the GCC.

Oil markets recorded one of their strongest weeks in recent months thanks to disruptions to supply along the US Gulf Coast as Hurricane Delta shut in production, and anxiety over a strike among Norwegian oil workers that affected around 8% of the country’s production. Brent futures gained 9.1% to settle at USD 42.85/b while WTI closed the week at USD 40.6/b, a rise of 9.6%.

Attention this week will turn to both the OPEC and IEA oil market monthly reports. The IEA has been increasingly cautious in its expectations for demand to return to pre-pandemic levels and has warned it is more likely to downgrade its demand growth forecasts, rather than revise them higher.