The European Union statistics office Eurostat said Euro zone industrial production rose in the 19-country currency bloc rose by 9.1% m/m in June from May, after it had increased by 12.3% m/m in May. The rebound after Covid-19-induced record drops in March and April was below expectations for a second straight month. The manufacturing output increase was driven by a ramp-up in production of durable goods, in what could be seen as a sign of rising consumer confidence as COVID-19 restrictions ease. In a further sign that the EU's manufacturing sector is still far from pre-crisis recovery, output tumbled by 12.3% y/y in June, more than market expectations of a 11.5% y/y fall. However the year-on-year drop was less than that of May and April, confirming a gradual rebound. One exception in the bloc was Ireland where industrial output grew by 4.5% in June compared to a year earlier. Capital goods went up significantly 14.2% m/m in what could show stronger appetite among factory managers for investments. Production of durable goods rose by 20.2% m/m, the highest increase among segments measured by Eurostat.

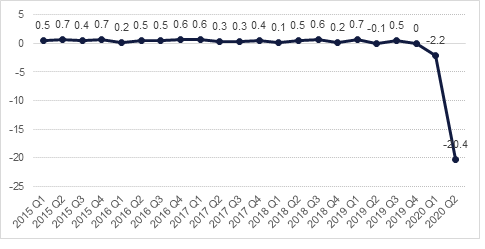

The UK Office for National Statistics said Britain's economy contracted by a record 20.4% q/q between April and June, when the COVID-19 lockdown was tightest, marking the largest contraction reported by any major economy so far. The slump exceeded the 12.1% q/q drop in the euro zone and the 9.5% q/q fall in the United States. The UK GDP shrank by 2.2% in Q1 as the lockdown started on March 24. The data shows the UK entered a recession as it shrank for two quarters in a row. However, there were signs of a recovery in the month of June alone when gross domestic went up by 8.7% from May. Last week the Bank of England said it would take until the final quarter of 2021 for the economy to regain its previous size, warning unemployment was likely to rise sharply.

The US Labor Department on Wednesday issued its U.S. consumer prices report, showing the consumer price index rose 0.6% m/m in July, with gasoline accounting for a quarter of the gain. The CPI increased by 0.6% m/m in June also. Measured on a yearly basis, the CPI accelerated 1.0% y/y in July after climbing 0.6% y/y in June. Excluding the volatile food and energy components, the CPI jumped 0.6% m/m last month, marking the largest gain since January 1991, following a 0.2% m/m rise in June. Measured yearly, the core CPI jumped 1.6% y/y after increasing 1.2% y/y in June. According to the report gasoline prices went up 5.6% m/m in July after jumping 12.3% m/m in June. Food prices fell 0.4% m/m in July, the first decrease since April 2019, after rising 0.6% m/m in June.

Source: UK Office for National Statistics, Emirates NBD Research

Source: UK Office for National Statistics, Emirates NBD Research

Stronger than expected CPI numbers for July in the US helped yields extend their gains overnight. Yields on 2yr USTs moved back to a 0.16% handle, a gain of 1bp, while 10yr UST yields moved within sight of 0.7% before closing at 0.6747%, a gain of more than 3bps. Several Fed officials explicitly criticized the US approach to reopening the economy too early with Boston Fed president Eric Rosengren said the reopening was likely to “prolong the economic downturn” while his counterpart in Dallas, Robert Kaplan contrasted the US experience with other countries who have had more success. All policy indications and commentary from Fed officials imply that a dovish stance is here to remain for the duration of the coronavirus crisis and it may become increasingly challenging to identify a moment when policy can begin to normalize.

Bond markets globally were weaker in line with USTs with European majors all seeing yields rising: 10yr bund yields were up almost 3bps to -0.45% while gilt yields added almost 4bps to 0.235%.

EM USD bonds were weaker overnight down by around 0.15%. Regionally Oman has managed to secure a USD 2bn bridging loan and is likely to tap markets later this year to repay the financing. Oman’s 2029 bond currently yields around 6.3% after having spiked to as much as 11.6% earlier this year.

The dollar has failed to hold onto the momentum it garnered on Tuesday evening. The DXY index fell by -0.40% on Wednesday and is sliding further this morning to 93.230. CPI data out of the US was better than expected but the currency remains on the defensive. USDJPY advanced to a 3-week high of 107.01 and currently trades at 106.65.

The euro has rebounded from its lowest level in more than a week. The currency is hovering just above the 1.18 handle, earning modest gains from last week's closing price. The UK has suffered the worst economic downturn in Europe with a 20.4% contraction in GDP in the second quarter of the year, pushing the country into recession. Sterling remains above the 1.3 level at 1.3060. The AUD has climbed to 0.7170 while the NZD trades at 0.6570.

The global stock rally continued yesterday. Gains were seen in most major equity indices around the world barring the Shanghai Composite and Brazil’s Ibovespa, as investors continue to focus on the potential for a coronavirus vaccine and an extended period of ultra-loose monetary and fiscal policy as authorities look to ease the pandemic-related pressures on the economy. The S&P 500 closed up 1.4%, having briefly traded at an all-time high of 3,387 yesterday, exceeding February’s record close of 3,386. In the UK the FTSE 100 closed up 2.0% on the day as investors shrugged off the calamitous Q2 GDP data as a backward-looking indicator – although the index remains one of the global underperformers in terms of the recent rally, and is still down 16.7% ytd. Within the region, the DFM closed up 0.9% and the Tadawul 0.3%.

Oil prices rallied in line with a risk-on tone to markets with Brent futures adding 2% to settle at USD 45.43/b and WTI up 2.55% to close at USD 42.67/b. Data from the EIA showed a strong draw in crude inventories of 6.7m bbl last week along with draws across most of the rest of the barrel. Production actually slipped below 11m b/d to 10.7m b/d last week, a drop of 300k b/d. Meanwhile product supplied moved up to 19.4m b/d, a gain of almost 1.5m b/d w/w.

OPEC’s monthly report indicated the producers’ bloc expects US oil production to start recovering in Q3 and raised its overall estimate for non-OPEC supply in 2020. With a lower demand forecast the OPEC secretariat also cut the ‘call on OPEC’ crude, the level of production required from members to balance markets. This comes precisely as OPEC countries are beginning to increase production and thus sticking to output targets will be crucial to avoid overwhelming markets with volume.