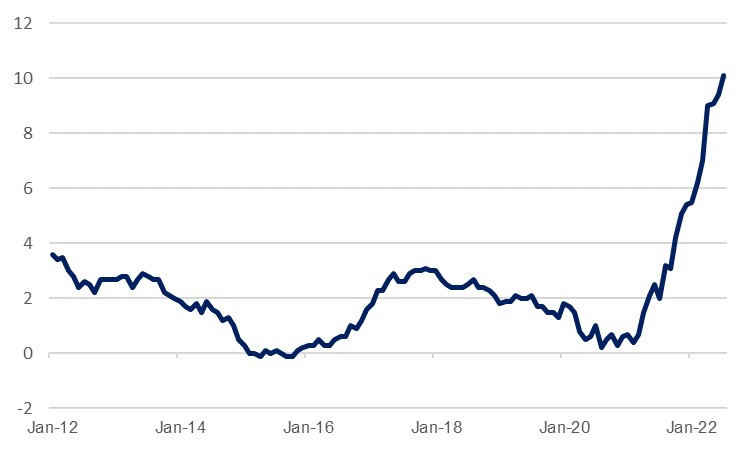

UK CPI inflation came in higher than expected in July, rising to 10.1% y/y compared to expectations of 9.8%. This was up from 9.4% the previous month and marks the first time the measure has breached double digits since February 1982. Prices were 0.6% higher than in July, a moderate slowdown from the 0.8% recorded in June but still higher than the analyst consensus prediction of 0.4% m/m. The figure stands in contrast to those out of North America over the past week, where inflation has moderated in the US and Canada; much of the upwards moves in the UK’s headline CPI continues to be driven by energy prices which are set to push higher still in the coming months as the energy price cap is adjusted upwards once again. The Bank of England already expected CPI inflation to hit 13.3% in October and gas futures in Europe are soaring once again this week (they rose some 10% yesterday and are now double the levels seen in May and some 10-times ‘normal’ levels).

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Other key drivers noted by the ONS press release include rising mortgage costs and motor fuels. While global oil prices have now fallen to a six-month low, these benefits have been slow to manifest at the pump thus far – although the ONS did note that forecourt prices have started to fall and so we expect they could provide a more pronounced break in the August figures. Food meanwhile was the largest single contributor to the CPI increase, rising 2.3% m/m and 12.7% y/y, which was the highest figure since 2008.

The Bank of England is of course relatively powerless in the face of some of these global dynamics, and Governor Andrew Bailey has laid the blame at the door of Russia’s invasion of Ukraine and the subsequent turmoil in global commodity markets. However, core inflation also continues to move higher, hitting 6.2% y/y in July, up from 5.8% in June and again higher than consensus projections (5.9%). The BoE implemented a 50bps hike to 1.75% at its recent August 4 meeting, and this latest inflation print has strengthened our conviction that there will be a further 50bps hike in September and 25bps in November, taking the bank rate to 2.50% at year-end.

The higher-than-expected inflation print will place more pressure on the two candidates running to be the next leader of the Conservative and Unionist Party in the UK, and hence the new Prime Minister following Boris Johnson’s resignation, to promise more help for households struggling with the cost-of-living crisis. The current Chancellor of the Exchequer, Nadhim Zahawi, has commented on the inflation figures, pledging ‘GBP 400 off energy bills for everyone in the coming months.’

Nevertheless, with data released by the ONS yesterday already showing that the real value of UK workers’ pay had fallen by 3%, the fastest pace since the record began in 2001, households will face increasing difficulties in the face of still mounting prices over the winter months. With industrial action on key services becoming more common already and the risk of a trade war with the EU still pertinent, the UK is facing a difficult few months, and the BoE will be wary of completely throttling growth as it looks to curb inflation. As such, the bank rate is set to remain below that of the US Federal Reserve and we see little that would significantly boost sterling in such a scenario, seeing 1.20 in Q3.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research