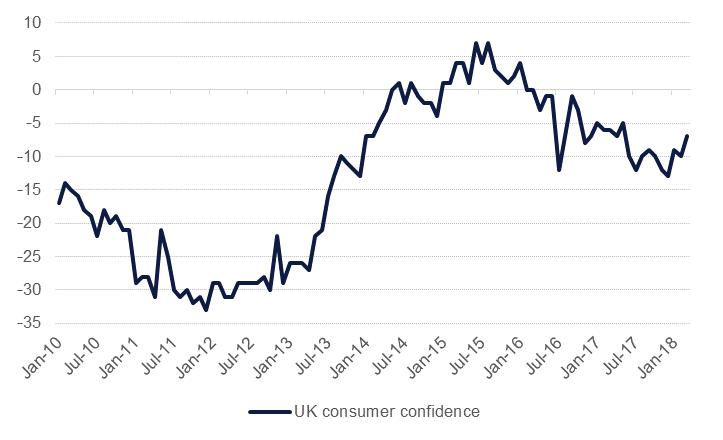

Consumer confidence in the UK improved in March according to the latest data as inflation began to ease and negotiations over exiting the EU took on a more positive hue. The GfK poll reported UK consumer confidence at -7, better than the market had been expecting and an improvement from a report of -10 previously. However, the data still remains in negative territory where it has been since the Brexit vote occurred. More data out from the UK showed private sector growth in Q1 is likely to have slowed as poor weather conditions affected output.

The US continued to walk back from an aggressive trade posture with the US Trade Representative, Robert Lighthizer, saying that new tariffs on China would not be imposed until June. This will give both countries more breathing room to try and negotiate a new trading relationship. Mr Lighthizer said he had ‘hope’ China would avoid tariffs that are meant to redress the large trade imbalance between the two countries.

Inflation data released on March 28 showed that Iranian inflation fell to 8.3% in March, the lowest level this year, but a renewed sell-off in the currency will exacerbate inflationary pressures once more over the coming months. Growing concerns over a more hawkish turn towards Iran by the administration of US President Donald Trump – potentially meaning that sanctions waivers will not be renewed in May – have led to a renewed sell-off of the Iranian rial on the parallel market. While the official exchange rate remains at IRR37,686/USD, the black market rate has broken the psychological IRR50,000/USD level, despite the authorities’ efforts to clamp down on money changers and to limit foreign currency withdrawals.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Upward revision of the US GDP growth from 2.5% to 2.9% for 4Q2017, did little to move treasuries. Yields on 2yr UST rose by two bps to 2.28%, 10yr were unchanged at 2.78% and 30yr yields were down slightly to 3.02% (-1bp). Fall in oil prices saw some pressure on credit spreads with CDS levels on US IG closing 2bps wider to 68bps. Safe haven bid continued to benefit the Bunds and the Gilts with yields on 10yr closing down to 1.36% (-5bps) and 0.50% (unchanged) respectively.

Regional rates market will see launch of new EIBOR setting methodology in the UAE soon after the central bank announced appointment of Reuters as the calculation agent. Regional credit markets held ground well despite weakening oil prices. Yield and credit spread on Bloomberg Barclays GCC index closed at 4.27% (-1bp) and 171bps (-1bp) yesterday.

Bahrain curve was under pressure ahead of pricing of the proposed new offerings which now is believed to be only a sukuk. Bahrain 25s fell circa three points to $95.08 and yield of 6.13% (+54bps).

The dollar was continued to gain against peers overnight with the DXY index nearly recovering all of the past week’s decline. JPY was a notable laggard yesterday as the official announcement that North Korea’s President Kim Jong Un had visited Beijing and pledged to denuclearise his country helped lower geopolitical risk anxiety. CHF and gold also fell in line with a move away from haven currencies.

Benchmark global equity markets sank again as tech stocks weighed on the overall market performance. The S&P 500 gave up 0.3% while the Dow was marginally flat. Asian equities are off to a softer start this morning even as geopolitical risk in the region appears to be declining. Regional markets were generally lower. The Tadawul fell 0.5% event with the FTSE Russell announcement while the ADX lost more than 1% and the DFM was marginally lower.

Saudi Arabia’s stock market will join the FTSE Russell emerging market index next year, opening up the country to potentially billions of dollars of new funds entering the kingdom’s market. An influx of capital will help take some pressure off the government as it tries to reshape the Saudi economy away from depending on oil and gas production and should help the private sector to grab more of the overall economy. As much as USD 5bn of funds could enter Saudi Arabia where the Tadawul currently has a market cap of around USD 500bn. MSCI, another index provider, will decide in June whether to upgrade Saudi Arabia to emerging market status which could allow even more flows into the kingdom.

Oil prices slipped again yesterday, their third consecutive day of declines and the longest slump since the end of February. The catalyst overnight was an unexpected build in US crude stocks last week. WTI prices fell more than 1% to close back below USD 65/b while Brent futures ended the day at USD 69.53/b, down 0.8%.

Click here to Download Full article