After slowing slightly over the summer, business conditions improved in September with the S&P Global UAE Purchasing Managers’ Index rising to 56.7 from 55.0 in August as businesses reported strong growth in activity and new work. Export orders also rose sharply in September after being relatively soft in H1 2023. Perhaps the most interesting part of the survey was the level of optimism reported by businesses at the end of the third quarter, which rose to the highest levels since March 2020.

Data for the UAE point to resilient non-oil growth in 2023, particularly when compared with much weaker PMI readings for the world’s largest economies, including China, the US and the Eurozone.

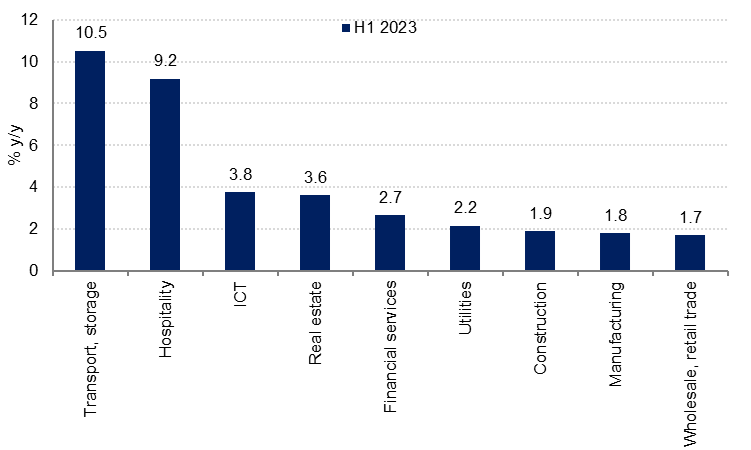

Dubai’s economy grew 3.6% y/y in Q2 2023, faster than in the first quarter, underpinned by double-digit growth in transport and hospitality. International visitor numbers to Dubai reached 9.8mn in the year to July, up 2.6% from the same period in 2019. Hotel indicators also show a full recovery from the pandemic, with hotel occupancy and revenue per available room well above pre-Covid levels. The outlook for the coming high season is also positive, with many hotels reporting full occupancy through Q4 2023, on the back of the COP28 event to be held in Dubai, and strong bookings for the first couple of months in 2024.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD ResearchAnother factor that may be supporting domestic demand in the UAE and wider region is public sector spending and investment. Consolidated budget spending in the UAE grew 8.3% y/y in H1 2023, even as budget revenues declined almost 20% y/y in the same period. While most of the growth was in current spending (including social benefits and subsidies), capital spending on fixed assets rose almost 4% y/y in H1 2023. Even with the increase in spending and lower oil revenue in the first half of the year, the consolidated budget recorded a surplus of AED 47bn, and we expect a full year surplus of just under 5% of GDP in 2023.

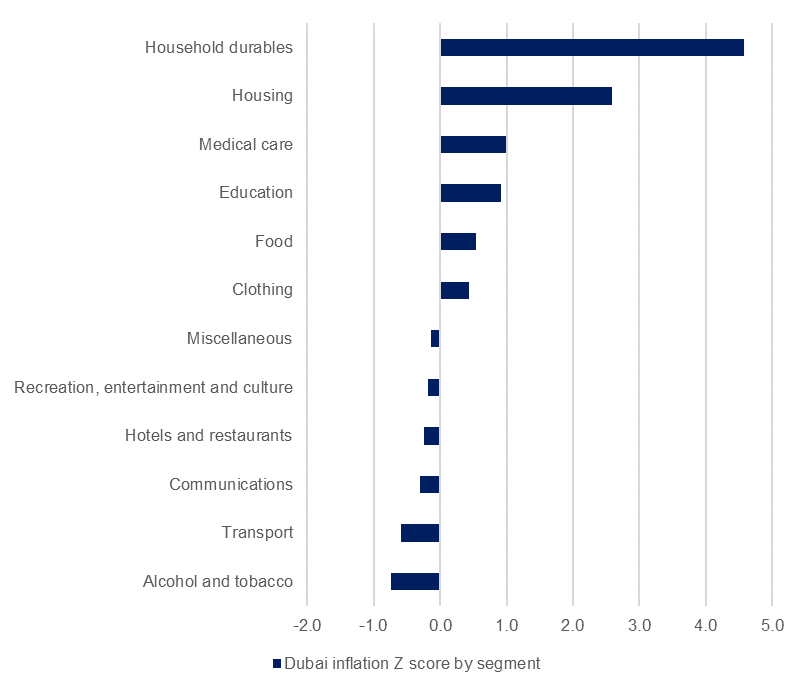

Finally, anecdotal evidence points to population growth in the UAE this year, which has likely also contributed to aggregate demand growth. This is particularly evident in the sharp rise in housing and household durables costs which have been key drivers of official inflation as well.

Housing costs in the CPI are running at around 6% y/y in Dubai in Q3 2023, but housing in the CPI is a lagging indicator with market rents having risen significantly more than 6% over the last 12 months. The chart below shows which components of Dubai’s CPI have deviated the most from the average over the last five years. The increase in prices for furniture and household equipment over the last year may reflect higher production and transport costs for these items, but may also reflect strong demand on the back of new household formation, which has allowed retailers to pass on their higher input costs to consumers.

We expect inflation in Dubai to accelerate further from the 3.8% y/y recorded in September, as the housing component of the index continues to rise and the drag from lower petrol prices seen in the first half of this year dissipates.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD ResearchSo far at least, higher interest rates have not significantly dampened non-oil growth in the UAE, although of course, there can be long and variable lags when it comes to the impact of higher interest rates on the real economy. With interest rates now expected to remain higher for longer into 2024 – given the apparent resilience of the US economy to tighter monetary policy – uncertainty around the outlook for 2024 remains high. Higher borrowing costs are likely to weigh on private sector consumption and investment, and a strong US dollar makes the region a more expensive destination for visitors from emerging markets.

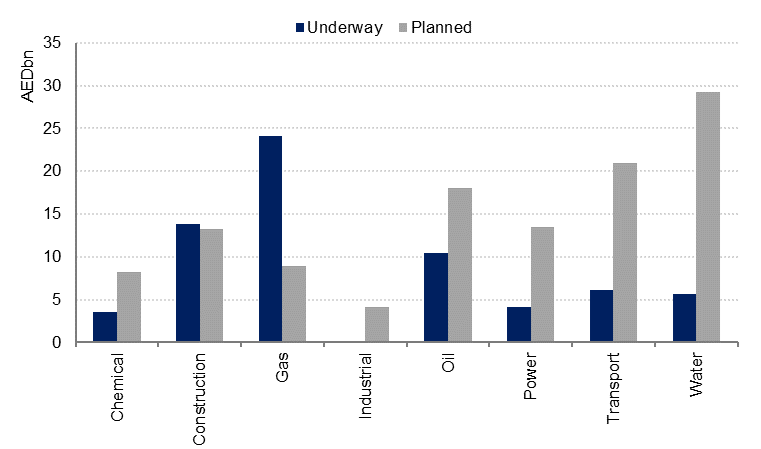

However, we expect sustained government investment in strategic growth sectors to offset some of the expected softness in private sector investment next year and beyond. Data from MEED shows almost AED 68bn in infrastructure projects underway and due to be completed by 2028, with another AED 116.3bn in planned (but unawarded) investment through 2030.

Source: MEED, Emirates NBD Research

Source: MEED, Emirates NBD Research

Overall, we expect non-oil sector growth to slow slightly from an estimated 5% this year to 4% in 2024. We also expect an unwinding of existing curbs on oil production in 2024, which should allow the hydrocarbons sector to contribute positively to headline UAE GDP growth of 3.6% in 2024.