The UAE economy proved remarkably resilient to weaker global growth and higher interest rates in 2023. While GDP growth did slow from the 7.9% recorded in 2022, both oil and non-oil GDP likely came in ahead of our forecasts. We had pencilled in a -2% contraction in oil and gas GDP in 2023, but Bloomberg oil production data shows the UAE produced 3.15mn b/d on average last year, almost unchanged from 2022, so we have revised our estimate for oil and gas GDP growth up to zero in 2023.

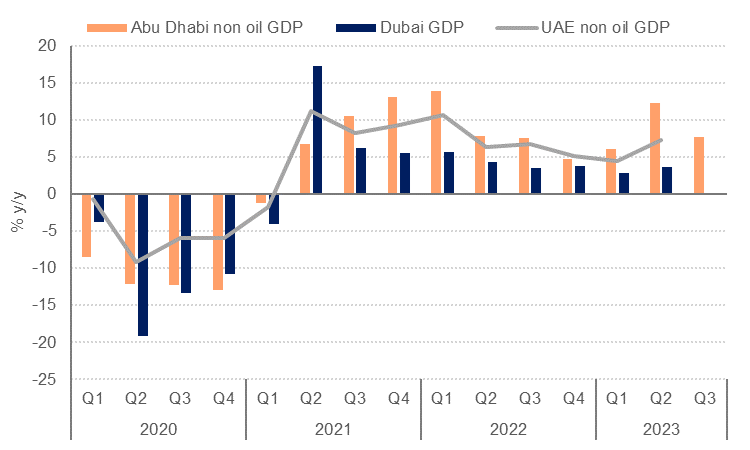

Non-oil sector growth came in at 5.9% y/y for the whole UAE in H1 2023, driven by growth of 9.2% y/y in Abu Dhabi’s non-oil sectors compared with Dubai’s 3.2% first half growth. Preliminary data for Q3 showed non-oil growth in Abu Dhabi slowed only slightly to 7.7% y/y, with average January-September growth of 8.7% in the emirate. PMI data point to an acceleration in activity in Q4 across the UAE, and there is likely upside risk to our 5.0% UAE non-oil GDP growth estimate for 2023. We estimate headline GDP growth of 3.6% last year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD ResearchThere were several factors that contributed to the stronger than expected growth in the UAE’s non-oil sectors in 2023, which we think will continue to underpin growth in 2024. Private consumption was likely boosted by population growth across the UAE, as structural reforms to labour and personal laws, new visa options and a low tax regime encouraged new business formation and attracted skilled workers to the UAE. While official population estimates are not yet available for 2023, Dubai’s school enrollments grew 12% at the start of the new school year in September 2023, and the number of mobile phone subscribers were up 7% y/y at the end of Q3.

The rebound in tourism also contributed to strong growth last year, as international visitor numbers to Dubai exceeded pre-pandemic levels even without the full return of visitors from China. Hotels across the UAE saw occupancy levels rise to average 75.6% in the year to November from 71.5% in 2022, with no decline in the average daily rate. Abu Dhabi hotels saw a 25% y/y rise in revenue per available room (RevPAR) in the year to November 2023, while Dubai hotels saw RevPAR growth of 4.4% y/y.

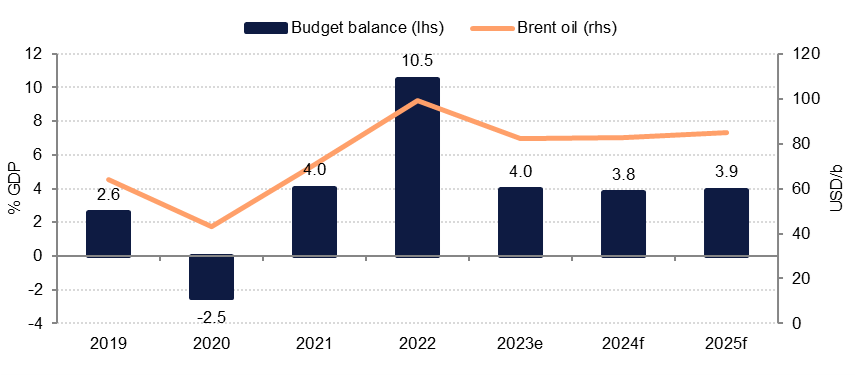

Fiscal policy was supportive of economic growth in the UAE last year, with government spending up more than 10% y/y in the year-to-September. However with revenues down -18% over the same period, we estimate the budget surplus for the full year shrank to 4.0% of GDP from over 10% in 2022 (based on Ministry of Finance data). Current spending increased around 8% in the first nine months of 2023, while investment spending in the budget reached almost AED 18bn, up 64% on the first three quarters of 2022.

Source: UAE Ministry of Finance, Emirates NBD Research

Source: UAE Ministry of Finance, Emirates NBD ResearchIndicators on private sector investment are mixed. MEED data points to a slowdown in private sector investment in 2023 on a cashflow basis, likely due to higher borrowing costs. However, FDI data for Dubai is encouraging: total FDI in H1 2023 stood at AED 21.1bn, roughly half the AED 44.7bn in FDI for the full year 2022. Wholly owned greenfield FDI accounted for almost 40% of total FDI into Dubai in H1 2023, creating an estimated 15,875 jobs.

In 2024, we expect non-oil growth to slow only slightly to 4.5% on the back of slower global growth. Continued structural reform to improve the business environment and attract investment is expected to underpin aggregate demand, albeit at a slower pace than in 2023.

Data from MEED projects indicate a significant further increase in government investment spending in 2024, based on estimated cashflows of projects already in execution and announced (but not yet awarded). This will help to offset a forecast slowdown in private sector investment in 2024, although the latter may be revised higher as more projects are announced over the course of this year.

International travel has largely returned to pre-pandemic levels according to data from IATA, and growth in passenger traffic is thus expected to slow in 2024 and beyond, but tourism and hospitality are still expected to contribute positively to UAE GDP growth this year.

In our baseline scenario, the oil and gas sector will likely see no growth again in 2024. The UAE has indicated it will deepen production cuts in Q1 2024 in line with the voluntary cuts announced by OPEC+ in November 2023. We then assume only a gradual increase in UAE oil production over the remainder of 2024, leaving average oil output at a similar level to 2023.

Overall, we expect headline GDP growth of 3.3% in the UAE in 2024, down from an estimated 3.6% in 2023.

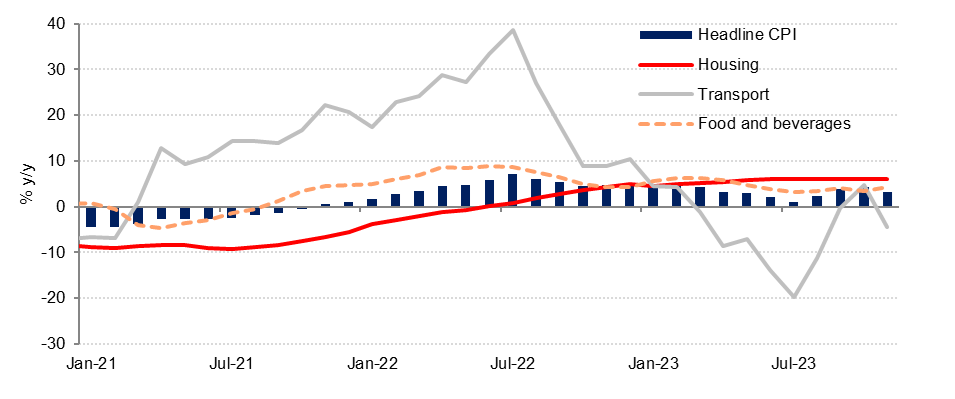

Dubai CPI inflation slowed to 3.3% y/y in November from 5.2% in December 2022. We estimate inflation averaged just under 3.5% in 2023 from 4.7% in 2022, despite rising housing costs. Housing and utilities costs grew 5.6% on average in 2023, up from 0.7% in 2022, while household durables prices increased 8.2% last year from 2.3% in 2022. The only other categories of the CPI to see inflation accelerate in 2023 were education (1.9% y/y) and healthcare (0.7%). Most other components of Dubai’s CPI showed disinflation in 2023, including food, hospitality, and recreational services. The biggest driver of slower CPI inflation in Dubai last year was transport which declined -4.8% y/y after a 22% rise in 2022.

We expect housing costs to remain the key driver of inflation in 2024, as the lagged impact of last year’s increase in rents continues to feed through to the official CPI. However, we expect all other components of the CPI to see slower price growth in 2024 compared with 2023, helping to keep overall inflation contained to an average of 3.0%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD ResearchMoney supply growth surged in 2023, reaching 18.0% y/y in October from 9.0% at the end of 2022. M1 growth doubled to 10.5% y/y by October as demand deposits increased, while quasi money (FX and long-term dirham deposits grew almost 24% y/y in October. Growth in money supply far exceeded growth in private sector and non-bank FI credit, which stood at 4.7% y/y in October.

Bank deposits grew 11.4% y/y in October, with corporate deposits increasing over 20% y/y, followed by individuals’ deposits (17% y/y) and GRE deposits (14% y/y). Deposit growth was likely supported by higher interest rates as well as growth in business activity and the sharp rise in real estate sales in 2023.

Bank loans increased 5.1% y/y in October, with loans to individuals rising 11% y/y, followed by loans to GREs at 9.6% y/y. Businesses appeared reluctant to take on new credit, likely deterred by high borrowing costs and strong cash positions, with business loan growth slowing to 2.1% y/y in October from a 2023 peak of 5.9% y/y in February.

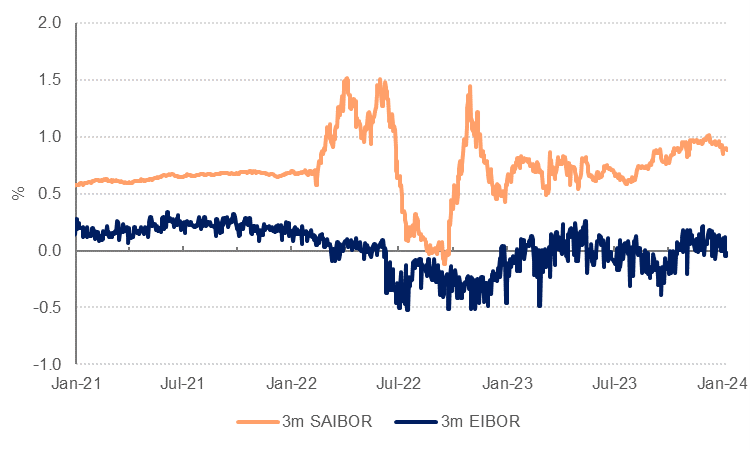

Excess liquidity in the UAE banking system helped to keep 3m AED interbank rates in line with the underlying 3m USD rate, with zero spread on average over the year. To the extent that lower borrowing costs in 2H 2024 spur demand for credit, and deposit growth slows, we could see some modest widening in AED 3m rates over the underlying SOFR rate over the course of 2024.

Source: Bloomberg

Source: Bloomberg