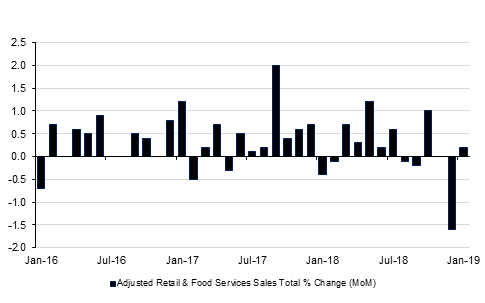

US retail sales January retail sales rose 0.2% m/m, and sales ex-autos moved up 0.9%. The December headline was revised to -1.6% (from -1.2%) and ex-autos were revised to -2.1% from 1.8%. The control group measure rose by 1.1%, twice as strong as expected and signalling that consumer demand is holding up despite the appearance of a slump in December when it fell by -2.3%.

Brexit returns to the centre stage today. UK PM May claims to have negotiated some meaningful changes to her Brexit deal regarding the legality of the Irish backstop. However, it remains to be seen if it will be enough to win over Parliament which is due to vote on the deal later. The last ‘meaningful vote’ on May’s deal resulted in a loss in Parliament by 230 votes, but it seems that the markets believe that she could get it through this time with GBP rallying sharply overnight. The consequence of losing it would be greater uncertainty with the clock ticking for the UK to leave the EU on the 29th March. However, as there is also no majority for a ‘no-deal’ Brexit, the likelihood is that Parliament could vote to request an extension to Article 50 of around two or three more months.

The UAE is now ready to receive applications for longer term residence visas, after the regulatory framework was approved by the cabinet. According to local press, investors who own residential property worth at least AED 5mn or have AED 10mn in a portfolio of investments in the UAE are eligible for 5-year visas, along with their families. Entrepreneurs are also eligible for residence visas up to five years. Professionals and researchers in specific sectors such as medicine and science may apply for 10 year residence visas, if they already have a valid employment contract in their specialist field. Separately, the UAE’s finance minister said the country would set up a debt management office and seek a sovereign debt rating this year, but noted that there was no need to issue federal bonds in the near term.

Fixed Income

Treasuries traded with a heavy tone amid a sharp rebound in equities. Yields on the 2y UST, 5y UST and 10y UST closed at 2.47% (+1 bp), 2.44% (+1 bp) and 2.63% (+1bp) respectively.

Regional bonds closed largely unchanged. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed at 4.31% and credit spreads tightened 2 bps to 178 bps.

According to comments from Finance Ministry official, UAE will seek sovereign credit rating and set up a debt management office before the end of the year.

FX

GBPUSD gained 1.04% on Monday, closing at 1.3150 after the U.K. government announced that it had secured changes to its deal with the EU (see macro). This morning the cross has added another 0.50% to its gains and as we go to print, GBPUSD is currently trading at 1.3216. Fundamentally, should Parliament approve the deal, the pound will hold onto these gains, however if they vote against it, these gains are likely to be reversed and further losses added. Technically it is noteworthy that so far this week, GBPUSD has found support just below the 50 and 200-day moving averages (1.2987 and 1.2984 respectively) and is currently trading back above the 50-week moving average (1.13116) and sitting on the 200-week moving average (1.3216). A close above these levels is technically bullish for the price and could result in a retest of 1.34, not far from the 50% one-year Fibonacci retracement of (1.3409).

Equities

Developed market equities closed higher as US equities received a lift from technology stocks. The S&P 500 index and the Euro Stoxx 600 index added +1.5% and +0.8% respectively.

Regional equities closed mixed. The DFM index was a notable outperformer with gains of +0.5%. Real estate sectors stocks rallied with Emaar Malls adding +4.2% and Aldar Properties gaining +5.1%. Elsewhere, it was all rather quiet.

Commodities

A general boost to risk assets helped lift crude prices to start the week. Both WTI and Brent gained 1.3% with Brent now within distance of USD 67/b and WTI trading just above USD 57/b. Markets are being driven by headlines coming out of CERAWeek in the US, a major energy conference, where OPEC’s secretary general, Mohammed Barkindo, said production cuts remained a “work in progress” in terms of rebalancing crude markets.

The IEA released long-term projections for oil markets out to 2024 this week and expects a prolonged struggle between OPEC producers and non-OPEC supply growth led by the US. The agency expects non-OPEC supply to expand by 6m b/d from 2018-24 compared with capacity growth of 0.8m b/d for OPEC nations in the same period provided no sanctions were enforced (with the sanctions currently in place the IEA projects a decline in OPEC’s total capacity). Along with a slowing pace of global demand the call on OPEC crude will be capped at around 31m b/d over the agency’s forecast period, not far off current levels restricted by the December production cut agreement.

Click here to Download Full article