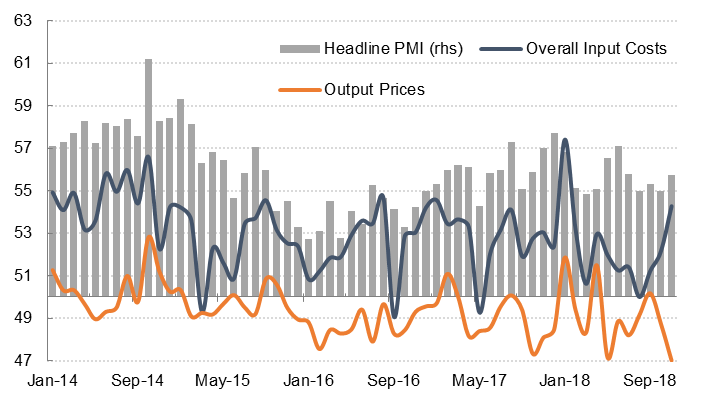

Selling prices in the UAE fell at the fastest rate since the 2009 recession in November, with the output price index declining to 47.0 from 48.7 in October. That input costs rose at the fastest rate since January even as firms were cutting output prices speaks to the challenging business environment and the pressure this is putting on firms to compete on price.

However, the steep price discounting, combined with other marketing efforts helped support domestic demand, and both output and new work rose at a faster rate last month, compared with October. Firmer export demand also contributed to overall new orders growth in November, with new export orders rising at the fastest pace in four months. Some businesses reported increased orders from other GCC countries in particular.

Largely as a result of the stronger output and new orders growth, the headline Purchasing Managers’ Index for the UAE rose slightly to 55.8 in November from 55.0 in October. The average PMI with just one month left of the year is 55.7, marginally lower than the average of 55.9 recorded in the same period last year, signalling growth in the non-oil private sector at a similar rate to 2017. Official data showed the UAE’s non-oil sector grew 2.5% in 2017.

The employment index rose marginally to 50.6 in November from 50.1 in October, but the majority of firms (94.2%) reported unchanged headcount last month. The 3.1% of firms who reported increased hiring attributed this to higher workloads. Staff costs were only marginally higher in November, with just 1.4% of respondents saying they had increased wages & salaries.

Purchasing activity increased sharply in November, as firms responded to increased new orders and output requirements. However, the overall level of inventories was unchanged, suggesting that firms are unwilling to invest in pre-production goods until they are actually required.

Optimism about future output remained near the series high, although this index declined modestly from October. 75% of firms surveyed expected their output to be higher in a year’s time, compared with 6.7% who predicted lower output.