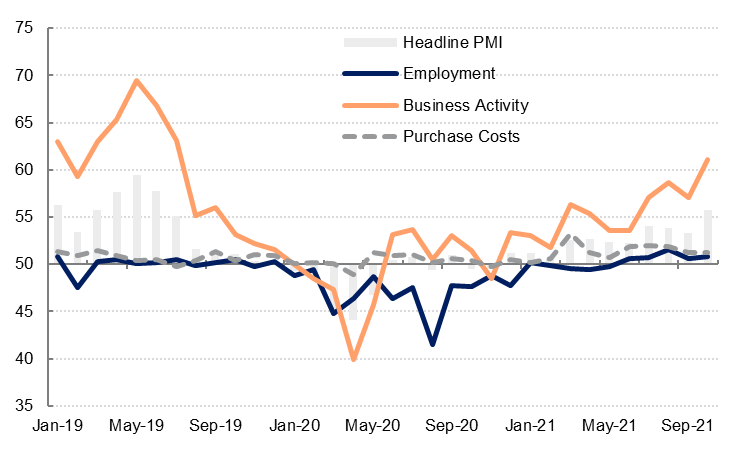

The UAE’s headline PMI rose to 55.7 in October from 53.3 in September, the highest reading since mid-2019. The main driver of the improvement was a sharp acceleration in business activity and new work, which were attributed to the start of Expo 2020. Export demand remained relatively soft last month. The increase in domestic demand in October led to only a slight increase in private sector employment however, and staff costs declined fractionally for the first time since January. Backlogs of work at private sector firms increased for the fourth month in a row.

Input cost inflation eased and supplier delivery times improved slightly in October, notwithstanding global problems with supply chains. Firms in the UAE reduced selling prices modestly last month as firms sought to remain competitive. Businesses were the most optimistic about their future output in October than they have been since the start of the pandemic last year.

We expect to see improved growth momentum in Q4, as travel restrictions continue to be relaxed and Expo 2020 should boost domestic spending. Overall we expect the UAE non-oil sectors to grow 3.5% this year, accelerating to 4.0% in 2020.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

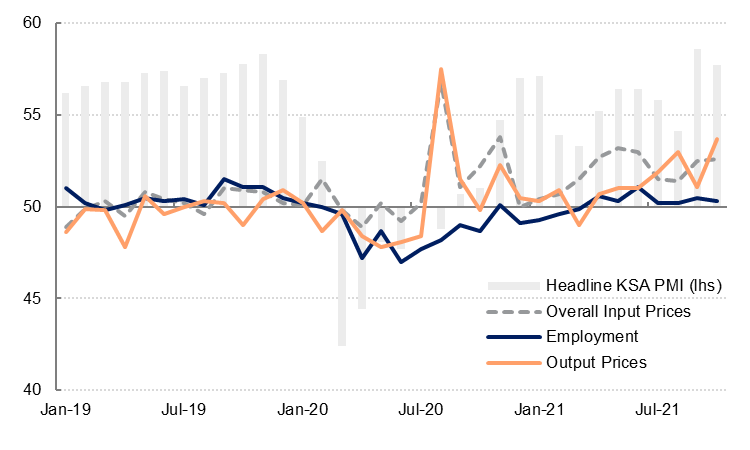

Saudi Arabia’s PMI declined slightly to 57.7 in October from 58.6 in September, but continues to reflect a solid improvement in business conditions in the kingdom. Both business output and new orders grew at a sharp rate last month, and Saudi Arabia also saw an improvement in new export orders relative to August and September. However, as in the UAE, there is little evidence that rising demand is translating to increased private sector employment in Saudi Arabia – the employment index stood at 50.3 last month, barely above the “no change” level. Staff costs also declined slightly for the third consecutive month.

Purchasing activity picked up in October and input costs rose at a similar rate to September. Firms in Saudi Arabia have passed through their higher purchase costs to buyers however, with selling prices rising at the fastest rate since last summer (when VAT was increased). Businesses remain optimistic about their future output although the future output index slipped slightly in October to 58.1. Higher oil prices in recent months have likely underpinned positive sentiment in the private sector.

We expect Saudi Arabia’s non-oil sectors to grow 5.0% this year following last year’s -2.3% contraction. We expect non-oil sector growth to moderate to 4.0% in 2022, although headline GDP will be boosted by increased oil production next year. We forecast headline GDP growth at 5.7% in 2022.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Egypt’s PMI index declined to 48.7 in October, down modestly from the 48.9 recorded in September. The global supply chain issues that have been weighing on PMI manufacturing surveys around the world have weighed on the Egyptian private sector also, contributing to the sharpest contraction in output since April. The supply constraints were evident in the stocks of purchases subcomponent which declined sharply as firms were forced to draw down on their inventory to meet demand.

The global trend for rising prices was also manifest, as input prices rose at the fastest pace in over three years. This was driven by both purchase prices (from shipping costs and raw materials) and staffing costs, as firms were forced to compensate workers for the rising cost of living.

These supply-side price pressures heighten the risk of faster consumer inflation in Egypt, although our core view remains that price growth will remain fairly contained. Firms have started to pass their rising input costs on to consumers, and output prices were, like input prices, rising at the fastest pace since August 2018 last month. CPI inflation in Egypt hit 6.6% y/y in September, and the domestic and global conditions lead us to believe that there will be no further rate cuts by the CBE in this cycle, with a 25bps hike pencilled in for Q1 next year.

Looking ahead, the contraction in new orders – with new export orders falling particularly sharply – alongside the ongoing price pressures, will likely continue to weigh on output in the coming months. The business optimism subcomponent of the PMI survey declined by more than 20 points in October, with only 32% of companies expecting higher output next year (most expect conditions to be unchanged).