.jpg?h=457&w=800&la=en&hash=3FE41A56F90FEE7421407E8321AE11EA)

The Emirates NBD Purchasing Managers’ Index (PMI) for the UAE rose to a 2018-high of 57.1 in June, as both output and new orders rose at a fastest pace this year. New export orders increased for the third month in a row but at a slightly slower rate than in May.

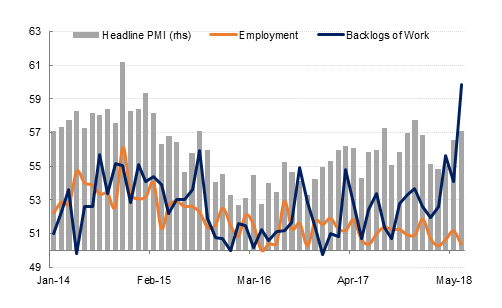

Despite the surge in business activity and new work, employment was broadly unchanged in June, with less than 1% of firms surveyed indicating they had hired new workers last month. As a result of strong new order growth and no increase in employment, the backlogs of work surged in June, with this index rising to 59.8, the highest reading in the nearly 10-year series history. Backlogs have been rising at a faster pace since February this year, indicating capacity constraints in the non-oil private sector are being reached. In our view this is unsustainable, and we expect firms to boost hiring in Q3 if new work continues to rise as strongly as it has in recent months.

Some of the strong demand recorded in June was partly due to competitive pricing and promotions, as average selling prices declined again in June, although to a lesser extent than in May. Input costs inflation also moderated however, rising at the slowest rate since May 2017.

In the context of rising new orders, easing pricing pressure as well as recent announcements of fiscal stimulus and higher oil prices, firms remain highly optimistic about their future order growth. Nearly 70% of all firms surveyed in June expected their output to be higher in 12 months’ time, compared with just 14.5% in the February survey.

Overall, the June survey data supports our view that the UAE’s non-oil sectors will see faster growth this year relative to 2017. Moreover, the decision by OPEC to increase oil output in the coming months is likely to be reflected in higher oil production by the UAE in H2, which poses upside risks to our oil sector and total GDP forecast for 2018.