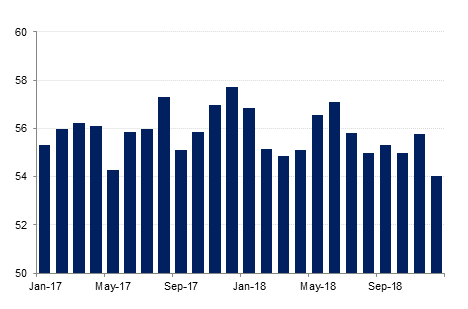

The Emirates NBD Purchasing Managers’ Index (PMI) for the dipped from 55.8 in November to 54.0 in December. This marked the slowest pace of expansion in the non-oil private sector since October 2016, and has weighed on the 2018 average, which declined to 55.5 from 56.1 in 2017.

Both output and new order growth slowed in December, while employment and wage growth were broadly unchanged. A slower pace of growth in new export orders (52.3) suggests that most of the rise in new orders was domestically driven. Firms purchased only what was required to meet output requirements, and the overall stock of pre-production inventories declined in December. This likely reflected a desire to reduce operational costs at year-end.

Output (selling) prices did not fall as quickly in December as in the previous month – which was the fastest pace recorded since the 2009 recession – but they remained sub-50 at 49.0. Domestic competition led to sales promotions, according to firms surveyed. However the fall in output prices was mitigated somewhat by a slower pace of growth in purchase costs which at 50.7 expanded at the slowest pace since August.

Despite the squeeze on firms and dip in the headline reading, a sizeable majority of respondents (65.4%) retain the view that output will be higher in 12 months’ time, while only 5.2% expected conditions to deteriorate. However, some firms cited expectations of successful sales drives to help boost output, suggesting that price discounting will remain necessary to boost output in 2019.

The lower annual average for the PMI suggests that the rate of expansion in the non-oil private sector slowed from 2017. Official data put 2017 non-oil sector growth at 2.5%, and we have revised our estimate for 2018 non-oil GDP growth down to 2.3% from 2.7% previously. However, slower growth in the non-oil sectors was offset by sharply higher oil production in Q4 2018, with crude oil output rising to 3.35mn b/d in December (from 2.8mn b/d in September). As a result, we now estimate real GDP growth at 2.4% in 2018, up from 0.8% in 2017 and our previous forecast of 2.2%.