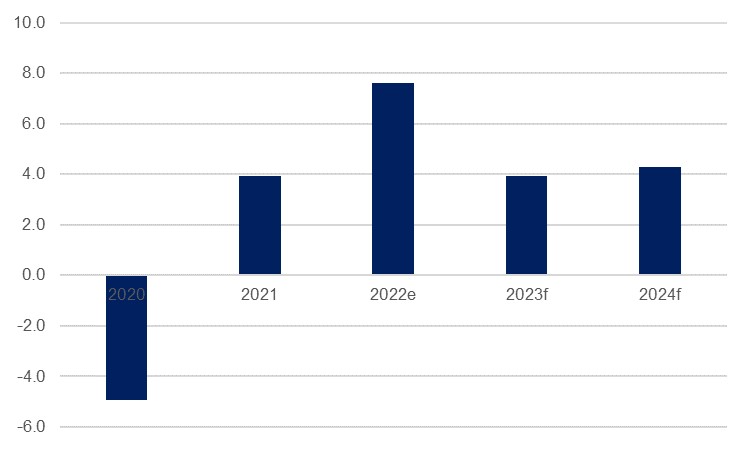

We expect growth in the UAE to settle to a more moderate rate over the next couple of years compared with that seen in 2022: we forecast real GDP growth of 3.9% this year and 4.3% in 2024, compared with an estimated 7.6% last year.

The primary driver of the slowdown is our expectation that our estimated 13% increase in oil GDP recorded last year will not be repeated with OPEC+ oil production curbs in place once more to start the year, and we forecast that oil GDP growth will slow to 5.0% this year. Over the first three quarters of 2022, hydrocarbon GDP growth in the UAE was 14.3% y/y according to preliminary estimates from the Central Bank, with Q3 growth at 13.0% y/y as oil production was ramped up compared with 2021.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

For the non-oil economy, we estimate growth of 5.6% last year and forecast a more moderate expansion rate of 3.5% this year, but this still represents a respectable pace of growth in a period when the world’s major developed economies are flirting with recession, and the non-oil sector’s slowdown will be less pronounced as compared with the oil economy’s. With the oil sector no longer the primary engine of real growth – though robust oil money inflows will remain a key supporter of growth in the non-oil economy – it will be other sectors that will pick up the slack. The central bank’s Q3 review publication did not break down the growth drivers of the non-oil sector, but it did cite travel & tourism, real estate, construction, and manufacturing as performing strongly.

The S&P Global PMI survey for the UAE confirmed a slowdown in growth momentum in Q4 2022, after a strong third quarter. The headline index fell to 54.2 in December from 54.4 in November and 56.6 in October. While business activity and new orders increased last month, they grew at the slowest pace since September 2021. New export orders declined slightly last month, reflecting weaker external demand. Private sector firms slowed hiring in December and staff costs were unchanged. Purchasing activity also slowed even as input costs slipped slightly. Firms passed on some of their lower costs to consumers, with selling prices falling at the fastest rate in three months. While firms were somewhat optimistic about the outlook over the next year, the future output index declined to its lowest level since February 2021 as firms fretted about the deteriorating global backdrop and what this could mean for their business activity in 2023.

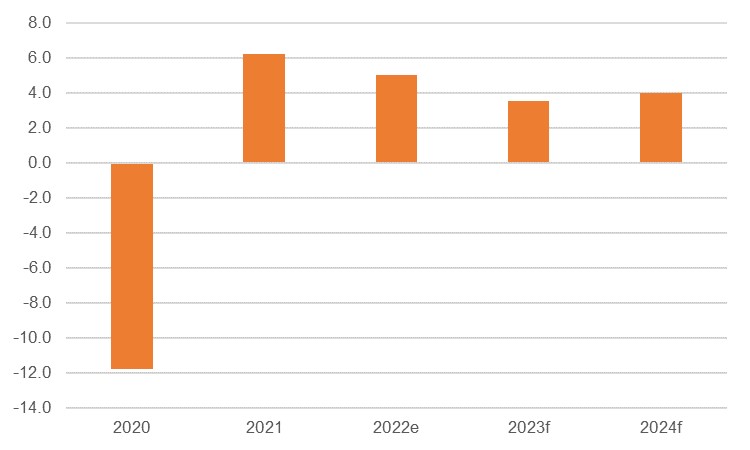

Dubai averaged y/y real GDP growth of 4.7% y/y over the first three quarters of last year, informing our estimate of 5.0% growth in 2022. If realised, this would have marked a modest slowdown from the 6.2% expansion logged in 2021, when the economy benefitted from sizeable reopening gains. In 2023, we forecast a further slowdown to 3.5% growth as Dubai is not immune from the headwinds facing the global economy given its small and open nature. Global trade flows have been slowing in recent months and will likely continue to do so, posing a challenge for the large logistics and warehousing sector (although comparatively robust growth within the rest of the GCC should soften some of this blow).

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The real estate sector has been one of the fastest-growing sectors in Dubai in recent quarters, and we estimate that it was the second-largest contributor to headline growth in 2022, second only to wholesale & retail (which is the largest sector by size). The real estate sector averaged real GDP growth of 2.4% y/y over Q1-Q3. GDP figures for Q4 are not yet available, but the sector continued to outperform according to timely data – the latest figures from the Dubai Land Department show an increase of 14.7% q/q in the total number of transactions in Q4 2022 and a 18.3% q/q increase in the value of those transactions to AED 82.11bn.

Rising interest rates and a strong USD have done little to deter the underlying demand for real estate so far, but these factors have gone some way in influencing the type of property purchasers invest in. Existing property sales made up the largest chunk of transactions in Q1 and Q2 of last year, seeing q/q growth of 19.2% and 12.7% respectively but that growth then slowed to 2.1% and 5.3% respectively in Q3 and Q4. By comparison off-plan sales saw q/q growth of 9.2% and 5.1% in the first two quarters, before jumping to 31.6% and 25.6% in the final two.

Dubai’s S&P Global PMI ticked up in December as it came in at 55.2, up from 54.9 the previous month. Nevertheless, this was the second-lowest reading since April and the fourth quarter was the slowest pace of expansion since Q1. The slowing in momentum in Q4 is consistent with that seen in national PMIs in the GCC. Output for Dubai private sector firms in December – while still very strong – grew at the slowest level in 10 months. The slowing activity is in line with our expectations that growth in the private sector would moderate through the end of the year, but the expansion rate remains robust as compared with most PMI surveys from around the world. Over 2022 as a whole, the Dubai survey averaged the strongest pace of expansion since pre-pandemic 2019.

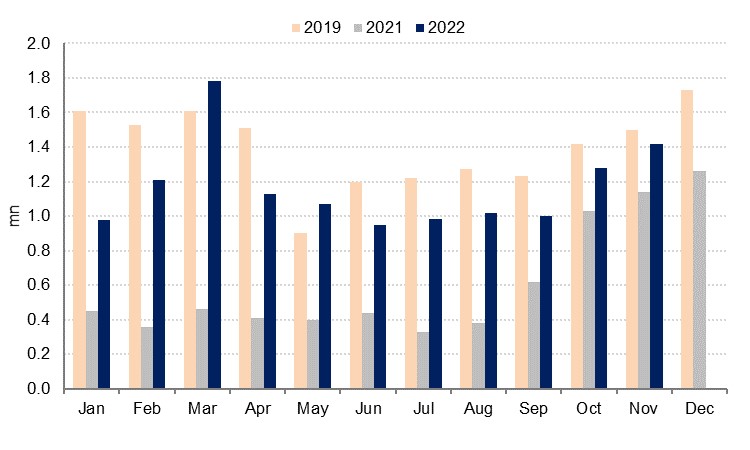

The tourism sector has become steadily more important to the UAE economy, especially that of Dubai but increasingly the other emirates also as they look to further diversify their local economies. The UAE government puts the sector’s contribution to GDP at 11.9% in pre-pandemic 2019, and while it came under pressure over the past several years, falling to just 5.4% of GDP in 2020 at the peak of the Covid-19 pandemic, it has been recovering strongly. The UAE government target is for the sector to account for 15.0% of GDP by 2030. In 2019, there were 27.1mn hotel guests in the UAE, generating AED 30.7bn in hotel revenue over 85mn nights.

Source: Department of Economy and Tourism, Emirates NBD Research

Source: Department of Economy and Tourism, Emirates NBD Research

Dubai has long been the primary tourism destination within the UAE, and it continues to account for the bulk of visitors to the country. Over January to November last year the emirate logged 12.8mn overnight visitors – a marked improvement over 2020-2021 but still 14.7% off 2019’s 15.0mn visitors over the same months. The average daily rate paid by these visitors was higher than seen in 2019, however, as this was at AED 521 over the first 11 months of last year, compared to AED 405 over the corresponding period in 2019. According to the World Travel & Tourism Council, spending in Dubai was USD 29.4bn in 2022 and it expects this to rise to USD 43bn by 2030.

While the industry faces significant headwinds this year from interest rate rises, ongoing dollar strength and a general slowdown in the global economy, all of which could weigh on demand for international travel from key source markets, the expectation is that the sector should remain resilient. This is especially the case as the easing of zero-Covid restrictions in China should see a return in Chinese visitors later in the year – they have traditionally been a top-five source market for visitors to Dubai and have been almost completely absent for the past three years – and as the slowdown in the Eurozone appears to not be so severe as initially expected as we start the year.

Dubai's inflation accelerated sharply in 2022 as higher food and energy costs pushed the headline CPI to a peak of 7.1% y/y in July 2022. Inflation slowed in H2 2022 to finish the year at 5.2% y/y and averaging 4.7% for all of 2022. With oil prices only expected to rise modestly in 2023 - we forecast an average price for Brent of USD 105/b compared with USD 99/b in 2022 - base effects should see transport inflation slow. Food prices (as measured by the UN world food price index) have also declined to levels last seen before Russia invaded Ukraine and this should allow food price inflation to ease in the coming months as well.

While a strong USD has helped to keep imported goods inflation contained through 2022, services prices rose sharply as tourism rebounded. The recreation and culture component of the CPI peaked at 44% y/y in July 2022 and slowed to a stil high 21.7% y/y in December, while restaurant and hotel prices rose 10% y/y according to the CPI survey.

The largest component of the CPI basket in Dubai is housing, and this is likely to push up headline inflation in 2023 as higher rents feed through to the consumer price index. Housing and utilties in the CPI were up 4.9% y/y in December 2022, while market rents in some freehold residential areas have seen double digit growth over the last year. Consequently, we expect headline CPI in Dubai to average 3.5% in 2023, slower than last year but still high relative to the previous 7 years.