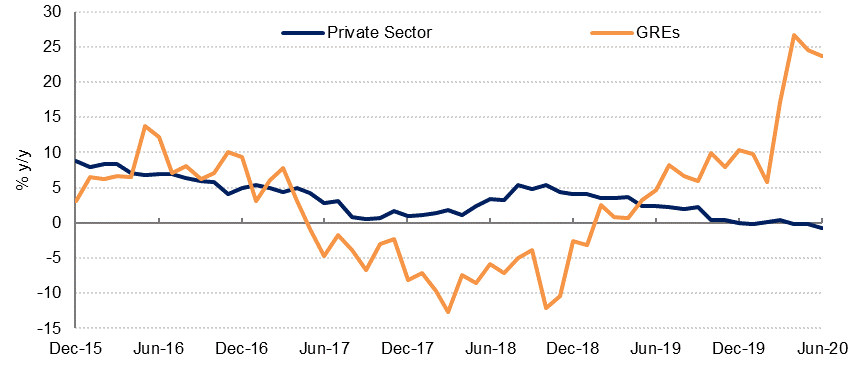

Broad money supply in the UAE rose 0.4% m/m in June, with the annual growth rate slowing to 7.9% y/y from 9.9% y/y in May. Lending to the private sector contracted -0.1% m/m in June and -1.1% y/y, the sharpest annual rate of contraction in private sector borrowing since 2010. Lending to public sector entities remained strong at 20.0% y/y in June. Monthly banking data showed bank deposit growth slowed slightly to 5.2% y/y from 6.1% in May, while gross credit growth was unchanged at 5.8% y/y.

The breakdown of bank loan growth showed government and public sector borrowing at over 20% y/y, while loans to the private sector declined -0.7% y/y, as lending to individuals declined -2.4% y/y while loan growth to businesses stalled. The breakdown of loans by sector shows a surge in bank lending to the transport and communications sector (+32.7% q/q) in Q2 as the coronavirus pandemic effectively halted international travel. Lending to the utilities sector also rose sharply at 13.4% q/q in Q2.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

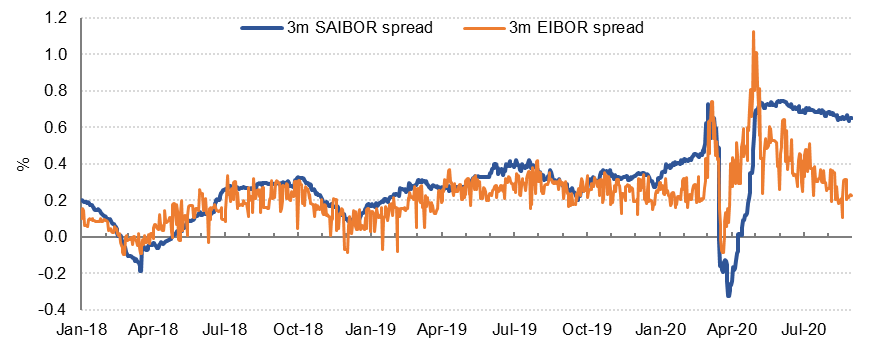

The 3m EIBOR spread over 3m USD LIBOR has narrowed back to just over 22bp, after spiking as high over 100bp in April when the Brent oil price fell to USD 20/b. The current spread is broadly in line with the average 3m EIBOR/LIBOR spread seen in 2019 and reflects ample liquidity in the UAE interbank market. In contrast, the 3M SAIBOR spread has remained elevated since April, even as oil prices have recovered to around USD 45/b. In our view this reflects the increased domestic debt issuance which was needed to finance the wider budget deficit in Q2.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research