Foreign Direct Investment (FDI) has been at the heart of the GCC countries’ economic vision to grow their economies and diversify away from oil and gas. The region has achieved significant success in deploying capital in various asset classes across the globe, evident from the prominent position of GCC sovereign wealth funds, which consistently make headlines and rank amongst the largest globally. Nevertheless, when it comes to attracting capital to the region, there is still a lot of room for growth.

The UAE led the GCC region in FDI inflows in 2022, attracting USD22.73bn, representing a 10% y/y increase. Dubai accounted for approximately half of the total FDI inflows, attracting USD12.8bn. The top five sectors for FDI inflows in Dubai in 2022 were Transportation and Warehousing with a 45% share, Hotels and Tourism and Alternative/Renewable energy with a 9% share each, Software and IT services accounting for 8%, and Consumer Products with 5%.

The UAE announced recently that it’s forming a Ministry of Investment to boost the country’s diversification efforts and achieve its ambitious goals of both attracting USD150bn in FDI inflows by 2031 and ranking among the top 10 countries in terms of FDI inflows. The UAE currently sits in the 16th place globally in FDI inflows, a big jump from 22nd place in 2021. In terms of greenfield FDI projects, the UAE came in fourth after the United States, the United Kingdom and India, with 997 projects, a surge of 84% y/y. Notably, the UAE is the only GCC nation that experienced a constant growth in FDI inflows over the past five years.

Saudi Arabia came in second place amongst it’s GCC neighbors in total FDI inflows with USD7.89bn in 2022, a decline of 35% y/y. Saudi Arabia’s decline in FDI inflows comes after a record figure of USD19.29bn in 2021, the highest in the Kingdom’s history, which can be attributed to the privatization law passed to facilitate public private partnerships and ease of regulations for foreign investors. The privatization law has enabled Aramco to sell a 49% stake in its pipelines for USD12.4bn to a consortium led by the US-based EIG Global Energy Partners. The Aramco deal accounted for 65% of the total FDI inflows in 2021.

Oman followed in third place with $3.72bn, down 8% y/y. Bahrain came in fourth with USD1.95bn, marking a 10% increase y/y. Kuwait came in fifth with USD756mn, which indicates a considerable 34% jump y/y, yet remains 74% lower than the levels recorded in 2012. Qatar saw the smallest inflows within the bloc, with USD76mn, amounting to a 107% decline y/y.

Source: UNCTAD, Emirates NBD Research

The UAE has also led the GCC region in FDI outflows in 2022, deploying USD24.83bn in investments abroad, a 10% increase y/y. Saudi Arabia came in second with USD18.82bn, reflecting a notable 21% decline y/y. Qatar came in third with USD2.38bn, experiencing a surge of 1391% y/y from a mere USD160mn in 2021. Bahrain came in fourth with USD1.95bn, a significant jump of 2926% y/y from USD64mn in 2021. Oman came in fifth with a negative FDI outflow of USD520mn, signifying a 31% decline y/y. Kuwait came in sixth with a negative FDI outflow of USD25.6bn, a 649% decline y/y. A negative FDI outflow is typically attributed to factors such as asset sales, borrowing activities, or extraction of dividends.

Source: UNCTAD, Emirates NBD Research

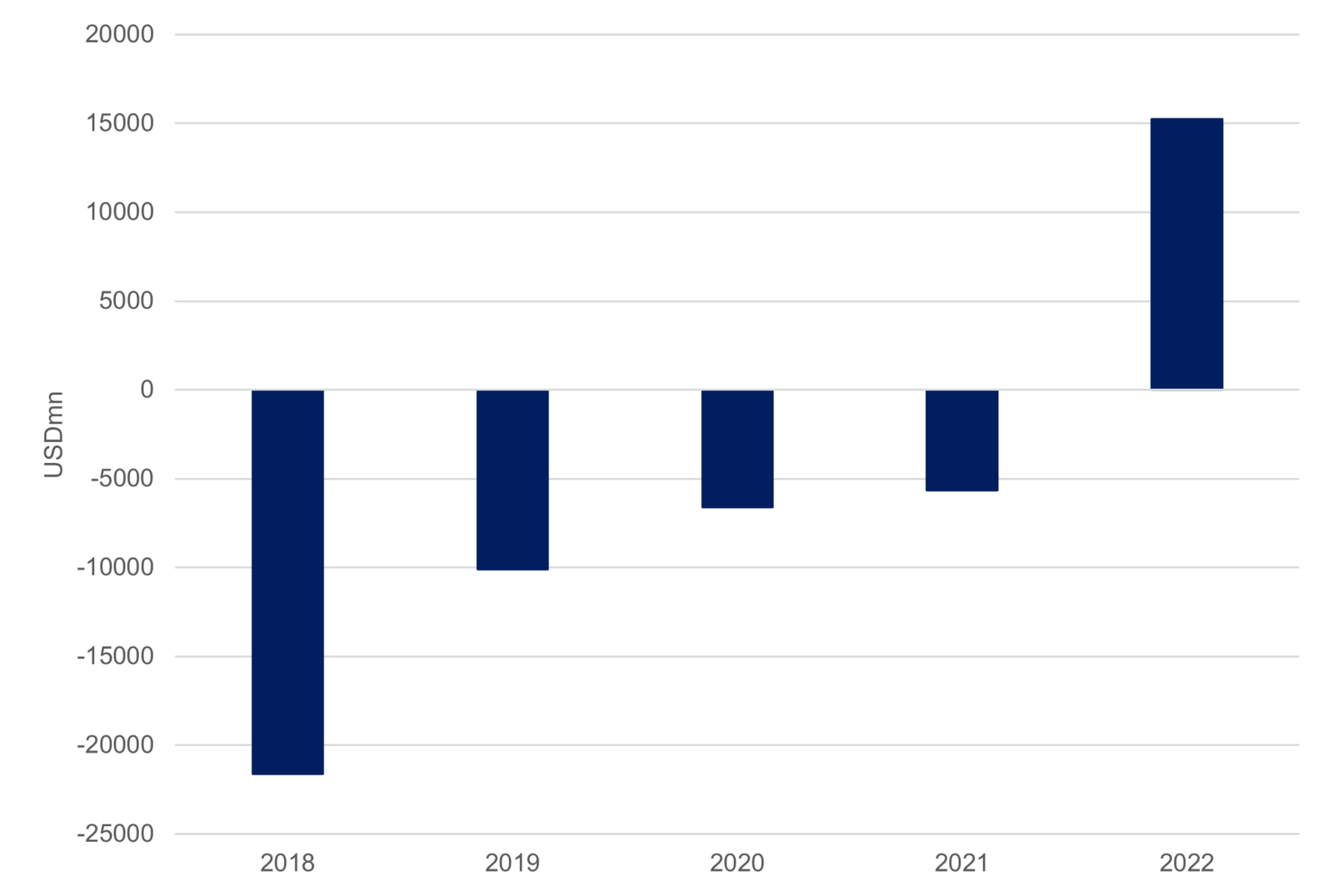

The GCC region achieved a net positive FDI of USD15.25bn in 2022, after a substantial surge of 369% y/y. However, this net positive in FDI for the region is mainly attributed to the substantial decrease in FDI outflows by Kuwait, rather than an increase in FDI inflows. In fact, the total FDI inflows in the region experienced a 18% y/y decline, dropping from USD45bn to USD37bn. The region’s decline in FDI inflows parallels the global decline in FDI which were down by 12% in 2022 according to Unctad’s annual World Investment Report 2023.