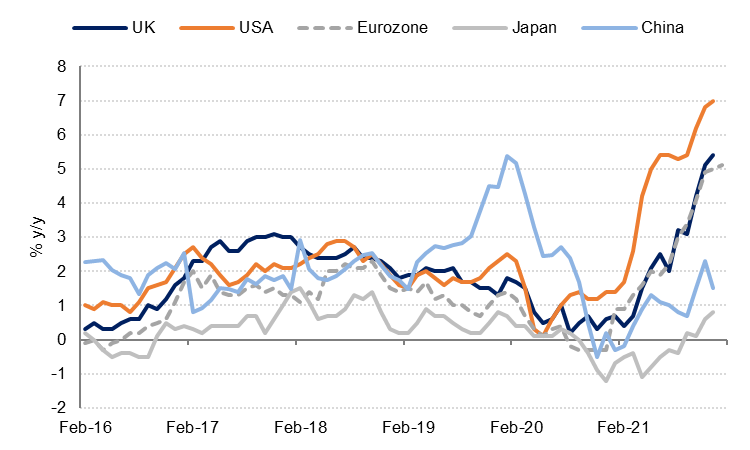

The acceleration in inflation to levels last seen decades ago has dominated headlines in recent weeks. However, it appears to be mainly a problem for the large, developed economies in North America and Europe. China's inflation is lower than it was pre-pandemic at 1.5% y/y in December and Japan’s perennially low inflation remained sub-1% at the end of last year. In the UAE too, inflation has been much weaker over the last year than in most developed economies, and some neighbouring ones.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The main drivers of inflation in the developed markets last year were energy prices, supply chain disruptions, re-opening frictions and food prices. Energy price inflation reached 29% y/y in the US in December 2021, accounting for 27% of headline US inflation. Energy price inflation was similar in the EU and UK at just under 25% y/y at the end of last year. This reflected the surge in natural gas prices as well as higher crude oil prices feeding through to household energy and petrol costs.

Supply chain issues were cited as the main reason for the more than 20% increase in the price of new and used cars in the US last year, and goods inflation more broadly. In the UK, the supply chain problems were exacerbated by Brexit, with all goods inflation rising to 6.9% by the end of 2021. Higher food prices have increased the cost of living not just in the larger developed markets but in many emerging economies as well.

For most of the last three years, consumer prices in the UAE as measured by the consumer price index (CPI) have been declining. It was only in August 2021 that the UAE’s annual inflation rate returned to positive territory, and rose to 2.5% by the end of last year. This is still around half the inflation seen in Europe and around a third of the US inflation rate.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

In this note, we look at what the CPI in the UAE measures and why inflation has been relatively contained over the last year, even as it has accelerated in many other countries. We also provide an outlook for the three key components of the UAE consumer basket - housing, transport and food - which informs our view on overall inflation in 2022.

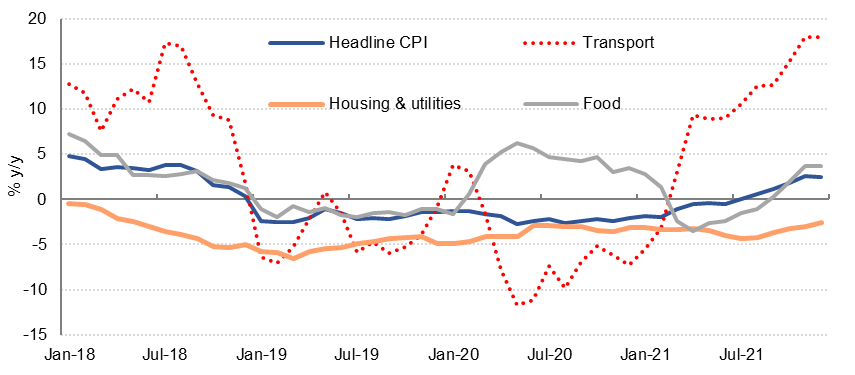

Housing (including utilities), transport and food together account for almost 63% of UAE’s consumer basket, with housing alone accounting for just over one-third. This component of the index includes rents, owners’ equivalent rent, home maintenance costs, water, refuse and sanitation service charges, and electricity and other energy costs used in homes[1].

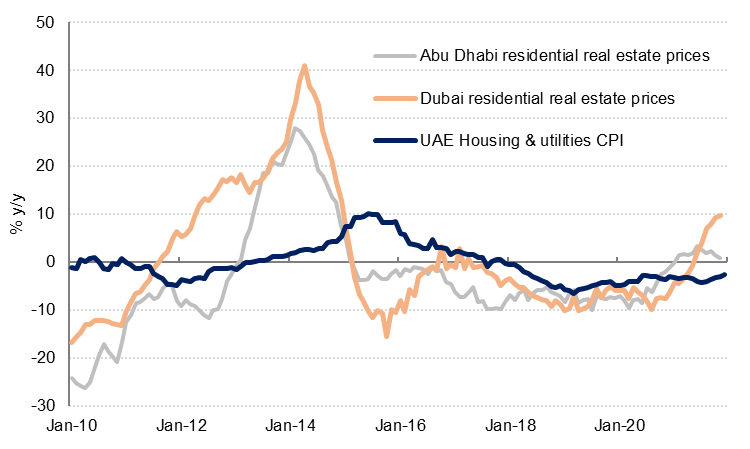

Last year, housing and utility costs in the CPI declined -3.5% from 2020, which has helped to offset some price increases in other components of the CPI. While this may sound counter intuitive – real estate consultancies have reported average rents rising in the second half of 2021 – it takes time for changes in the market rates to feed through to consumer price index. Not all households are renewing leases at the same time, and price increases are only registered at the time of renewal. Also, not all consumers will see their rents rise by the same amount. It can take 18 months to 2 years for changes in market rents to feed through to the CPI. As a result, we don’t expect significant upward pressure from housing in the CPI this year either.

Source: Bloomberg, Haver Analytics, Emirates NBD Research

Source: Bloomberg, Haver Analytics, Emirates NBD Research

Utility prices (electricity, water, gas and other fuels) in the UAE have also had less of an impact on inflation in the UAE than in the US and Europe, where gas is more commonly used for residential purposes than it is here. The UAE’s Federal Competitiveness and Statistics Authority doesn’t provide a detailed breakdown of the housing & utilities index, so we cannot see how household energy prices specifically have fared relative to the rest of the world. However, DEWA reduced electricity and water surcharges from December 2020 as Dubai increased the share of clean energy capacity in its energy mix, which would have contributed to the deflation in the housing & utilities price index last year.

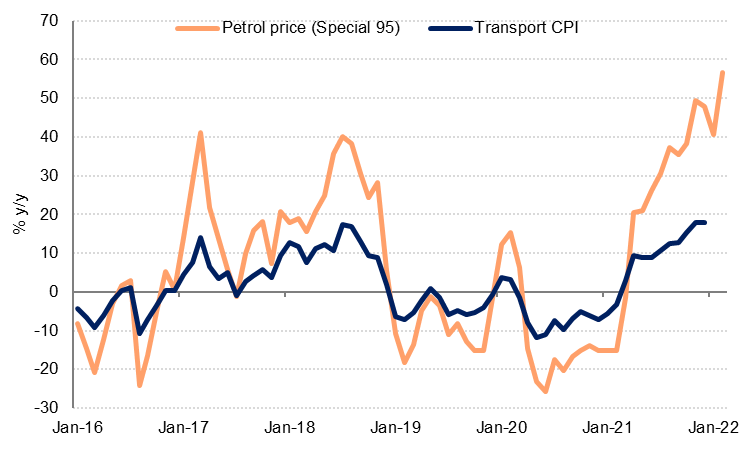

The biggest increase in the UAE’s CPI in 2021 was in the transport component of the index, which reached 18% y/y by December and averaged a 9% increase over the whole of last year. The transport component of the CPI measures changes in the prices of petrol at the pump, new and used vehicles, vehicle parts and maintenance, road tolls, passenger transport services (including buses, taxis and airfares) as well as goods transport (couriers, goods delivery etc). The UAE’s inflation releases don’t provide the weights of these items in the index, but it is likely that the main drivers of transport inflation are petrol prices and the cost of vehicles, both of which have increased sharply over the last year.

UAE petrol prices had increased almost 48% y/y by the end of last year, broadly in line with the increase in petrol prices in the US, reflecting the higher price of crude oil in 2021. While petrol prices are likely to increase further in the short term– the February hike was 11.5% m/m - as oil prices remain elevated, we expect crude prices, and therefore petrol prices at the pump, to soften in the second half of the year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

New and used vehicle prices likely also contributed to the increase in transport costs for consumers in the UAE last year. Once again, this was something of a global phenomenon as semiconductor chip shortages (themselves a result of covid-related lockdowns across Asia) meant car producers could not increase production fast enough to meet demand. The shortage of new cars put upward pressure on second-hand cars as well. In the UK, the price of second-hand cars jumped 29% y/y by the end of last year, while in the US the price of used cars and trucks had risen more than 37% y/y.

While it will take some time for chip shortages to be fully resolved, supply is expected to recover this year allowing vehicle manufacturers to boost production. However, demand is likely to outstrip supply and keep prices elevated through at least the first half of 2022. There is also the risk that new strains of the coronavirus could lead to further lockdowns and manufacturing disruptions this year, which could delay the recovery of the sector.

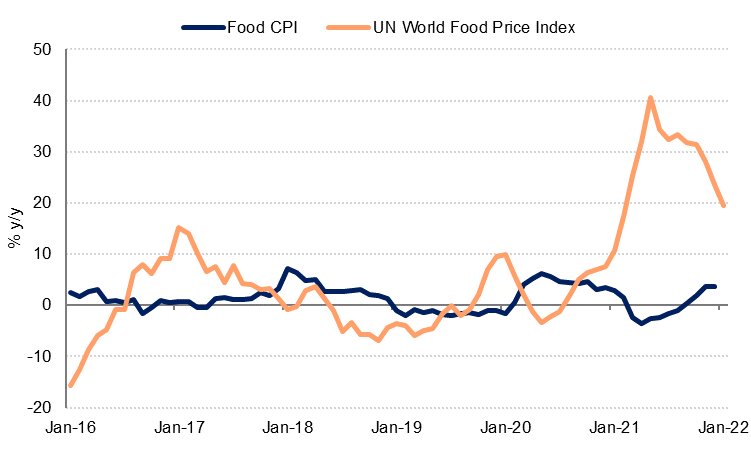

The UN World Food Price Index shows that food inflation peaked at around 40% y/y in mid-2021 and had slowed to a still high 19% y/y by December 2021. Food inflation accelerated to 6.3% y/y in the US in December 2021, 4.5% in the UK by end 2021, and 3.6% y/y in Europe. Many emerging markets have also seen food prices rise sharply over the last year.

In the UAE, food price inflation accelerated in Q4 2021 to end the year at 3.7% y/y, but had declined on an annual basis for most of H1 2021. Consequently, the average price of food in the UAE was broadly unchanged from 2020.

We expect food price inflation to continue feed through to the UAE CPI over the course of this year as the UAE imports most of its food. However, food prices are typically very volatile and we do not anticipate a sustained increase in domestic food prices, not least because we expect the US dollar to strengthen this year, mitigating some of the increase, and also because the UAE authorities can step in to stabilize the market through price caps and managing essential food supplies.

Source: Bloomberg, Haver Analytics, Emirates NBD Research

Source: Bloomberg, Haver Analytics, Emirates NBD Research

The other segments of the UAE CPI that recorded some increase in prices last year were mainly services. Recreation & culture prices increased 4.5% on average last year as leisure activities normalised, after declining more than -16% in 2020. Education costs rose 1.1%, healthcare was up 0.4% and hotel & restaurant prices rose just 0.7% on average over 2020, even as most restrictions were lifted and tourism recovered in the final quarter of 2021. To some extent, this relatively modest increase in prices reflected excess capacity in education, healthcare and hospitality sectors last year, and high levels of competition which have kept prices from rising more quickly.

We expect inflation in the UAE to accelerate in H1 2022 before slowing in H2. We forecast average inflation at 2.0-2.5% this year, and 2.5% in 2023.

While high energy and commodity prices are likely to keep input costs for businesses elevated in the coming months, the PMI survey data suggests that most firms are absorbing these higher costs rather than passing them on to customers. That should help to keep consumer inflation contained.

Fed rate hikes this year should underpin the USD, keeping imported inflation into the UAE in check. Finally, supply chains are expected to improve over the course of the year, and shipping costs have already started to ease.

[1] The UAE uses the UN’s COICP to classify goods and services in the consumer price index. The weighting of each item is determined by local expenditure surveys. This can vary by emirate.