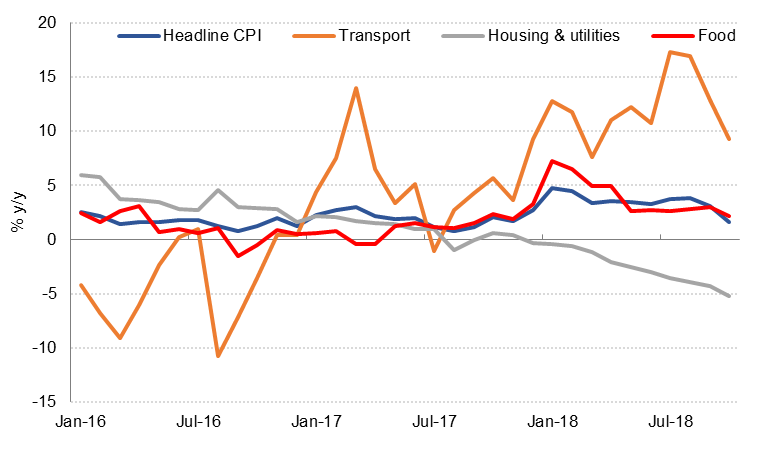

Inflation in the UAE eased to 1.6% in October from 3.1% in September, declining -0.5% m/m. The biggest m/m drop was in the transport component (-2.3% m/m), which is a little surprising as petrol prices increased in October as they have for most of this year. However, other components of the transport index include the cost of vehicles, vehicle repairs and maintenance services, which may have declined in price. Housing, which accounts for nearly 40% of the basket, declined -0.2% m/m (-5.4% y/y), while food inflation moderated to 2.1% y/y from 3.0% in October. We expect inflation to continue to ease as lower oil prices feed through to petrol prices.

US equity markets closed sharply higher and 10y bond yields declined slightly after Fed Chairman Powell said in New York that interest rates were “just below” the estimated neutral policy rate, and that the Fed would be watching data very closely to see how recent rate hikes were affecting the economy. The market interpreted this as a more cautious stance on tightening in 2019. The minutes of the November FOMC meeting will be released today. Separately, IMF managing director Christine Lagarde said that global growth may be slowing by more than forecast in its report last month, highlighting one of the factors that the Fed will need to take into account in its deliberations next year.

In the UK, the Bank of England’s (BoE) Brexit stress tests showed the banking system would be able to withstand even the worst case scenario of a “Disorderly Brexit”. In the BoE’s worst case scenario, the economy could shrink by 8% in the first year, house prices would fall by a third and the pound would lose 25% of its value. The estimates in the BoE’s “no deal” scenarios were more severe than the Treasury’s fifteen year forecasts released earlier, but both analyses showed the UK being worse off economically post-Brexit, even with a deal in place, than if it remained in the EU.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries closed higher following comments from the Fed Chair Powell. He said that the rates are ‘just below’ the range of estimates of neutral. He also said that the economy is yet to feel the full impact of the hikes. Yields on the 2y UST, 5y UST and 10y UST closed at 2.80% (-3 bps), 2.86% (-3 bps) and 3.05% (-1 bp) respectively.

Regional bonds trade in a tight range for a second consecutive day. The YTW on the Bloomberg Barclays GCC Credit and High Yield remained flat at 4.79% while credit spreads rose +1bp to 192 bps.

The dollar softened yesterday following comments from Federal Reserve Chairman Jerome Powell (see macro) which resulted in investors scaling backing on the number of rate hikes expected in 2019. Over the course of Wednesday, the Dollar Index declined for the first time in 5 days, losing 0.6% to close at 96.786. As we go to print, the index remains near this level and we expect support at the 50-day moving average (96.056), a level which has held since breached on October 17th 2018.

Developed market equities closed higher following comments from Fed Chair Powell on neutral rates which was interpreted as dovish by investors. The S&P 500 index added +2.3% while the Euro Stoxx 50 index gained +0.1%.

Regional equities closed mixed. The DFM index dropped -0.5% while the Tadawul gained +0.8%. Real estate sector stocks continue to drag the DFM index lower. Union Properties and Rak Properties dropped -5.4% and -3.8% respectively.

Oil prices remained near one-year lows as US crude stockpiles continued to rise and comments by President Putin that current oil prices were “absolutely fine”, suggesting that Russia may not be on board with cutting production next year. US crude inventories rose 3.6mn barrels last week, the 10th week in a row.