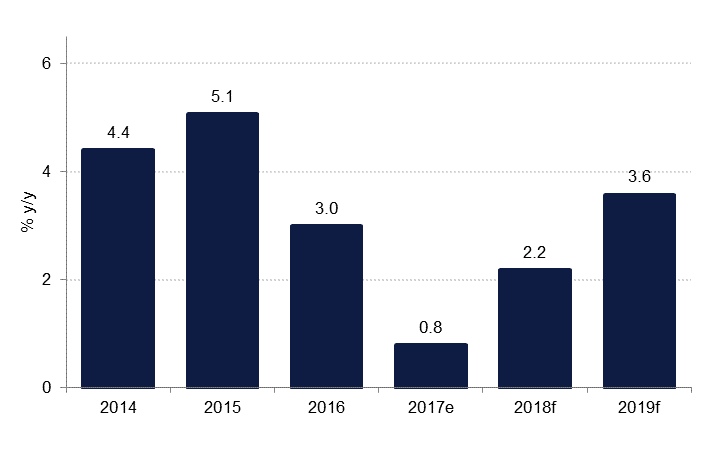

The Federal Competitiveness and Statistics Authority has recently released updated estimates for the UAE’s economy. The latest data show real GDP growth of just 0.8% last year, down from 3.0% in 2016. This is lower than the initial estimate released earlier this year of 1.5% real growth in 2017. The key changes are a deeper recession in the oil & gas sector (-3.0% y/y) than initially estimated and a downgrade of non-oil GDP growth to 2.5% (from 3.0% in the preliminary figures).

While the economy’s performance last year was significantly below our expectations (we had forecast 2.0% growth), we note that this was in large part due to deeper than expected cuts to oil production last year. The non-oil sectors did grow, albeit by less than we had expected. The latest official estimates are still subject to revision.

Looking at the details of the release, the UAE’s biggest sectors remain wholesale & retail trade (11.7% of GDP), followed by finance & insurance (8.6%), construction (8.4%) and manufacturing (8.3%). Growth in the wholesale & retail trade sector slowed sharply last year to just 0.3%, compared with average growth of 4.5% over the prior five years, while finance & insurance growth slowed to 2.0% y/y. The construction sector contracted -1.6% y/y while manufacturing grew 3.4%, the slowest rate of growth in this sector since 2012.

The sluggishness in the larger sectors was offset by strong growth in accommodation & food services, which grew 8.5% in 2017, the fastest growth in three years. Utilities also grew 8.0%, up from 5.45 in 2016. Public administration, defence and social security expanded 6.2% in 2017, more than double the growth rate seen in 2016.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The UAE has increased oil production to 2.96mn bpd in July (Bloomberg estimates) from the low of 2.8mn bpd in February 2018. If production in maintained at this level through the rest of H2, then average oil output for the UAE will be unchanged relative to 2017, whereas we had assumed a decline of -2.0% in our GDP forecast. We have thus revised up our forecast for oil sector growth to 0%.

We had expected non-oil sector growth to accelerate this year, driven by increased government spending both on infrastructure and on wages and social spending. The government announced a stimulus package only towards the end of Q2, so the impact may not become evident until later this year.

The PMI survey data also suggests that the UAE’s non-oil sector grew at a similar pace in H1 2018 as H1 2017, rather than accelerating. While we remain cautiously optimistic that higher oil prices, rising oil production and increased government spending will boost non-oil sector growth through H2, we recognise that our non-oil GDP growth forecast of 4.0% now looks too ambitious, and we have revised it down to 3.1%.

The upwards revision to oil sector growth effectively offsets the downward revision to non-oil GDP growth estimates for this year. As a result, we retain our headline GDP growth forecast for 2018 at 2.2%. We expect growth to accelerate to 3.6% in 2019, both on (sharply) higher oil production and faster non-oil sector growth.

Click here to download the full report.