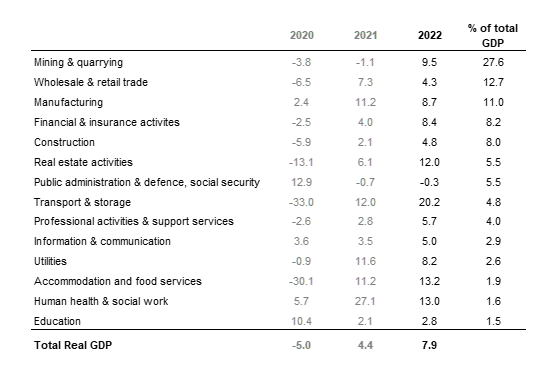

Preliminary data for UAE GDP show real growth of 7.9% in 2022, led by a 9.5% increase in hydrocarbons GDP. Non-oil sector growth came in at 7.2%, a full percentage point above our estimate, underpinned by strong growth in the services sectors in particular (see Table 1 below). Manufacturing output was also robust, growing 8.7% in 2022, slower than the 11.2% recorded in 2021. The expenditure GDP breakdown shows a sharp rebound in both private consumption and gross capital formation (investment) last year.

We have revised our forecast for UAE growth in 2023, to take into account the data we have seen in the first half of the year. With OPEC+ extending production cuts through the end of 2024, we now expect the UAE’s hydrocarbons GDP to contract by -2.5% this year, down from a forecast expansion at the start of 2023.

However, the non-oil sectors have proven to be resilient to both a slower global growth backdrop and higher borrowing costs in the UAE. The PMI has averaged 55.5 in the first five months of the year, higher than the average over the same period last year, despite weakness in external order growth. Business activity has been supported by domestic demand so far in 2023.

Emirates NBD data points to robust consumer demand through the first quarter, as card spending (both credit and debit) grew at a solid pace. We expect aggregate demand is supported by continued population growth in the UAE, which has likely also been a driver of higher housing costs. The tourism sector has continued to rebound and overall visitor numbers were only fractionally below pre-pandemic levels in the year to April. We expect full year visitor numbers to exceed 2019 levels, which will also underpin growth in the transport and services sectors this year. We have thus revised up our forecast for non-oil GDP growth in the UAE to 5.0% this year, from 3.5% previously.

We have revised our forecast for total GDP down to 2.9% in 2023, from 3.2% previously.

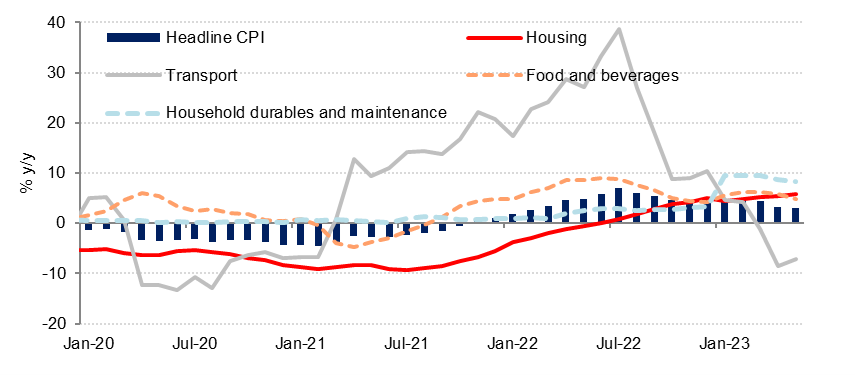

Inflation has slowed from last year’s peak of 7.1% (July 2022), as last year’s surge in energy and food costs has started to unwind and is now in the base. Dubai’s inflation fell to 3.0% y/y in May from 4.6% y/y in January and we expect inflation in the emirate to average 3.5% in 2023, down from 4.7% in 2022.

The main driver of inflation in H1 2023 has been - surprisingly - the cost of household durables such as furniture, appliances, and home maintenance services. This supports our view that new household formation has been a key driver of private sector consumption growth over the last year. Housing costs in the CPI have also accelerated to 5.7% y/y in May and are likely to rise further as the increase in market prices feeds through to the official index. However, this has been offset by the decline in transport costs, which reflects easing supply chains and also lower petrol prices at the pump relative to last summer.

Lower than expected crude oil prices year-do-date – while helpful in easing inflationary pressures – is less positive for the budget. We have revised down our forecast for the UAE’s budget surplus to 4.9% of GDP from 5.6% previously as we now expect Brent oil to average around USD 82/b this year. However, the growth in non-oil sector activity will likely contribute to additional tax and fee income in the budget. We have not assumed any income from the UAE’s new corporate tax, as revenue from the new tax are unlikely to be received before 2025.