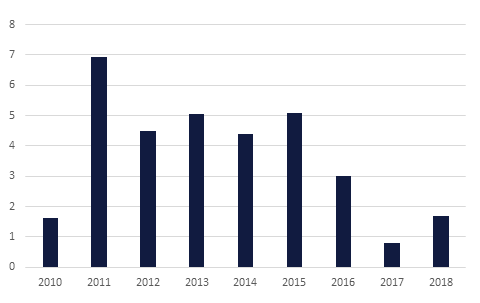

The UAE has released its real GDP growth figures for 2018, showing an expansion of 1.7%. This marked an acceleration on the 0.8% seen in 2017, and the expectation is that there will be a further improvement in growth this year, with the Central Bank forecasting an expansion of 3.5% in 2019. The non-oil sector posted growth of 1.3%.

China’s official manufacturing PMI index saw an improvement in March, climbing from 49.2 in February to 50.5. This marked the first expansionary 50-plus reading since November, and there was a strong performance from the new orders and new export orders components of the index, which both climbed to six-month highs. Trade talks are set to continue in the US this week, following what US Treasuy Secretary Steven Mnuchin termed ‘constructive’ meetings in Beijing on Friday.

The Brexit debate is set to continue in the UK today, as MPs will hold another series of indicative votes, following that they held last week. PM Theresa May’s deal remains unpopular, having effectively been defeated for a third time on Friday, but nevertheless there is seemingly still no outright majority for any alternative plan of action. While a customs union with the EU is expected to garner the most votes today, this would raise problems for the PM given deep-rooted opposition to this among many members of her governing Conservative Party.

Turkey held municipal elections on Sunday. With most of the votes counted, President Erdogan’s AKP took around 52% of the national vote, but it did lose some key cities, including the capital, Ankara. Foreign banks had been prevented from accessing lira liquidity in the run-up to the vote, in a bid to prevent another sharp sell-off similar to that seen in 2018.

Egypt’s central bank kept its benchmark overnight deposit and overnight lending rates on hold on Thursday, at 15.75% and 16.75% respectively. Meanwhile, President Sisi announced a 67% raise to the minimum wage announced on Saturday.

Source:FSCA, Bloomberg, Emirates NBD Research

Source:FSCA, Bloomberg, Emirates NBD Research

US Treasuries continued their rally amid mixed economic data. Comments from Larry Kudlow, reported by Axios, that the Federal Reserve should cut rates by 50 bps also contributed. Yields on the 2y UST, 5y UST and 10y UST ended the week at 2.26% (-5 bps w-o-w), 2.23% (-1 bps w-o-w) and 2.40% (-3 bps w-o-w).

Notwithstanding further chaos in the Brexit process, yields on 10y Gilts closed only marginally lower at 1.0%. Elswhere in Europe, yields on 10y Bunds moved deeper into negative territory to end the week at -0.07%.

Gains in regional bonds stagnated last week. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -1bp w-o-w to 4.07% while credit spreads widened 3 bps to 175 bps.

Saudi Fransi Bank has said that it will redeem Tier 2 subordinated sukuk due in 2024 on 18 June 2019 at face value.

In terms of ratings, S&P affirmed the unsolicited sovereign rating of Saudi Arabia at A- with stable outlook. The rating agency said that the outlook reflects its expectation that Saudi Arabia will maintain a pace of moderate economic growth and retain strong government and external balance sheets over the next two years.

AUD has gained on all the other major currencies following stronger than expected economic data out of China. A rebound in the Caixin Manufacturing PMI (see macro) has helped AUDUSD climb 0.31% to 0.71187. This move has resulted in the price testing the resistive 50-day moving average (0.7120). Above this level further resistance can be expected at 0.7150, close to the 38.2% one-year Fibonacci Retracement and 100-day moving average (both at 0.7150).

As a result of improved risk appetite, JPY is softer in the Asia session and being driven lower by the positive performance of Asian equity markets and a climb in yields. As we go to print, USDJPY is currently trading 0.19% higher at 111.06, just above the 100-day moving average (111.06) and below the 50-week moving average (111.10). A close above these levels can result in a retest of the 112 handle.

Regional equities started the week on a mixed note. The DFM index and the Tadawul added +0.1% and +0.4% respectively while the Qatar Exchange lost -0.4%.

The DFM index was supported by strength in Emaar-related names. Emaar Properties, Emaar Malls and Emaar Development added +2.1%, +1.7% and +0.5% respectively. Elsewhere, Dana Gas gained +1.1% after reports that the company has revived plans to list shares in London to get a better valuation for the business.

Brent crude gained 2.0% to USD 68.39/b last week, capping off a strong quarter in which it rose 25%. The benchmark international index averaged USD 63.9/b over Q1 – we forecast an average of USD 65/b over the course of the year. WTI meanwhile gained a similar 1.9% over last week, to USD 60.14/b. An improving outlook in China as trade talks continue and PMI turns positive has been a driver of the rise in oil prices.

In local developments, Saudi Aramco was given an A+ rating by Fitch Ratings as the oil company begins preparations for its first international bond.