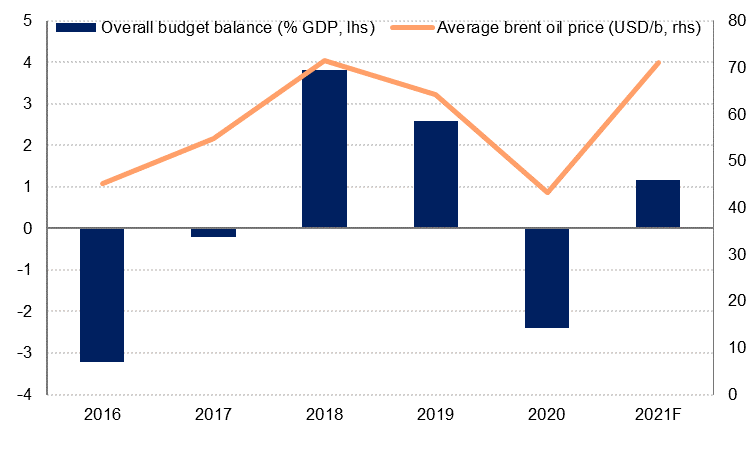

The latest data from the UAE Ministry of Finance show that the UAE ran a consolidated budget deficit of -AED31.6bn (-USD 9bn) or -2.4% of GDP in 2020, wider than the initial estimate of -AED 3.0bn (-0.2% of GDP). 2020 expenditure was revised up 7% to AED 400bn from the preliminary estimate. However, this is still a decline from the 2019 consolidated spending of AED 437bn as the government reduced current spending on the back of a sharp decline in revenues. Oil revenue declined last year on the back of lower prices and production cuts, while tax revenues declined as the economy went into recession due to the lockdown and restrictions on travel.

Budget data for Q1 2021 show a deficit of -AED 13.0bn, compared with a surplus of AED 28.8bn in Q1 2020, as revenues were down by almost 50% y/y while expenditure was only 16% lower than in Q1 2020. For the year as a whole, we expect the consolidated UAE budget to record a surplus of 1.2% GDP.

Oil revenue is set to rise by 30% on the back of both increased production since August and higher oil prices – we estimate the average Brent price this year will be 64% higher than in 2020. Non-oil revenues will also recover as the economy returns to growth after last year’s Covid-induced recession. On the expenditure front, we now expect only a modest increase in expenditure this year, as last year’s actual spending was higher than initially estimated.

Source: UAE Ministry of Finance, Haver Analytics, Emirates NBD Research

Source: UAE Ministry of Finance, Haver Analytics, Emirates NBD Research

We expect the UAE to maintain a conservative approach to government finances and target spending towards strategic initiatives to boost longer-term growth prospects. These include developing higher value-added manufacturing, clean energy projects and investment in space missions and technology. Many of the recent policy announcements have focused on enabling and encouraging greater private sector investment in the UAE, with a view to reducing the reliance on government spending as the main engine for growth and economic diversification.

Following the recent USD 4bn bond issue by the UAE federal government, the total bond and sukuk issuance from the UAE and its emirates this year stands at around USD 15bn. The federal budget is forecast to run a deficit of around USD 1.3bn this year and the 2022 budget announced yesterday keeps spending largely unchanged next year, so the bond proceeds should cover any shortfall for 2022 as well.

While the 2021 Abu Dhabi budget reportedly projected a deficit of AED 43bn (USD 11.7bn), this was based on an average oil price of USD 46/b according to Reuters. With the Brent price likely to average USD 71 this year, the emirate will likely not need the proceeds of its bond issuances earlier this year. However, the UAE has locked in relatively low-cost funding, giving it flexibility in managing its finances over the next few years.

Oil production grew 3.9% q/q in Q3 21 to 2.8mn b/d by end September. We expect oil production to continue to rise to 2.9mn b/d by year end and to over 3mn b/d by end-2022. We have revised our headline GDP forecasts to 1.9% (2021) and 4.6% (2022) on the back of higher oil production. Non-oil GDP forecasts remain unchanged at 3.5% in 2021 and 4.0% in 2022.

PMI data for September confirm a steady recovery in the non-oil private sector. The outlook for Q4 is brighter with easing in travel restrictions likely to support tourism and hospitality sectors, while Expo 2020 should result in a bump up in domestic demand as well.

Bank deposit growth slowed to 1.5% y/y in July from 2.3% in June, while gross bank lending contracted -1.8% y/y in July. Gross lending has been declining on an annual basis since March, partly due to last year’s pandemic-related high base. Loan growth to government and public sector entities slowed to 0.3% y/y in July while private sector lending declined -2.4% y/y. Within private sector lending, the softness has been evident in business loans (-4.5% y/y in July) while lending to individuals accelerated to 4.0% y/y from 3.6% in June and -1.0% in December 2020.

.png) Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Inflation in the UAE is picking up, reaching 0.5% y/y in August - the first positive annual inflation rate since December 2018. Food and transport have been the main sources of inflation in the UAE in ercent months on a m/m basis but food prices are still lower than they were a year ago. Housing remains deflationary but the rate of price decline has slowed. We expect inflation to average 0% in 2021, accelerating to 1.5% in 2022.