The UAE central bank has cut its forecast for UAE economic growth this year after non-oil growth slowed slightly in the second quarter, according to a report released by the central bank yesterday and reported in the press this morning. The central bank now expects the UAE’s real GDP growth to expand 2.3 per cent in 2018, instead of the 2.7 per cent which it had projected in its last report. This brings the central bank’s forecast close to our own estimate of 2.2%. Non-oil GDP grew 3.6 per cent y/y in Q2, compared to a revised 3.8 per cent in Q1 according to the central bank, while oil production shrank 1.7 per cent y/y in Q2 because of output reductions agreed by OPEC. Going forward the central bank now expects the non-oil economy to grow 3.6 per cent in 2018 while oil GDP shrinks just 0.5 per cent overall, following the OPEC agreement to increase output in the second half of this year. This is also broadly in line with our own view which sees the oil sectors’ contribution to growth increasing in H2 this year.

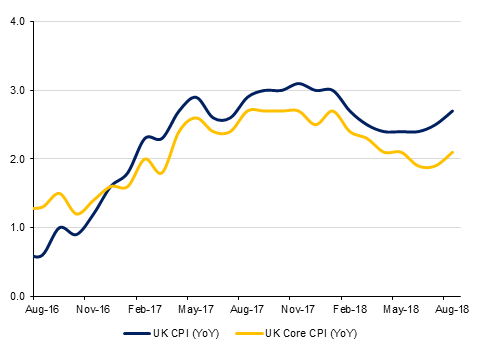

Inflation rose in the UK with a report showing that consumer prices increased 2.7% y/y in August compared with 2.5% y/y the previous month. The same report showed that core CPI accelerated from 1.9% y/y to 2.1% y/y. The increase in prices appears to be on account of some volatile components in the basket and is therefore likely to be temporary, but the expected timing of a rate hike from the Bank of England has been brought forward a little with the OIS now showing a 34.2% chance of a rate hike in February 2019, compared with a 25.4% chance before the data was released. Meanwhile the EU leaders’ comments about Brexit going into the EU summit in Salzburg last night were less encouraging than had been expected, with Jean Claude Junker the Commission President calling a Brexit deal far away, while UK PM May said there would be no extension of talks to give a deal more time. The Salzburg meeting is expected to call a another special summit to be held in November at which a Brexit deal will be done, but both sides appear to be digging in over contentious issues like the Irish border.

Treasuries closed lower and the curve bear steepened again. The move appears to be driven by renewed appetite for risk assets. Yields on the 2y UST, 5y UST and 10y UST closed at 2.79% (-1 bps), 2.94% (+1 bps) and 3.06% (+1 bps) respectively.

Regional bonds followed moves in USTs and closed lower. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2bps to 4.52% even as credit spreads remained flat at 161 bps.

According to a report in Reuters, Abu Dhabi government is considering proposals to restructure some USD 1.2bn of bonds issued by Etihad Airways in partnership with other airlines.

The pipeline for primary market continues to grow with Nakheel said to plan a sukuk issue.

GBP has lost ground overnight as the comments from the Salzburg EU summit were less encouraging about a Brexit deal than had been expected. GBP had attempted to breach 1.32 on the back of earlier strong UK inflation figures, but has since fallen back to 1.3150 currently. Meanwhile the NZD has strengthened to 0.6650 after NZ Q2 GDP advanced by more than expected, rising by 1.0% q/q and 2.8% y/y. The data is seen reducing the prospect of an RBNZ easing in the coming months. Meanwhile USDJPY is holding in above 112 as US 10-year yields consolidate their recent gains above 3.0%.

Developed market equities closed higher following strength in banking sector stocks. The S&P 500 index and the Euro Stoxx 600 index adding +0.1% and +0.3% respectively.

The recent trend of Saudi Arabian equities outperforming their regional peers continued. The Tadawul added +1.1% as real estate sector stocks rallied. Dar Al Arkan and Jomar gained +3.0% and +3.7% respectively.

Elsewhere, the EGX 30 closed sharply lower with losses of -3.8%. It appears that margin calls for retail investors dragged the broader index lower.

Oil markets were up overnight as crude inventories in the US dropped along with a decline in gasoline inventory levels. WTI futures rose 1.8% while Brent added less than 0.5%. Total crude stocks dipped 2m bbl last week while gasoline fell by 1.7m bbl. Production remains at 11m b/d while refinery demand ticked back but is still healthily above its five-year average.

We expect oil prices to hold relatively close to the range they have settled into for the last few months and to keep those levels as we head into 2019. Trade war concerns and the general maturity of the business cycle in the US are to us two of the major downside demand risks for next year.

Click here to Download Full article