The UAE central bank revised down its forecast for 2020 real GDP in its Q2 Quarterly Economic Review to -5.2% from its previous forecast of -3.6%. The central bank’s revised forecast is closer to our estimate of -5.5% for UAE real GDP this year, although risks to our forecast are skewed to the downside. The UAE economy contracted by -0.8% y/y in Q1 2020, with the non-oil sectors contracting -2.7% y/y. We expect the non-oil sectors to contract by -4.6% for the full year. The central bank noted that employment in the UAE had declined in Q2 but did not provide any figures.

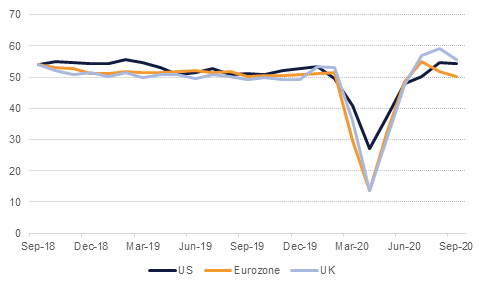

Germany’s manufacturing sector managed to record another strong month of growth in September with the headline PMI coming in at 56.6, up from 52.2 a month earlier. France also reported an improvement in manufacturing with its PMI coming in at 50.9 compared with market expectations of 50.6. However, in both countries services remain lacklustre. In Germany the service PMI fell to 49.1 as social distancing and coronavirus measures continue to hamper activity. As the number of Covid-19 cases has picked up in Europe in recent weeks, the services component of future PMI prints is likely to remain soft, weighing on the outlook for hiring and wage growth. The broader Eurozone’s composite PMI number fell to 50.1 from 51.9 a month earlier as the drag on services regionally hits the growth outlook.

In the UK the composite PMI for September fell to 55.7 from a strong print of 59.1 in August. Like in the Eurozone, manufacturing still managed to report a decent number of 54.3 but services saw a sharper fall to 55.1 from 58.8. As the UK government has now impose more stringent measures to control the Covid-19 pandemic we would expect the services numbers to weaken more considerably for the October read of the PMI.

In contrast the US showed more resilience in its flash composite PMI for September. The reading fell marginally to 54.4 this month, barely down from 54.6 a month earlier. The manufacturing PMI gained to 53.5 but services slipped slightly to 54.6 from 55 a month ago.

Saudi Arabia will allow residents to perform religious pilgrimages from October 4th and will re-open to international pilgrims from November 1st. Umrah had been restricted since March.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasury markets were little changed overnight despite more dovish commentary from Fed officials. Fed vice chair Richard Clarida along with Chicago Fed president Charles Evans both noted that rates would not rise until inflation on the Fed’s PCE measure had hit 2% at a minimum. But monetary policy officials in the US continue to kick the responsibility of stimulating the economy to fiscal policymakers, with Fed chair Jerome Powell telling a congressional committee that the recovery would be stronger if “there is support coming from both Congress and the Fed.”

Emerging market USD bonds fell a fifth day running, their worst performance since mid-August as investors calibrate positions ahead of quarter end and in response to worries that a resurgence of Covid-19 cases will derail global growth in the final months of the year.

Morocco has mandated banks for an dual tranche issue (5 and 10yr maturities) which may hit markets soon. Morocco is rated ‘BBB-‘ by Fitch and S&P.

The USD advanced for the third straight session on Wednesday. The DXY index consolidated modest gains and remains comfortably above the 94 handle at 94.390. The next key indicator to lookout for will be the 23.6% one-year Fibonacci retracement of 94.400. USDJPY has retained its position above the 105 big figure, increasing by 0.45% to reach 105.40, just under the 38.2% one-year Fibonacci retracement of 105.41.

The EUR dropped after mixed PMI data out of the region and currently trades at 1.1663, its lowest point since late July. GBP received some respite after three sessions of losses and remains largely unchanged around 1.2720. Both the AUD and NZD have extended their slumps, declining to 0.7055 and 0.6540 respectively.

The Fed’s warning that more the economy needs more stimulus raised risk-off tone in equities yesterday. With the fiscal deadlock showing no signs of lifting for the time being the Dow Jones, the S&P 500 and the NASDAQ closed down 1.9%, 2.4% and 3.0% respectively. The gloomy words from the US were too late to affect European equity markets which enjoyed a rally from the previous losses. In the UK, hopes for new fiscal support from the Chancellor Rishi Sunak saw the FTSE 100 gain 1.2%, while the DAX (0.4%) and the CAC (0.6%) also climbed. However, Asian stock markets are following the US into the red this morning – the Nikkei and the Shanghai Composite are down 0.6% and 1.8% respectively so far – and European futures are also falling.

Oil prices have given up most of the gains of the past two trading sessions this morning as markets remain fixated on the broad—and negative—macro implications of a resurgent Covid-19 virus and lack of fiscal stimulus in the US economy. Brent futures are down 0.9% in trading this morning at USD 41.38/b while WTI is off by 1.2% at USD 39.45/b.

The EIA reported a 1.6m bbl draw in US crude stocks while gasoline inventories were down by 4m bbl last week. Again, oil industry data has been affected in the US by hurricane and storm activity that has disrupted production and refining activity. Output fell by 200k b/d to 10.7m b/d last week while product supplied jumped by 1.4m b/d to 18.4m b/d.