Preliminary data from the UAE Ministry of Finance show that the consolidated UAE budget posted a surplus of AED 37bn (USD 10bn), around 2.4% of estimated GDP in 2019. This was the second consecutive year of budget surplus for the country, although the size of last year’s budget surplus was smaller than in 2018.

Source: UAE Ministry of Finance, Emirates NBD Research

Source: UAE Ministry of Finance, Emirates NBD Research

Total revenue declined -2.2% y/y in 2019, while expenditure rose 2.8% y/y. While current spending (on salaries, goods & services, subsidies etc) declined -1.8% from 2018, capital spending rose sharply to AED 49.2bn in 2019, the highest since 2016.

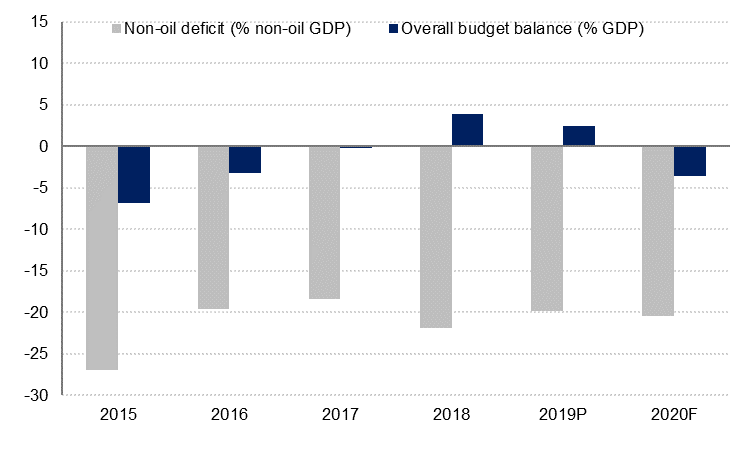

If we strip out volatile oil revenues*, we estimate the UAE’s non-oil budget deficit narrowed to just under 20% of non-oil GDP, down from -27% of non-oil GDP in 2015, and pointing to a tightening of fiscal policy in recent years.

While the UAE’s oil revenue will decline sharply this year on the back of lower oil prices (we expect Brent will average USD 45/b in 2020 compared with USD 64/b in 2019), the conservative fiscal stance over the last couple of years means the UAE is able to withstand this external budgetary shock much better than some of its neighbours. Even assuming a 2% rise in total expenditure this year, we estimate the overall budget deficit will reach -3.5% of GDP in 2020, while the non-oil deficit is likely to widen slightly to around 20.5% of non-oil GDP.

*The Ministry of Finance does not disclose oil revenues, we have estimated this based on oil production and price.