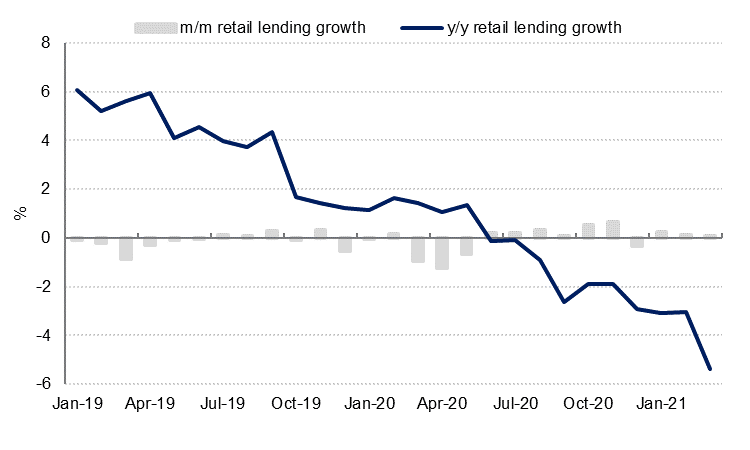

Gross bank lending declined -1.3% m/m and -0.8% y/y in March. This was the first annual decline in bank lending since at least 2015, and reflects to some extent the high annual base – bank loan growth (mostly to the government and GREs) jumped 1.3% m/m and 5.6% y/y in March 2020 as the coronavirus pandemic started to impact the economy and the central bank launched the Targeted Economic Support Scheme (TESS), allowing banks to boost lending. As such, we would not be surprised to see relatively weak annual loan growth through Q2 and into Q3 this year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

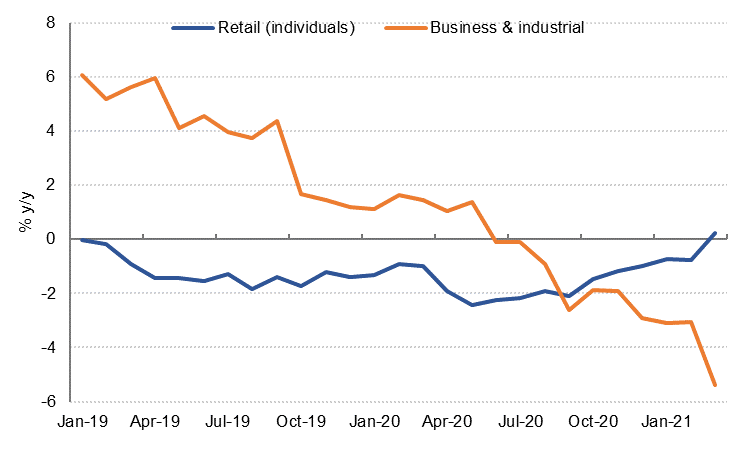

Lending to the private sector declined -3.7% y/y in March, as loans to business and the industrial sector fell -1.0% m/m and -5.4% y/y. While lending to the transport & storage and utilities sectors grew strongly y/y in Q1 21, this was more than offset by a sharp decline in lending to the manufacturing and retail trade sectors on an annual basis.

The actual data on business lending is not consistent with the findings of the central bank’s credit sentiment survey for Q1 21, which noted an improvement in the demand for credit in the business sector, particularly from local, large corporates. The survey indicated that the retail & wholesale trade sector, utilities, manufacturing and non-bank financial institutions showed the biggest improvement in demand for credit in Q1 21. However, credit standards tightened slightly, particularly for SMEs, albeit by less than in previous quarters.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Lending to retail borrowers (individuals) appears to be recovering following deleveraging by households during the peak lockdown months in Q2 2020. Retail loans grew 0.2% y/y in March, the first annual growth in this component since November 2018.

The credit sentiment survey for Q1 also reflects a “moderate” increase in demand for personal loans, with demand for housing, credit card and car loans improving from Q4 2020. This appeared to be driven by a more optimistic outlook for the housing market, financial markets as well as changes in income. Credit standards were also eased on auto and housing related loans in Q1 21.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

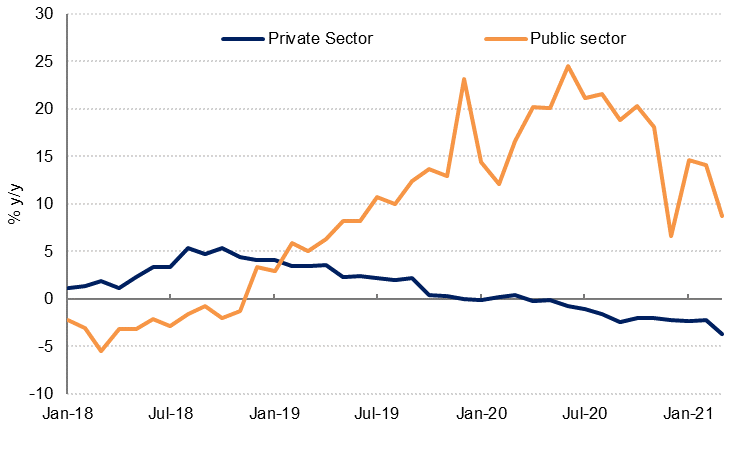

Lending to the government and (GREs) has also slowed in recent months, easing to 8.7% y/y in March off the high March 2020 base. Bank loan growth to the public sector peaked at 24.5% y/y in June 2020 before slowing as the economy re-opened in H2 2020. We expect loan growth to the public sector to continue to slow as the economic recovery gains momentum.