The UAE has approved emergency use of a Covid19 vaccine developed by Sinopharm, with front-line workers “who are at the highest risk of contracting the virus” able to get it. According to the National Emergency Crisis and Disaster Management Authority (NCEMA), 31,000 volunteers have participated in clinical trials including 1,000 volunteers with chronic diseases, with no unexpected side effects seen. Phase 3 trials of the vaccine are continuing.

In Japan, Chief Cabinet Secretary Yoshidide Sugo was elected as the leader of the ruling LDP and will replace outgoing Prime Minister Shinzo Abe. Sugo has pledged to continue with “Abenomics” and indicated he was willing to do more on fiscal and monetary policy if needed. Sugo could announce his cabinet today.

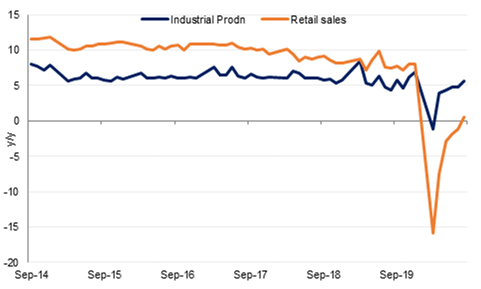

China’s industrial production rose by a bigger than expected 5.6% y/y in August, faster than the 4.8% growth seen in July. Retail sales increased 0.5% y/y, the first increase this year, suggesting that consumer demand is starting to recover. Unemployment also edged lower to 5.6% from 5.7% previously. Eurozone industrial production rose 4.1% m/m in July, slower than the 9.5% rise in June and fractionally lower than the market had expected. Output remains below pre-coronavirus levels however.

Overnight, British MPs voted to pass the controversial Internal Market Bill by 340 to 263. PM Johnson argued the legislation was necessary as the EU threatened to disallow food exports to Northern Ireland from other parts of the UK, which it would have been able to do under the terms of the Withdrawal Agreement if a trade deal was not agreed by the end of the year. The bill will need to go through further readings in the House of Commons (where it could be amended) and must also be approved by the House of Lords before it can be signed into law. The EU has given the UK until the end of this month to withdraw the bill or it will take legal action.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Major sovereign bonds were little changed at the long-end yesterday. Yields on 10-year USTs and gilts added one basis point on the previous day’s close to 0.6723% and 0.1940% respectively, while 10-year bunds were unchanged at -0.4820. Two-year USTs also closed one basis point higher at 0.1350%.

Sterling rose on Monday ahead of a controversial debate in parliament that would allow the U.K. to override parts of the divorce treaty it signed with the EU. GBP consolidated modest gains this morning and was amongst the biggest movers of the day, advancing by 0.45% to trade at 1.2850. The NZD advanced the most out of major currencies, increasing by 0.67% to retain its position above the 0.67 handle at 0.6710.

The USD has failed to hold onto gains garnered towards the end of last week. The DXY index fell by -0.40% to reach 92.950. The JPY declined off the back of this, breaking below the 106 big figure, and trades at 105.70. The EUR slowly approached the 1.19 level before stumbling in the evening. The currency is operating around 1.1885, which still represents modest gains, whilst the AUD rallied early this morning to trade at 0.7312.

Equities were broadly positive yesterday, led by a recovery in US indices following their collapse over the previous week. The tech-heavy NASDAQ, which bore the brunt of the losses last week, rose 1.9% and is now back up to positive m/m territory at 0.3%. The S&P 500 (1.3%) and the Dow Jones (1.2%) also closed higher yesterday. Asian markets generally closed higher yesterday, with the Shanghai Composite gaining 0.6% and the Nikkei 0.7%, although both are trading moderately lower at the time of writing this morning. In Europe, the FTSE 100 had started the day at a three-week high on its opening amid news of deals, but retrenched over the course of the session to close down 0.1% as the contentious Internal Market Bill was debated and passed in parliament.

Oil prices remained under pressure yesterday, with a revised demand outlook from OPEC raising further questions with regards market balance. WTI futures closed 0.2% lower at USD 37.3/b, while Brent lost 0.6% to USD 39.6/USD. Both benchmarks are trading moderately lower this morning. The weaker-than-expected recovery so far saw OPEC revise down its demand projection for 2020 by 400,000 b/d, to an average 90.2mn b/d. This marks a drop of 9.5mn b/d compared to last year, and could see the oil-producing bloc change tack in terms of their easing production curbs when they convene online on Thursday. It’s been a challenging start to the week for oil, with a report stating that peak oil may have been reached from BP, the news that Libyan volumes may be returning to the market, and now this bearish Monthly Oil Market Report from OPEC.