The UAE announced a series of measures yesterday to help bolster economic growth. Most of the measures fall within the AED50bn spending package announced in June, putting details on that amount under the banner Tomorrow 2021, with AED20bn allocated to 2019 and with 50 initiatives associated with it, helping start-ups and companies by cutting costs. Some of the most high profile changes relate to immigration where a new law will allow for retirees to stay in the UAE over the age of 55 for 5 years based on various criteria. Cuts to electricity fees for companies were also announced starting in Q4 which will perhaps have the most direct impact on growth in the near term.

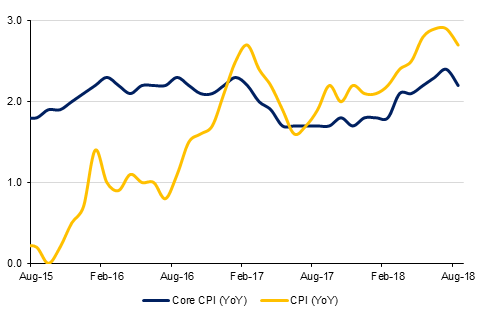

U.S. consumer price inflation slowed in August according to the Bureau of Labor Statistics. Headline consumer prices increased 0.2% m/m in August slowing y/y growth to 2.7% from 2.9% in July. Core consumer prices increased by 0.1% m/m, resulting in y/y growth slowing from 2.4% to 2.2%. Both setbacks are likely to be temporary however, and with inflation remaining above the Fed’s 2% target, the FOMC is expected to continue with its gradual tightening of monetary policy, with the OIS pricing in a 97.5% chance of a 25bps rate hike at the central bank’s meeting on September 26th.

Meanwhile policy makers met in Europe towards the end of last week. At the European Central Bank, as widely expected, President Draghi and his colleagues made no changes to monetary policy. However the ECB did make downwards revisions to its 2018 and 2019 forecasts for growth. Elsewhere the Bank of England’s monetary policy committee also made no tweaks to policy but it did issue a warning on the effects that trade tensions can have on global growth. In the coming week the Bank of Japan is widely expected to leave its short term interest rate target unchanged at -0.1% this week and to maintain its policy of yield curve control. The Swiss National Bank is also widely expected to maintain its deposit rate at -0.75% and the range for 3-month Libor held at -1.25% to -0.25%. Meanwhile the economic data flow in the US will be quiet with no primary tier data expected.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasuries closed lower as economic data from the US lent further credence to Fed’s dot plot projection which indicates two more rate hikes in 2018. Yields on the 2y UST, 5y UST and 10y UST closed at 2.77% (+7 bps w-o-w), 2.90% (+8 bps w-o-w) and 2.99% (+5 bps w-o-w) respectively.

Regional bonds drifted lower for a third consecutive week. The YTW on the Bloomberg Barclays GCC Credit and High Yield index increased +2 bps w-o-w to 4.48%. However, credit spreads tightened 5 bps to 163 bps.

Primary issuances picked up speed last week with Saudi Arabia raising USD 2bn and ADIB raising USD 750mn. The KSA paper will mature in 2029 while ADIB is a perpetual with call date in 2023. Al Hilal Bank also raised USD 500mn in a 5-year paper which was priced 148bps above mid-swaps.

EURUSD rose for the first time in three weeks, gaining 0.64% to close at 1.1623. Over the course of the week, the price was able to break back above the formerly resistive 50-day moving average (1.1609) but had further gains halted at the 100-day moving average (1.1677). While the price remains above the 23.6% one-year Fibonacci retracement (1.1597), it is likely to retest the 100-day moving average. A daily close above this level may catalyze further gains towards 1.1780, the 38.2% one-year Fibonacci retracement.

Elsewhere, GBPUSD rose 1.14% last week, closing at 1.3068. In the process, the price rose above the 50-day moving average (1.2992) which is now acting as a support level. Over the course of the week, the price even broke above the 100-week moving average (1.3081) before finding resistance. A weekly close above this key level is the likely catalyst for a bigger move towards the 1.32 handle.

Most regional equity markets started the week on a negative note. The DFM index dropped -1.3% while the Qatar Exchange lost -0.8%. Emaar Properties dropped -3.2% as investors’ likely switched their position to Emaar Development (+0.2%). Emaar Development announced an interim dividend of AED 0.26 per share for 2018. Drake & Scull continued to remain under pressure with the stock losing -0.5%. Elsewhere, the ADX index added +0.6% with ADCB and Etisalat gaining +1.7% and 1.4% respectively.

Oil markets nudged higher last week as the market absorbed agency forecasts and analysis from the EIA, IEA and OPEC. Brent futures closed up 1.6% after having breached USD 80/b mid-week. Brent ended the week just above USD 78/b. WTI managed to recover some, but not all, of the previous week’s losses and closed up 1.8% at just under USD 69/b. For Brent and WTI, USD 80/b and USD 70/b appear to be the topside barriers at the moment as both grades have struggled to break above and hold levels above those prices in the past month and a half. The risk of Brent re-touching USD 80/b in the short-term appears high but we would expect it could bring oil prices back into the focus of US president Donald Trump who has targeted OPEC several times this year.

Forward curves highlighted the pending shortage in international markets. The backwardation in Brent markets continues to expand, hitting USD 0.87.b on the 1-3month spread while in WTI the spread closed the week at USD 0.32/b. There is a risk that WTI moves back into contango, at least in the front of the curve, but with a slowdown in production expected for 2019 the flip of the curve may not linger for too long.

US exploration and production companies put 7 new rigs into operation last week, the largest increase since early August. Meanwhile investors have split their views on Brent and WTI. Net length in WTI fell more than 27k lots last week thanks to some long positions being closed and an increase in short positions of more than 7k contracts. The upside conviction in Brent, by contrast, appears quite strong: net length rose by 23k contracts thanks to a third weekly increase in long positions and some short positions being closed.