The UAE’s economy grew 3.6% in 2023, exactly in line with our forecast, according to preliminary data. The non-oil sector grew by a faster than expected 6.2% last year, while the oil and gas sector contracted by -3.1%.

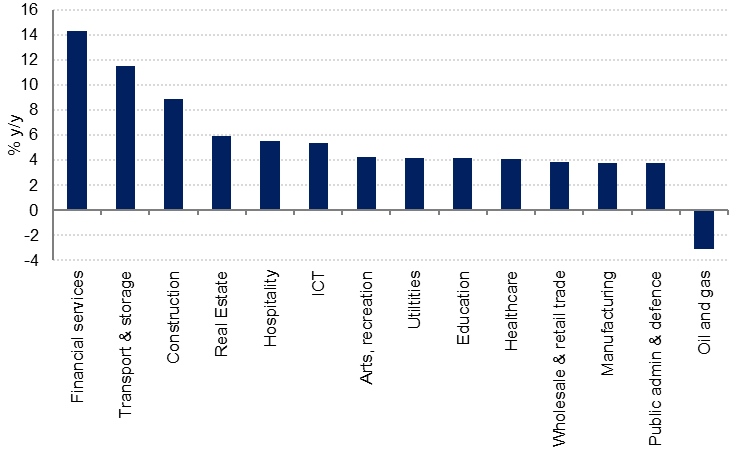

Financial services was the fastest growing sector in 2023, expanding 14.3% y/y after 6.6% growth in 2022. This was followed by transport and logistics (11.5% y/y), construction and real estate services.

Source: FCSA, Emirates NBD Research

Source: FCSA, Emirates NBD Research

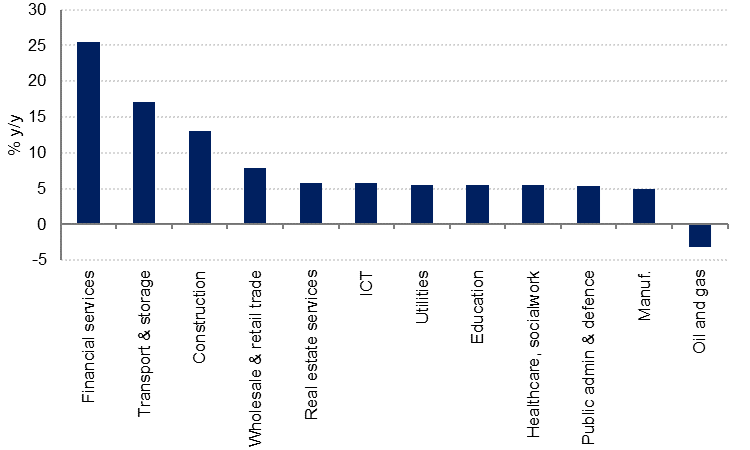

Emirate level data show that Abu Dhabi’s non-oil GDP grew 9.1% in 2023, only fractionally slower than the 9.2% growth recorded in 2022. The key sector growth rates for Abu Dhabi were similar to the UAE, although wholesale & retail trade grew at a robust 7.9% in Abu Dhabi last year, compared with 3.9% growth at a national level. With around half of Abu Dhabi’s GDP coming from hydrocarbons, the -3.1% contraction in oil & gas GDP last year meant that headline GDP growth for Abu Dhabi slowed to 3.1% in 2023 from 9.2% in 2022.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

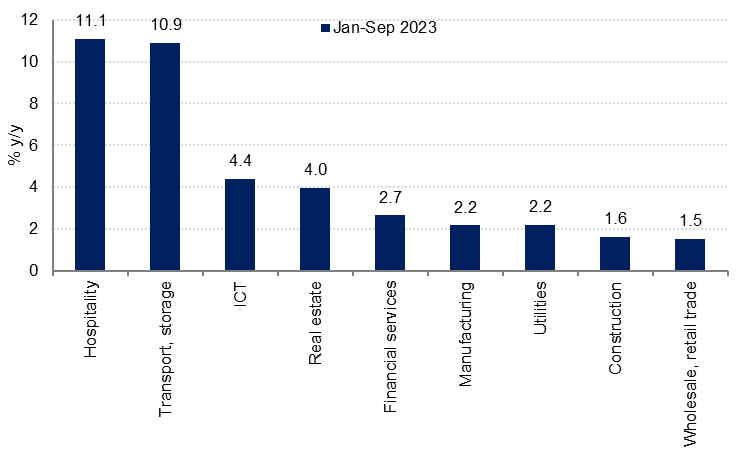

For Dubai, only Q1-Q3 data is available as of this writing, and the figures show 3.3% growth in Dubai’s GDP last year, with transport, logistics and hospitality driving the emirate’s economy in 2023, followed by information & communication (ICT) and real estate services. Manufacturing and wholesale & retail trade both grew at a slower pace in Dubai than at the national level.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The UAE’s economy has been remarkably resilient to both a lacklustre external backdrop as well as significantly higher interest rates in 2023. We now expect only a modest easing in monetary policy from the Fed towards the end of this year, with a total of 50bp in rate cuts pencilled in between September and December. This is likely to weigh on private sector investment this year. However, we expect public sector investment – particularly in transport and other infrastructure – to remain robust in 2024 and beyond, as the government has announced several large long-term projects including the expansion of the Etihad Rail network and Al Maktoum Airport. This will continue to underpin non-oil GDP growth in our view, offsetting any moderation in private sector investment and household consumption.

Consequently, we have upgraded our non-oil growth forecast for the UAE this year to 5.0% from 4.5% previously, taking headline GDP growth to 3.7% from 3.3% previously. We assume no growth in the oil & gas sector this year as oil production is likely to remain constrained by OPEC+ production limits. If there is an increase in the UAE’s target production level, this would pose an upside risk to our headline GDP growth forecast.