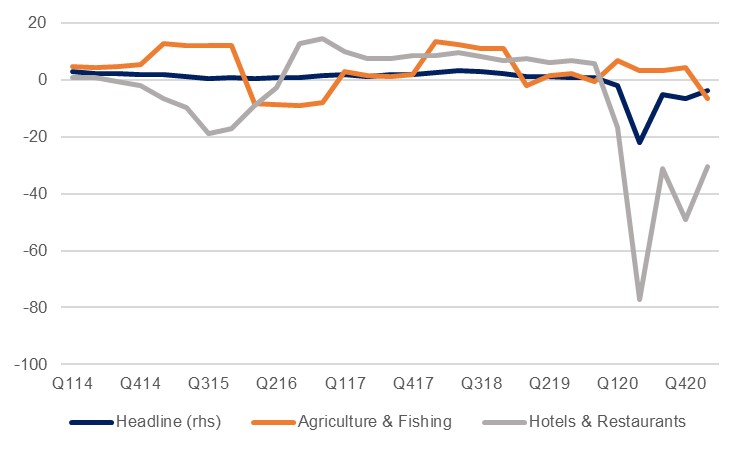

First quarter GDP results and persistently high new Covid-19 case numbers in Tunisia confirmed that the economy remains under significant pressure and reaffirmed our decision to downgrade our 2021 growth forecast from 4.5% down to 3.8% last month. Real GDP growth was -3.0% y/y in Q1, marking the fifth consecutive y/y contraction, and while we hold to the view that the second half will see a substantial improvement, the ongoing coronavirus crisis is starting to eat into another crucial holiday season already. The longer this persists, the greater the likelihood of a further downgrade as tourism and related sectors suffer.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Despite having fallen – Tunisia’s seven-day moving average of new Covid-19 cases each day stands at 1,253 compared to the recent April levels of over 2,000 – Tunisia’s case levels remain elevated, and the country relaxed its latest restrictions on movement and activity after only one week. Met with a range of protests, many felt that households, and the country at large, were not in a position to be able to afford such limitations on activity. Prime minister Hisham al-Mashishi has said previously that ‘It is not possible to impose a general lockdown in Tunisia because of the socio-economic difficulties.’ However, with vaccination progress still comparatively slow, this choice between health and the economy could prove to be a false dichotomy, as it has elsewhere. Persistently high new case numbers mean that Tunisia will likely remain off the crucial green lists for countries in Europe for now, meaning another slow summer for the tourism sector.

The effect of ongoing global and regional travel restrictions was evident in the Q1 data, where hotels and restaurants contracted by -30.3% y/y and transport by -13.2%. Tourist arrivals data past February is not yet available, but those levels were down -77.6% down compared to 2019 levels, and even -59.8% off levels seen in January alone last year. Base effects in the second quarter will mean a further contraction in these GDP components is unlikely, but equally the sector will probably remain far off the levels seen in 2019. This is especially the case when considering that there was a window of several months last summer when Tunisia briefly opened up to tourists, and Europeans were allowed to travel with fewer restrictions than currently imposed.

It is not only tourism and related industries which continued to contract in Q1; both agriculture and manufacturing also reported a decline. In manufacturing’s case this was the fifth in a row. Indeed, in the past 10 quarters the sector has only reported positive y/y growth once, in Q419. By contrast, agriculture had a comparatively robust 2020, recording real growth of 4.0% despite weak rains, but last quarter the sector contracted -6.7% y/y. Poor rains in the first quarter have raised concerns that there will be a weak harvest, which will further weigh on economic growth in 2021.