US President Donald Trump attacked China again in a speech to the Economic Club of New York, saying no country had “cheated” better than China in their trade dealings with the US. Trump also warned that if China does not agree to a trade deal then tariffs would be raised “substantially.” Markets are still waiting for more clarity when and if a direct meeting between Trump and China’s president Xi Jinping will occur in the coming months and an absence of a meeting will be taken as a negative sign for trade relations. The prospect of a trade deal had helped small business optimism rise although sentiment has yet to re-touch 2018 highs.

China wasn’t the only target of President Trump’s ire as he again criticized the Federal Reserve for not cutting rates to lower levels and for not implementing negative rates. Trump said the lack of negative rates in the US put the country at a “disadvantage” to other nations. Whether negative rates have actually helped to spur growth or just prevented a worse downturn in the Eurozone and Japanese economies will remain an issue of debate for decades but it no doubt does impact the banking sector heavily in both economies. A sluggish global economy and trade war makes it unlikely that corporates would take advantage of negative rates to borrow while there is no certainty over the economy.

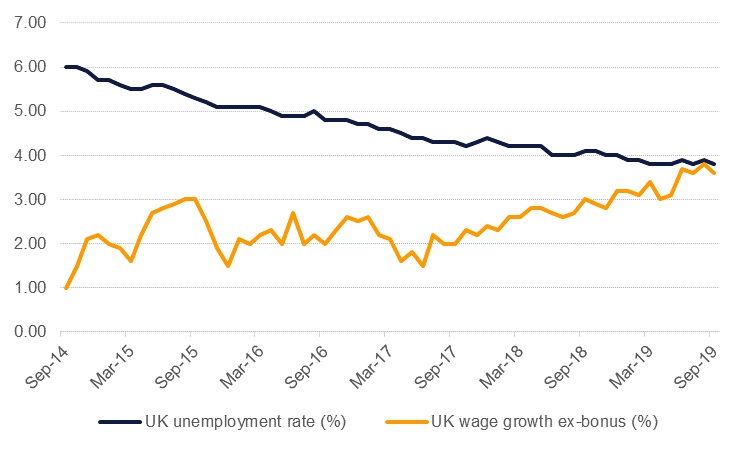

Unemployment in the UK fell in the three months up to September, taking the headline unemployment rate to 3.8% from 3.9% in the prior period. However, the UK jobs data was not uniformly positive as total employment also slipped while earnings growth ex-bonuses fell to 3.6% y/y from 3.8% previously. Both the Conservative and Labour parties in the UK have pledged significant spending boosts ahead of the December general election in an attempt to spur growth which came in at just 1% y/y in Q3.

The RBNZ kept rates on hold in a move that surprised markets. The central bank in New Zealand said that economic conditions don’t warrant a change in policy but would add stimulus “if needed.” Inflation expectations in the South Pacific country have been declining, prompting rate cut expectations, while New Zealand is also highly exposed to a downturn in global trade. The Kiwi dollar jumped on the news, moving back up above a 64 handle against the dollar compared with 63.20 overnight.

Source: Emirates NBD Research

Source: Emirates NBD Research

It was a rather volatile session for Treasuries amidst strong economic data and renewed uncertainty over trade following comments from the US President. Yields on the 5y UST and 10y UST closed at 1.74% and 1.93%.

Regional bonds closed largely unchanged.

The NZD rose almost 1.0% overnight after the RBNZ unexpectedly left interest rates unchanged at 1.0%, saying that economic developments since it lowered rates in August didn’t warrant more easing. Markets had built up short positions going into the meeting which were subsequently unwound. Elsewhere risk aversion came back into the market after President Trump threatened to increase tariffs on China if they do not reach a broader trade agreement, causing the JPY and the CHF to strengthen slightly, while Asian currencies like the KRW declined.

Notwithstanding trade uncertainty, developed market equities closed higher on the back of improved economic data and better than expected corporate earnings. The S&P 500 index and the Euro Stoxx 600 index added +0.2% and +0.4% respectively.

Regional equities closed mixed. The Tadawul continued its positive run ahead of the Saudi Aramco IPO. Elsewhere, Emaar Properties gave up some of their previous session gain to close -0.5%.

A lack of material trade developments or fundamentals data helped oil markets drift overnight. Brent futures closed down by 0.19% at USD 62.06/b while WTI was off by around 0.1% to settle at USD 56.8/b. the backwardation at the front of the Brent curve remains relatively wide, holding at around USD 0.8/b in the 1-2 month spread while in WTI the same spread is roughly close to neutral.

The IEA released its World Energy Outlook, its long term forecasts for energy demand and supply, and expects oil consumption will plateau at around 2030 thanks to drivers using more efficient vehicles and electric cars making more of an impact. Oil demand growth in the medium term, out to 2025, is set to grow by around 1m b/d but then flatline from 2030 onward. Like OPEC’s long-term forecast, the IEA projects a decline in market share for OPEC producers and cautioned that it the producers’ bloc continued to try and support prices though cutting output, production won’t hit 2018 levels until 2030.

The IEA also cautioned that greenhouse gas emissions won’t reach zero until 2070 at current levels of demand. The burst of investment in renewables hasn’t yet had an impact in terms of negating emissions from fossil fuels as their share of the global energy mix remains low.

Click here to Download Full article