President Donald Trump secured a pre-election victory as the Senate voted to confirm Amy Coney Barrett to the Supreme Court, giving the body a conservative tilt just days ahead of the presidential election. The implications of a conservative leaning supreme court could come into play quickly if the results of the election are disputed and the court needs to weigh in just as it did in the disputed 2000 election between George W Bush and Al Gore. Markets have generally been acquiescent to a Democrat victory next week, helping yields push higher and growth stocks rise. However, an uncertain result would perhaps be even worse for markets than an incorrect assessment from polls. With eight days remaining ahead of election day Joe Biden still has a sizeable lead in poll averages (53.3% of the popular vote compared with 45.4% for President Trump).

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin failed to make any headway in negotiations over stimulus measures at the start of the week. Pelosi said she was “optimistic” a deal could be reached before the election although Senate is now in recess ahead of the vote.

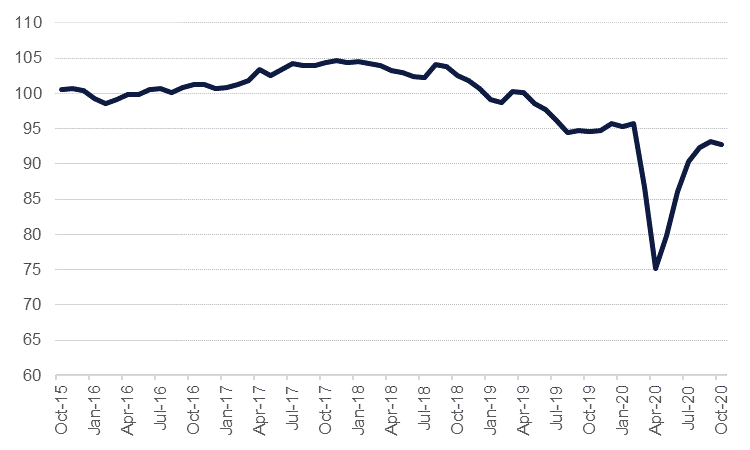

The IFO Business Climate survey of German companies showed firms were becoming more pessimistic in October, the first monthly decline in six months. The index fell to 92.7 from 93.2 a month earlier as the forward looking expectations element fell back to 95 from 97.4 a month earlier. The dampened mood is hardly surprising given that the number of Covid-19 cases in Europe has accelerated in recent weeks with several countries needing to re-impose lockdown measures, albeit in a more muted tone than earlier this year. Germany had so far not seen the same kind of uptick in cases and the country’s flash PMIs for October outperformed regional peers. Nevertheless, a broad downturn in the Eurozone economy will help to drag on German business confidence.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasuries snapped their recent losing streak as a broad sell-off in risk assets took hold of markets amid record daily Covid-19 cases in the US, more European countries needing to reintroduce lockdowns and curfews and no movement on a stimulus plan in the US. Yields ons 2yr USTs were slightly lower, pushing back below 01.5% while the 10yr yield fell more than 4bps back to 0.8%. Both benchmarks are testing lower today. The 2s10s curve also flattened in response to the risk-off tone, falling to 65bps.

Emerging market bonds didn’t display much reaction to the risk-off tone with investors treading water ahead of the uncertainty of the US election next week. The new issue pipeline is likely to be quiet ahead of the election and the next FOMC which also occurs next week.

The USD recorded a slight recovery on Monday. The DXY index increased by 0.30% and is currently trading around 92.970. A lack of any indication that a fiscal stimulus package will be reached anytime soon, as well as ever-rising Covid-19 cases, fueled a risk-off sentiment in markets. USDJPY has given up all its overnight gains and is back at 104.70 where it ended last week.

The EUR fell by -0.4% to reach 1.1810 as European coronavirus cases hit record highs. France exceeded 50,000 daily cases and Spain has announced a state of emergency. The GBP swung between losses and gains, even with reports of some progress in Brexit talks. Sterling is little changed at 1.3035. The antipodean currencies also experienced choppy movement, consolidating very minor losses this morning. The AUD sits at 0.713 whilst the NZD trades at 0.6690.

USDTRY moved above 8 for the first time as markets responded to the surprise hold from the CBRT at the end of last week.

Equity markets were a wall of red at the start of trading as a risk-off tone dominated. In the US the S&P 500 gave up 1.9% while the Dow was down almost 2.3%. European stocks were battered by the resumption of lockdown measures and a disappointing IFO survey from Germany: the FTSE lost 1.2% while the Cac fell 1.9% and the Dax was off by more than 3.7%. Asian markets are following suit in early trade this morning with the Nikkei and Hang Seng both lower.

Regional markets were mixed. The DFM fell 0.5% overnight while the ADX managed to gain 1.2%, bolstered by a new deal between Aldar and ADQ, an Abu Dhabi government holding company. The Tadawul closed the day flat.

Oil benchmarks both fell more than 3% at the start of the week. Brent is back at a USD 40/b handle while WTI has now pushed below USD 39/b. Saudi Arabia’s energy minister, Abdulaziz bin Salman, said the ‘worst part is over’ for oil markets in comments to a virtual energy event (even if he normally would have been an in-person keynote speaker). He also noted that OPEC+ countries still needed to stick to the terms of their production cut deal to ensure output does not flood markets just as demand is showing signs of tempering.