US president Donald Trump and North Korea’s leader, Kim Jong Un carried out the first bilateral meeting between the two nations today in Singapore. The road to the summit was precarious and fitful and that it is occurring at all is remarkable considering how close the nations were to actual conflict at the start of the year. Expectations for an all-encompassing deal seem low at this stage, particularly as some of the US demands on a complete denuclearisation of the Korean peninsula would mean North Korea loses its main diplomatic bargaining chip. Market reaction to the meeting has been relatively muted so far; the South Korean won has appreciated slightly this morning while the Japanese yen is trading slightly softer against the dollar. North Korea’s path to full engagement in the global economy and diplomatic channels will be long and likely not without setbacks. But as an initial meeting, the summit between Kim and Trump appears to have tempered geopolitical risks in Asia for the time being.

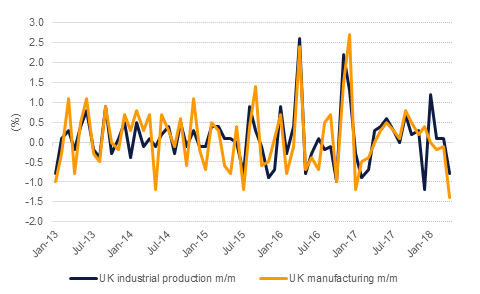

Industrial data from the UK surprised on the downside in the latest data for April. Overall industrial output fell by 0.8% m/m in April and manufacturing fell by 1.4% m/m, both worse than expected. Trade data showed that the UK’s goods trade balance with the rest of the world moved further into deficit in April at GBP 14.1bn, from GB 12bn in March. The soft data comes at a precarious moment for the UK as the government is looking for positive data to paper over the uncertainties surrounding Brexit. Parliament votes today on several amendments to the Brexit withdrawal bill, including whether parliament itself will get a final say or ‘meaningful vote’ on the conditions of exit. Support for that clause would be a failure for the May government to exert control over the process and could see more pressure on the prime minister.

The UAE, Saudi Arabia and Kuwait agreed a USD 2.5bn aid package for Jordan, following protests against IMF proposed tax-reforms there last week. The support will be in the form of a direct deposit to the Jordanian central bank, some funding for the budget for the next five years and guarantees from the GCC countries to allow Jordan to access World Bank financing.

Treasuries traded in a tight range ahead of key events in the week which includes the Federal Reserve meeting. The front-end of the curve underperformed with yield on the 2y UST and 5y UST rising +3 bps and +1 bp to 2.52% and 2.79% respectively. Yield on the 10y UST remained flat at 2.95%.

Regional bonds continued to remain in a range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index remained flat at 4.62% while credit spreads tightened 3 bps to 187 bps.

Fitch affirmed Saudi Arabia at A+ with stable outlook. The rating agency said that ratings are supported by strong fiscal and external balance sheets including high international reserves, significant government assets, low government debt and commitment to extensive government reforms.

Currency markets were caught between two summits to begin the week. The raucous outcome of the G7 meeting in Canada and risk that the US will impose further tariffs on its northern neighbor weighed on the loonie which continued its march higher while expectations for a positive meeting between US president Donald Trump and North Korean leader Kim Jong Un is helping to support the dollar against most peers. Sterling was a notable underperformer yesterday as disappointing industrial data and the risk of the government losing crucial votes on Brexit in parliament today are heaping downward pressure on GBP.

Developed market equities shrugged off the tensions visible at the weekend’s G7 meeting to close marginally higher. The S&P 500 index closed +0.1% while the Euro Stoxx 600 index added +0.7%. The focus remains on the US-North Korea summit and central bank meetings scheduled for this week.

UAE bourses outperformed their regional peers. The DFM index and the ADX index added +1.4% and +0.9% respectively. Gains were broad based with Emaar Properties adding +4.1%, Aldar Properties rallying +1.4% and First Abu Dhabi Bank gaining +1.6%.

Oil prices were little changed to start the week with few fundamental catalysts to affect the market. Saudi Arabia reportedly increased oil production in May, according to press reports, as anxiety grows ahead of next week’s OPEC meeting on whether the bloc will continue with its existing production cuts or endorse some level of increase in output.